Written by: Caleb Lund, CAP® Director of Charitable Strategies Group Schwab Charitable™ and Hayden Adams, CPA, CFP® Director of Tax Planning and Wealth Management Schwab Center for Financial Research

Are your clients reflecting on their 2023 income tax returns and considering what they might have done differently to lower their taxes? Tax season is an ideal time to talk with them about charitable giving, tax strategies, and overall financial planning for 2024. To help you start the philanthropic conversation, we summarize the 2024 giving environment and pair five client situations with five giving strategies so you can see if the strategies might work for your clients.

2024 giving and tax landscape

The U.S. is still experiencing high interest rates, which impacts the economy and causes some people to be more cautious with their money. Despite this, donors with Schwab Charitable™ donor-advised fund accounts granted $6.1 billion to charity in 2023, an increase of 31% compared to 2022.

The stock market has also performed very well. This means that many clients have gains they can harvest in donations to charity.

In addition, we are in an election year, and potential changes to federal tax laws for 2025 and beyond may create uncertainty. One potential change, on December 31, 2025, is the end of lowered individual income tax rates, enacted as part of the Tax Cuts and Jobs Act of 2017. Your clients can capitalize now on what we currently know about the tax benefits of charitable giving for 2024:

- Charitable deduction limits – If clients itemize deductions on their tax returns, their annual deduction limit for gifts to public charities, including donor-advised funds, is up to 30% of adjusted gross income (AGI) for donations of non-cash assets held more than one year and up to 60% of AGI for donations of cash. When a client’s 2024 charitable deduction amount exceeds these AGI limits, they may carry the excess amount forward up to five additional tax years, subject to AGI limits in each year.

- Standard deductions – Itemizing deductions makes sense if the total of all deductions exceeds the standard deduction. For 2024, the standard deduction amount is $14,600 for single filers and $29,200 for married couples filing jointly.

- Appreciated non-cash assets held more than one year – Donating these assets can unlock additional funds for charity in two ways. First, clients potentially eliminate the capital gains tax they would incur if they sold the assets and donated the proceeds, which may increase the amount available for charity by up to 20%. Second, if they itemize, they may claim a fair market value charitable deduction for the tax year in which the gift is made and may choose to pass on that tax savings in the form of more giving.

- Traditional IRA Qualified Charitable Distribution (QCD) – The QCD allows a donor age 70½ or older to instruct an IRA administrator to send up to $105,000 in 2024 to one or more operating charities (excluding donor-advised funds) tax-free.* While withdrawals from traditional IRAs are taxable income, QCDs are not and can satisfy some or all of the annual required minimum distribution (RMD). QCDs can also be used whether a client takes the standard deduction or itemizes deductions, but note that your client cannot claim a tax deduction for a QCD.

In addition, a one-time, $53,000 QCD, within the $105,000 per individual limit, can be made to a charitable remainder trust or charitable gift annuity as part of recently passed SECURE Act 2.0 legislation.

Five common client situations and corresponding giving strategies

Client 1: “This stock’s price has gone way up. What should I do with it? What are my tax implications?”

A top performer in an investment portfolio may now be an oversized position. The need to rebalance creates a tax-smart donation opportunity for a charitably inclined client.

Case study

Carla purchased 2,000 shares of publicly traded XYZ stock five years ago at $5 per share. The stock has appreciated to $50 per share and become an oversized position in her otherwise diversified portfolio.

She wants to use 1,000 of her shares to create a large gift to charity this year. Carla could sell the shares, pay capital gains taxes on the amount of appreciation, and donate the after-tax proceeds to a donor-advised fund or other public charity, as shown in Option 1. However, by donating the stock directly to a charity and eliminating capital gains taxes, as shown in Option 2, she can increase the amount available for charity and generate additional tax savings.

The actual deduction value is generally the average of the highest and lowest quoted selling prices on the date of gift.

This hypothetical example is only for illustrative purposes. The example does not take into account any state or local taxes or the Medicare net investment income surtax. The tax savings shown is the tax deduction, multiplied by the donor’s marginal income tax rate (24% in this example), minus the long-term capital gains taxes paid.

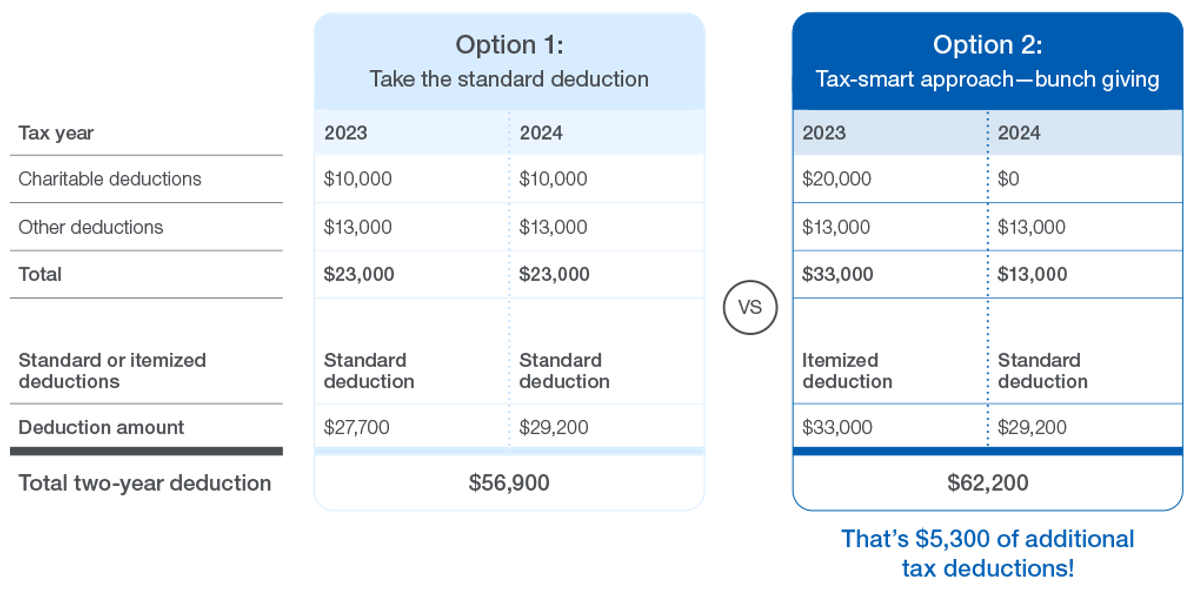

Client 2: “The total of my itemized deductions is below my standard deduction, so itemizing doesn’t make sense. Should I even make a charitable gift this year if I can’t get the tax deduction?”

Many clients who are charitably inclined find themselves on the margin between taking the standard deduction or itemizing. They can maximize their tax benefits by “bunching” two years of charitable contributions into one year, itemizing deductions for that year, and taking the standard deduction the next year.

Case study

Amelia and Hudson are a married couple with no children. Annually, they have $23,000 of itemized deductions, including $10,000 in donations to a donor-advised fund that they use for giving to multiple charities.

Because their total deduction amount is below the standard deduction for both 2023 and 2024, Amelia and Hudson could take the standard deduction each year, and over two years they would claim a total of $56,900 in standard deductions, as shown in Option 1.

If Amelia and Hudson instead take a tax-smart approach and bunch two years of donations into a single year, as shown in Option 2, they would end up with a $62,200 overall deduction for the two years, using both itemized deductions and their standard deduction.

Standard deduction amounts for 2025 will not be announced until later in 2024, so this example uses the 2023 and 2024 tax years.

This hypothetical example is only for illustrative purposes. Schwab Charitable does not provide tax advice, so your clients should consult their legal or tax advisor about their specific situation.

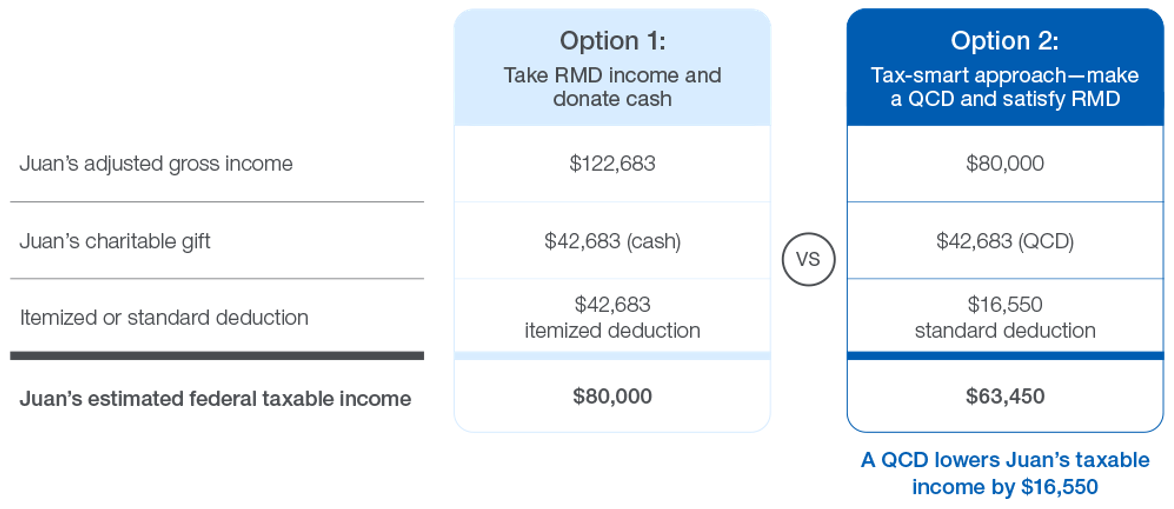

Client 3: “I’m subject to an RMD on my IRA. I don’t need the income this year, and the income would be taxed if I took it. What options do I have?”

A charitably inclined client can satisfy all or part of their traditional IRA RMD by giving through a QCD. The gift can be sent to one or multiple charities and is not taxable to the client.

Case study

Juan is 75 and has a traditional IRA valued at $1,050,000, resulting in a projected required minimum distribution (RMD) of $42,683 for 2024. Juan will already have $80,000 of income in 2024 and he doesn’t want the IRA RMD for income, so he would like to donate this amount to charity.

In Option 1, Juan takes his RMD, which increases his income to $122,683. He uses that $42,683 to make a donation to charity and will claim a charitable deduction when he itemizes deductions.

In Option 2, Juan uses an IRA qualified charitable distribution (QCD) to charity and satisfies his RMD. He then takes the $14,600 standard deduction when filing federal income taxes, plus an additional standard deduction of $1,950 because he is over 65 and has a single filing status. This approach – giving with a QCD – lowers Juan’s taxable income by $16,550.

This example is only for illustrative purposes. Both examples assume no Social Security income and that the charitable gift is to an operating charity.*

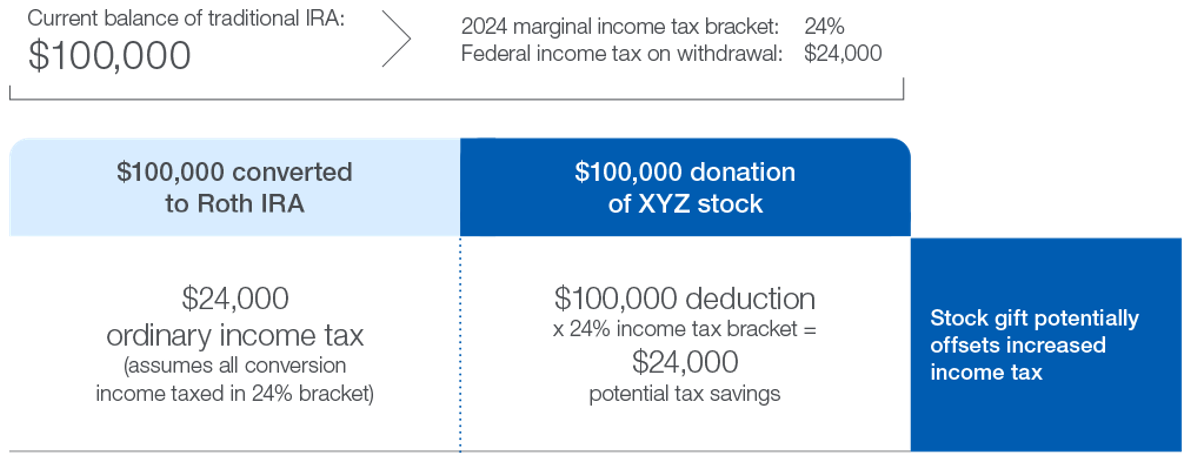

Client 4: “We’ve talked about converting my traditional IRA to a Roth IRA. My hesitation is the income taxes I’d have to pay on the amount converted.”

When a charitably inclined client is faced with an unexpected increase in income – from a Roth IRA conversion, bonus compensation, inheritance, or another event – they can make a donation and potentially claim a charitable deduction in an amount that offsets the corresponding income taxes.

Case study

Olivia wants to convert her traditional IRA to a Roth IRA. The primary benefits of a Roth IRA are tax-free growth, tax-free withdrawals (if holding period and age requirements are met), no annual RMD, and elimination of tax liability for beneficiaries (depending on the timing).

Her traditional IRA has a balance of $100,000. Converting the account to a Roth IRA involves withdrawing the assets, and the withdrawal is considered ordinary income. Olivia will be in the 24% income tax bracket, so her income tax on the withdrawal would be $24,000. This would be a large tax bill but also a tradeoff for having tax-free withdrawals from the Roth IRA in retirement.

Olivia’s financial advisor suggests that she could increase her charitable giving this year to $100,000, an amount that entirely offsets the income tax on the withdrawal.

This hypothetical example is only for illustrative purposes. The example does not take into account any state or local taxes or the Medicare net investment income surtax.

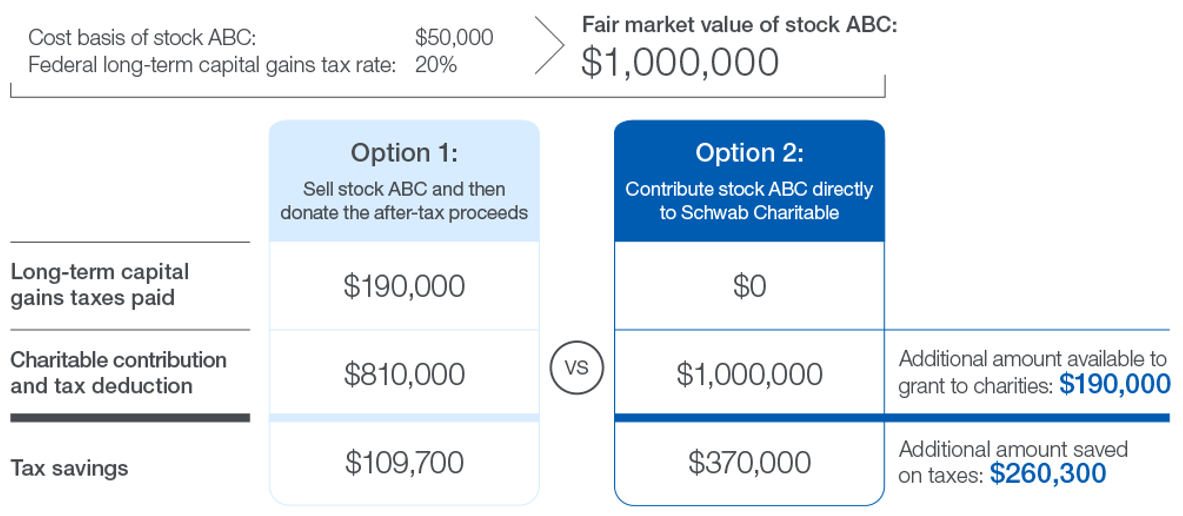

Client 5: “I want to sell a portion of my company. How can I minimize my taxes?”

Owners of privately held businesses often want to give back to communities where they operate, support their favorite causes and charities, and create a charitable legacy. Donating a business interest – instead of cash from the sale of the interest – can be a tax-smart way to give.

Case study

Chloe, a co-founder at privately owned Corporation ABC, plans to use $1 million of her ABC holdings to fund her philanthropic goals and reduce the concentrated position the stock has in her portfolio. The shares have a cost basis or original cost of $50,000. As there is no easily identifiable market for ABC stock, Chloe’s company has a buyback program in place.

In Option 1, if Chloe transfers the $1 million of shares to ABC, pays the 20% federal capital gains taxes, and donates the after-tax proceeds, her tax savings would be $109,700.

Her financial advisor suggests that she open a donor-advised fund account with Schwab Charitable and donate the stock to Schwab Charitable, as shown in Option 2. The account is an easy way for Chloe to give the money to other charities, and by donating the stock she eliminates capital gains taxes on the amount of appreciation. Chloe works with Schwab Charitable’s staff to complete the necessary paperwork for the assignment of $1 million shares of ABC to Schwab Charitable and transfer back to ABC through the company’s buyback program. This approach increases Chloe’s charitable contribution and tax deduction and increases her tax savings.

This hypothetical example is only for illustrative purposes. The example does not take into account any state or local taxes or the Medicare net investment income surtax. The tax savings shown is the tax deduction, multiplied by the donor’s income tax rate (37% in this example), minus the long-term capital gains taxes paid. In Option 2, while the charity will receive $1,000,000 upon sale, the qualified appraisal for tax deduction purposes will likely apply a minority discount, which is not reflected in this case study for simplicity.

What you can do next

With tax season upon us and with 2023 taxes top of mind for your clients, it’s a great time to share charitable planning ideas for 2024. Schwab Charitable offers various resources to help you initiate charitable conversations and guide your clients throughout their philanthropic journey. You may:

- Share the client version of this article.

- Explore the award-winning Schwab Charitable Giving Guide or the Navigating Family Philanthropy series.

- Visit the Schwab Charitable advisor resource center for additional materials, including helpful articles to share with clients.

- Learn more about incorporating charitable giving strategies into your practice or request an information kit. Email give@schwabcharitable.org or call 855-966-3764.

Related: Rise Above: Why Advisors Choose the RIA Model and How It Helps Them Soar

*Operating charities, or qualifying public charities, are defined by Internal Revenue Code section 170(b)(1)(A). Donor-advised funds, supporting organizations, and private foundations are not considered qualifying public charities.

A donor’s ability to claim itemized deductions is subject to a variety of limitations depending on the donor’s specific tax situation. Consult a tax advisor for more information.

This information provided by Schwab Charitable is for educational purposes only, and is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. Where specific advice is necessary or appropriate, you should consult with a qualified tax advisor, CPA, Financial Planner, or Investment Manager.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc., a subsidiary of The Charles Schwab Corporation.

Schwab Charitable™ is the name used for the combined programs and services of Schwab Charitable Fund™, an independent nonprofit organization. Schwab Charitable Fund has entered into service agreements with certain subsidiaries of The Charles Schwab Corporation.

Schwab Charitable Fund is recognized as a tax-exempt public charity as described in Sections 501(c)(3), 509(a)(1), and 170(b)(1)(A)(vi) of the Internal Revenue Code. Contributions made to Schwab Charitable Fund are considered an irrevocable gift and are not refundable. Once contributed, Schwab Charitable has exclusive legal control over the contributed assets.

© 2024 Schwab Charitable Fund. All rights reserved. (0324-P47M)