For some time it has been clear that there are at least two camps in banking: those who get tech and those who don’t. This applies at the executive level just as much as it applies at the customer level. The manifestation of this in reality is a bank that thoroughly doubles down on digitalisation of interaction versus a bank that still invests in human distribution. In a similar way, it is demonstrated by customers who would rather avoid a branch visit versus those who love branch interaction.

I remember a survey a few years ago saying that customers would rather have a dental appointment than visit a bank branch … and yet the human interface is still important. This was realised by Dutch supermarket chain Jumbo who recently introduced slow checkout lanes. These lanes are specifically dedicated to customers who want to chat and checkout, rather than just checkout. Interesting.

One of the primary problems that older people face globally is loneliness, especially in urban areas where life is hectic and becoming more and more digital. In order to combat this from a very common front—the grocery store checkout—a Dutch business came up with an idea. A Kletskassa, or "chat checkout," was created by Jumbo, a Dutch grocery chain with over 700 locations, for customers who are not in a rush and would want to converse with the cashier. In the Netherlands, there are 1.3 million individuals over 75, and a sizable grocery chain is making sure they don't spend their golden years feeling lonely …

The thing is that no bank could justify keeping branches open with humans, just to chat to old people. So, why would you keep branches open? Maybe, because people don’t like online, digital services?

I have actually said this for years, even though advocating digitalisation of banking, that not everyone wants to be digitalised. We still need human interfaces. In my discussions of digital banking, the argument is that banking needs to be reinvented for the distribution of data through software and servers, rather than the traditional model of the distribution of paper through buildings with humans. The thing I have never said is that we don’t need buildings with humans.

The question is where, why and when do we need buildings with humans? Where, why and when do we need a human interface?

Jumbo has got the idea: have you?

OK, so, by this point, you’re probably thinking: what’s the point of that? A high overhead cost for an audience that is literally dying out? Nah.

Well, here’s the point: people don’t like digital only.

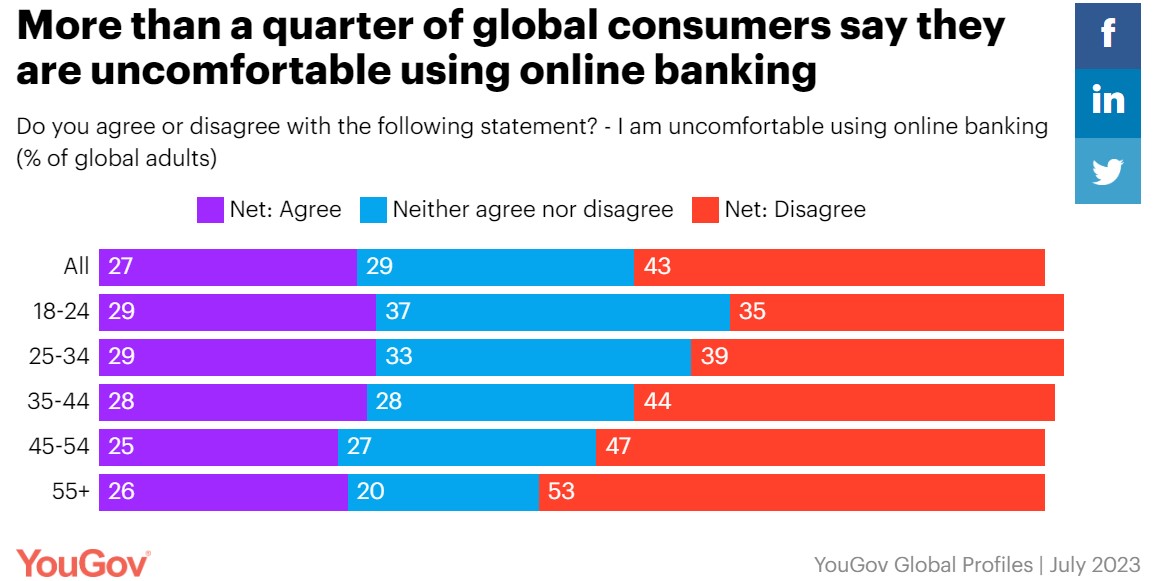

This is proven regularly, but the latest research from YouGov reinforces this view. Interviewing consumers across 18 international markets, the firm found that a quarter of global consumers are uncomfortable using online banking.

Interestingly, it varies widely by market. For example, nearly two in five consumers (37%) are uneasy with online banking in India compared to China where it is just 19%. 1 in 10 Finnish consumers are uncomfortable with online banking, compared with almost half (44%) of Germans. In America, two in five (38%) are cautious to bank online yet, surprisingly, younger people are more uncomfortable (18-24: 53% and 25-34: 46%) than older people (45-54: 28% and 55 plus: 31%).

The net:net is that you cannot generalise and say that digital is best for everyone. Digital is best for some, but not everyone and it is highly likely that some banks will thrive by not being totally digital.

#justsaying