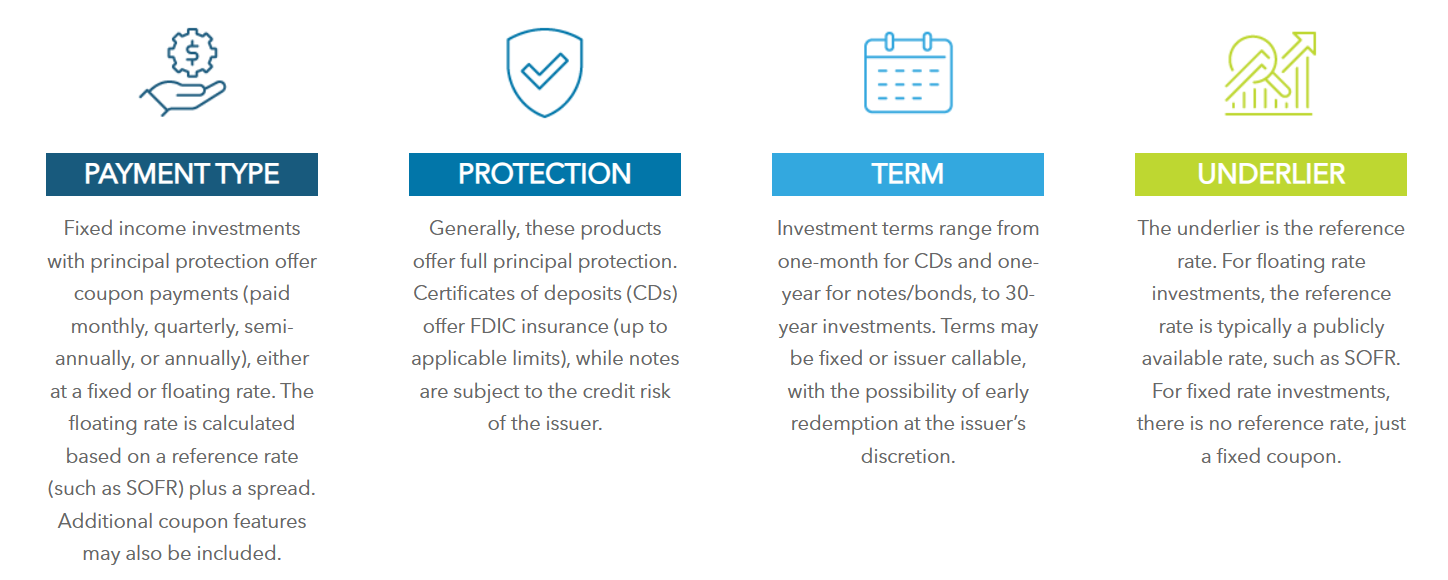

Fixed income investments with principal protection generally offer fixed-rate coupons or floating rate coupons linked to a reference rate, such as the Secured Overnight Financing Rate (SOFR) or changes in the Consumer Price Index (CPI). They are an income solution with a variety of coupon structures and varying degrees of credit risk, which may be used by investors to meet their portfolio income objectives.

What are Fixed Income Investments with Principal Protection?

Fixed income investments with principal protection, including rate-linked investments, can provide income to investors on a periodic basis, either at a fixed or a floating rate, often while offering full principal protection.

Fixed income investments with principal protection are generally buy-and-hold products when used to generate periodic income, and investors must be willing to hold their investment until maturity. Investors should always read and understand the offering document before investing—in it they will find clearly defined terms, fees, and risks, including issuer credit risk, any limits on upside participation, potential for loss, and limited liquidity.

How Do They Work?

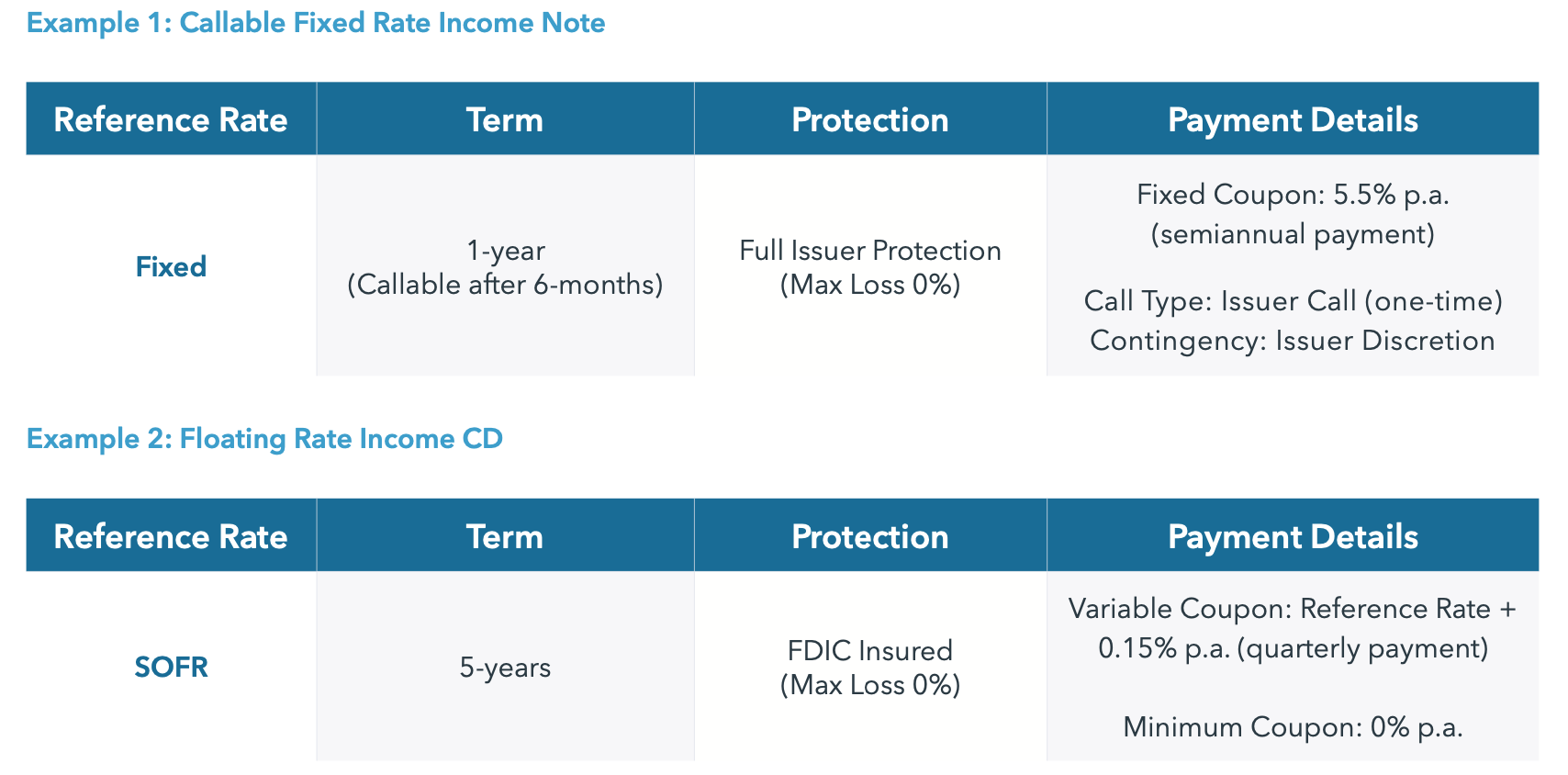

Let’s take a look at two hypothetical examples to further understand how the features of fixed income investments with principal protection work.

This callable fixed rate income note pays a semiannual coupon of 5.5% per annum. This note also offers full issuer protection, which means that the principal amount will be returned at maturity, subject to the credit risk of the issuer.

It has a one-year term, but it is callable at the issuer’s discretion, which means that on the call observation date the issuer may choose to redeem it prior to the scheduled maturity date after six months. If the note is called, investors will receive full principal back as well as any final coupon payment, and will no longer be invested in the market. If it is not called by the issuer, it will not be redeemed until the scheduled maturity date. In exchange for the issuer being able to determine whether to exercise the callability feature, which introduces additional uncertainty and risk to investors, issuer callable investments may offer higher potential returns than non- callable investments.

This floating rate income CD pays a variable coupon, which means that the coupon payment amount is calculated based on the reference rate. It pays a quarterly coupon of SOFR plus a spread of 0.15% per annum. It also is FDIC insured, which means that the principal amount is guaranteed to be returned at maturity and is insured by the FDIC, up to the applicable limit, which is typically $250,000 per depositor. Any amount of a CD that exceeds the applicable FDIC insurance limits, as well as any amounts payable under the CDs that are not insured by FDIC insurance, are subject to the creditworthiness of the issuer.

It has a five-year fixed term, which means that it cannot be redeemed prior to maturity. Investors must hold the CD until maturity in order to receive the protection described above.

When to Consider Fixed Income Investments with Principal Protection

For investors looking to generate portfolio income to meet their investment objectives, a diversified portfolio of fixed income investments with principal protection, including rate-linked investments, may be a welcome consideration. As with all fixed income investments, investors must be comfortable with the credit risk of the issuer and potential liquidity risk. Take note of the following key benefits and considerations:

Benefits

- Income Potential: Fixed income investments with principal protection offer a variety of coupon structures that can help meet income objectives, and issuer callable investments may offer higher potential returns than non-callable investments. While certain fixed income investments offer fixed rate coupon payments, others offer floating rate coupon payments that may not be guaranteed.

- Downside Protection: Fixed income investments with principal protection typically offer full protection. CDs offer FDIC insurance (up to applicable limits), while notes/bonds are subject to the credit risk of the issuer.

- Flexibility of Design: Fixed income investments with principal protection are available from a variety of issuers, and with varying tenors, coupon structures, and reference rates, offering income solutions that can be shaped to meet specific investor needs. Investors can typically invest in amounts as low as $1,000.

Considerations

- Credit Risk: Investors who hold fixed income investments with principal protection are exposed to the credit risk of the issuer and must be comfortable with the issuer’s creditworthiness for the life of the investment. CDs (including rate- linked CDs) are insured by the FDIC, up to the applicable limit. Any amount of a CD that exceeds the applicable FDIC insurance limits, as well as any amounts payable under the CDs that are not insured by FDIC insurance, are subject to the creditworthiness of the issuer.

- Liquidity Risk: Fixed income investments with principal protection are generally buy-and-hold investments when used to generate periodic income, which means that investors must be comfortable holding the investment until maturity in order to receive principal protection, and there is no guaranteed secondary market. Changes in interest rates and credit conditions will affect the market value and secondary liquidity, and any secondary market sale may result in investors receiving a price lower than the initial purchase price.

- Fees: Fees and costs are typically embedded in the price of a new issue fixed income investment with principal protection. The price an investor may receive if sold before maturity may be negatively impacted by the embedded fees and costs.

- Call Feature: Callable fixed income investments with principal protection can be called before maturity based on issuer discretion. It is possible the trade does not last for the full length of the stated term. This introduces reinvestment risk to the extent a trade is called early and similar alternatives are not available.

- Other Risks: Fixed income investments with principal protection are subject to interest rate risk, inflation risk, and market risk. Investors should also understand the unique set of risks of the reference rate, if any.

Related: Structured Investments 2023 Insights: Navigating Market Evolution with Flexibility

Securities products and services may be offered through iCapital Markets, LLC a registered broker/dealer, member FINRA and SIPC, and an affiliate of Institutional Capital Network, Inc. (“iCapital”). Please see the disclaimer at the end of this document for more information.