Written by: Gary Ashton

This week is a big one for big technology names in the S&P 500 index reporting 2Q20 earnings. First up is Facebook (NASDAQ: FB) and PayPal (NASDAQ: PYPL) reporting on Wednesday, followed by Apple (NASDAQ: AAPL), Amazon (NASDAQ: AMZN) and Google (NASDAQ: GOOG) reporting the next day. Oddly, analysts have been hardest on Amazon, with 2Q earnings revised down by nearly 70% over the last three months to $1.75 per share, according to data from Finscreener.com. Out of all the stocks reporting this week, only Apple has had its earnings expectations revised higher by 3.11% to $1.99 per share.

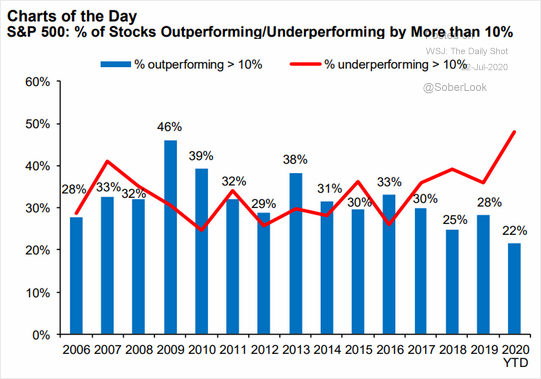

Technology companies have been the darlings of the market this year, with the tech-heavy NASDAQ 100 stock index up nearly 14% in 2020 compared to the broader S&P 500 index, which is still down 1.30% this year. 2020 has been a tough year for S&P 500 stocks. The chart below shows the percentage of stocks that are underperforming and outperforming by more than 10% this year compared to the previous 14 years. A staggering 50% of S&P 500 stocks are down by more than 10% in 2020 compared to only 22% that are up more than 10% this year. One can see that this data is out of step with years past, despite unprecedented market intervention from the US Federal Reserve Bank in the wake of the global Covid-19 pandemic.

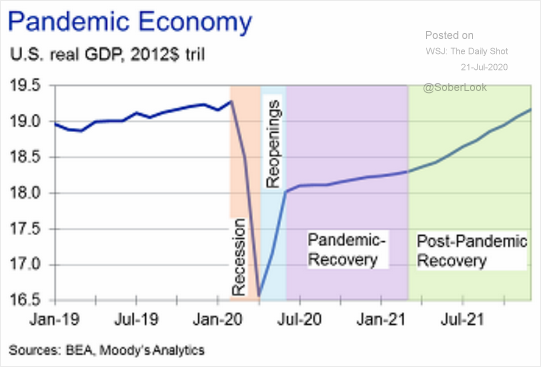

Analysts warn that the Fed intervention has made the market too expensive. Despite the relatively poor performance of stocks in the S&P 500 in 2020, the forward 12-month P/E ratio is above both the five and 10-year average at 22.2. As the US macroeconomic situation improves in 2H20, corporate earnings should follow and allow this ratio to revert to its longer-term average. Before that, however, investors will be carefully watching the first reading of second-quarter US gross domestic product that will be released Thursday. The key to understanding here is the scale of any economic recovery that resulted from reopening business after the lockdown (see chart below).

As of the end of last week, 26% of companies in the S&P 500 reported actual results for 2Q20. Data from the blue-chip names above will be critically important to get a better picture of the relative health of the US tech sector overall. However, out of the handful of tech names that have reported so far in 2Q, we can see that information technology is second only to health care in terms of revenue growth at 0.7%. Heath care, unsurprisingly, is reporting revenue growth of 1.5% in 2Q20. As more tech companies report financials, perhaps they can improve their pole position for this metric.

Related: Alteryx Stock: A Quality Company for Your Growth Portfolio

DISCLOSURE:The views and opinions expressed in this article are those of the contributor, and do not represent the views of Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.