Dividend Investing Just Got Tougher

It happens during every market selloff. The love affair with “dividend-paying stocks” and “dividend growth stocks” ensues. There is certainly merit to that. When you have earned a paycheck for a while, and are angling toward retirement, replacing that steady income with steady income looks like a good deal.

In some corners of the stock market, if given a long enough time period, this could work out well. However, in addition to the usual hurdles of what stocks or funds to choose, and at what prices to buy them, there are some historical firsts.

Namely, we have entered a phase of our investment lives where a lot of what was assumed to be, no longer is. One of those things is the reliability of companies to pay their dividends during the COVID crisis.

The allure of dividends

Dividends are more tangible and “real” than earnings. The dividend must be paid in cash, while earnings can be manipulated by accounting gimmickry. Investors learned that the hard way in past financial crises. That said, the current COVID-19-induced financial crisis is very different when it comes to evaluating dividend stocks. The reason is straightforward: many companies are suspending or reducing their dividend payouts. That throws the entire concept of “Dividend Aristocrats” into turmoil.

Another is how many of those businesses will resume dividends payment and annual growth of those payments AFTER the crisis subsides. In the same way that many folks getting laid off from work may not be welcomed back, dividend policies are changing by the day.

Growth…interrupted?

CNBC reported this week that about 1/4 of the companies in the S&P 500 have suspended “forward guidance.” In English, that means they don’t want to try to forecast their earnings in such a strange, opaque business environment. If they don’t have visibility about earnings, they don’t have visibility about dividend payments. After all, dividends are effectively the company sharing their profits with you, the shareholder.

And, if companies are hanging on to their dividend payouts by borrowing money to do so, that’s a bad habit. So, it makes sense that investors are more likely to avoid landmines by owning companies that grow their dividends each year, even if those dividend payouts are not as high as some other companies. For instance, some energy stocks now have eye-popping yields. But that’s on paper. The stats you read online may be based on pre-COVID data. Don’t get fooled by that.

Talking heads and yields

Also, don’t get distracted by professional dividend investors hawking their wares. While everyone needs a haircut today (I suppose), when life gets closer to normal again, asking your barber if you need a haircut is a “loaded question,” isn’t it? That’s why at times like this, be careful to not just fall for professional dividend-stock investors telling you that it’s a great time for dividend stocks. To them, it’s ALWAYS a great time to buy dividend stocks! After all, that’s how they get paid.

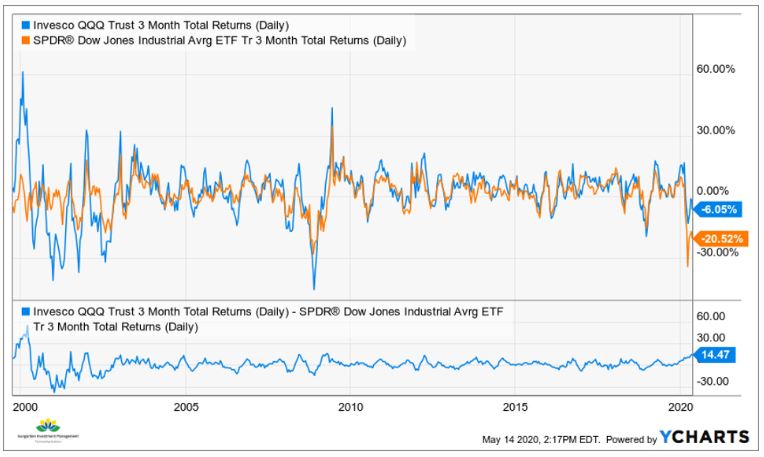

I am a dividend-stock investor at heart. But, as I discussed in a recent article here, I have been willing to accept far less dividend yield this year. In exchange for that, I endeavor to keep clients from losing 20-30-40% when “dividend stocks” fall with the rest of the stock market.

To navigate this treacherous time for finding income via stocks, it is about kicking your research process up a notch. It’s OK to be stingy about what you let into your portfolio these days, especially when you don’t know if a company will pay its dividend when you expect to receive that cash.

Aristocrats? No sure thing.

This is the issue of the so-called “Dividend Aristocrats;” the companies that have raised their dividend amount every year for decades. Are they more likely to be more predictable going forward? I think that’s a tough question. If the business is in technology or healthcare, it may have a better chance than would a retail store or oil stock in today’s world.

If you are inclined to try to pick dividend stocks in this environment, I would double-up on my due diligence on anything that is not large cap and liquid, if considering those non-Large Caps at all. And, just because a stock has been lower volatility in the past, it might not be in this new world.

Dividend stock strategy

To me, the key statistics are “Payout Ratio” and “Cash Flow.” The companies that had a large cash cushion to begin with, whose businesses are not in the cross-hairs of business shutdowns (sorry, mall retailers and energy companies) and who have a documented history of putting the dividend payment on a pedestal are the ones to concentrate on.

Any stock can potentially be considered for a “tactical” or trade position. But if you are trying to plant some seeds in your portfolio by holding onto some stocks for a while, financial stability is a top priority now.

Bottom-line: risk is always there in equity investing. But this is a time where some unique, additional risks are around us. Do your homework, and don’t succumb to the false security of what worked in the past. There will be a clearer lane for hogging all the dividend yield you can afford. It is more likely to be sometime in the future than right now.

Related: How To Evaluate Your Portfolio’s Performance. The Sensible Way.