Written by: Matthew R. DeCicco, CFA, Brian Foerster and Stephen Hillebrecht | Lord Abbett

- Innovation growth companies in industries such as biotechnology and e-commerce have been outpacing the broad market and cyclical stocks during the recent market volatility.

- Lord Abbett experts think that many of these stocks have the potential to realize strong growth, and capture market share from established competitors, in the future.

- These experts also believe that an actively managed approach that emphasizes rigorous research to identify these “disruptors,” along with a tightly focused buy-and-sell discipline, may be the optimal way to build an innovation growth portfolio.

Might the stocks of the most innovative companies potentially become a “new core” holding for equity investors, especially in the wake of social and economic disruptions caused by the pandemic crisis? That’s the intriguing thesis of the members of Lord Abbett’s Innovation Growth investment team. This concept was among the subjects covered in an April 8 webinar updating the current environment for growth equities—and the areas of that category that “we think are well-prepared to lead the market as we get to the other side of this economic interruption,” as one Lord Abbett expert says. (Register to view a replay of the webinar.) Director of Product Strategy Stephen Hillebrecht hosted the event, which featured Portfolio Manager Matthew DeCicco and Investment Strategist Brian Foerster. Here we present select highlights from the webinar.

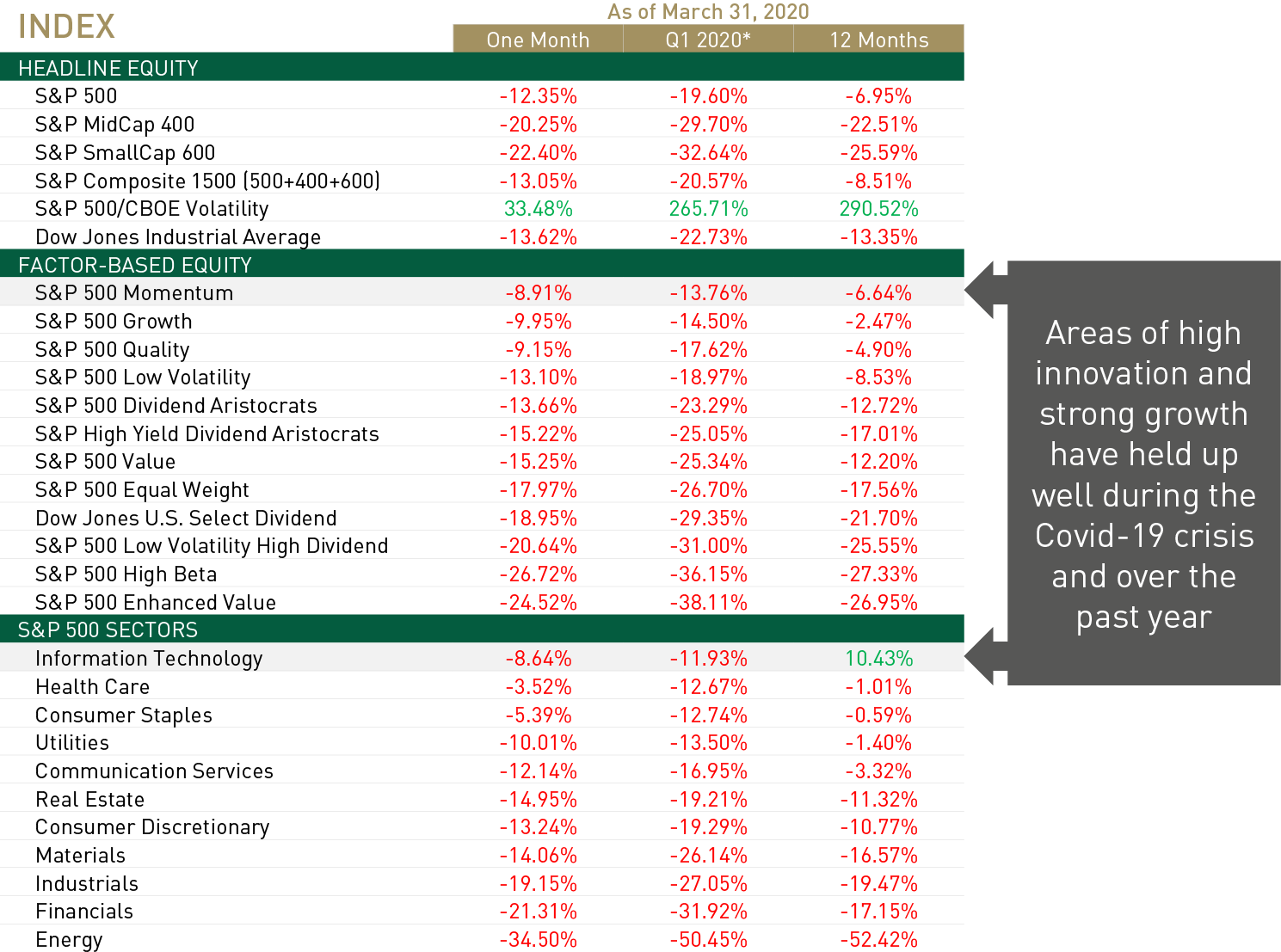

Innovation Stocks Held Up Relatively Well in the Recent Selloff

In the wake of the pandemic crisis, “we've seen a large dispersion of returns within the markets, whether you look at value versus growth, or large versus small, or other factors,” Hillebrecht says. In this volatile period,” innovation growth companies in particular have been outpacing the broad market and cyclical stocks.” (See Figure 1.)

Figure 1. Sector and Factor Performance Varied Greatly During the Recent Selloff

Performance of listed indexes and subindexes for the indicated time periods

Source: S&P Dow Jones, as of 3/31/2020. Definitions for headline indexes contained in Glossary and Index Definitions, below. Factor-based and sector subindexes are components of the S&P 500 Index, except as indicated.

“Historically, small caps have outperformed large caps coming out of a market downturn, and small caps have outperformed large caps when U.S. GDP growth is less than 2%,” DeCicco observed. “So keeping all this in mind, over the last two weeks we began to position our portfolios to take advantage of the potential opportunities in front of us.” He also said his team is looking at “the ways Covid-19 will potentially change our economy, and how different companies that we can invest in may be affected.”

“Something that we've been spending time on as we weigh new and existing portfolio investments,” he adds, “is to consider the strength of the potential investment coming into this crisis, and how the investment may potentially look on the other side of the chasm of social distancing.”

“Innovation was already leading the market in terms of return, and growing size in the economy, even before we headed into this pandemic crisis,” says Foerster. “At the same time, global cyclical stocks have largely struggled over the last decade. Secular growth had already been leading into this incredibly hostile period for the equity markets.”

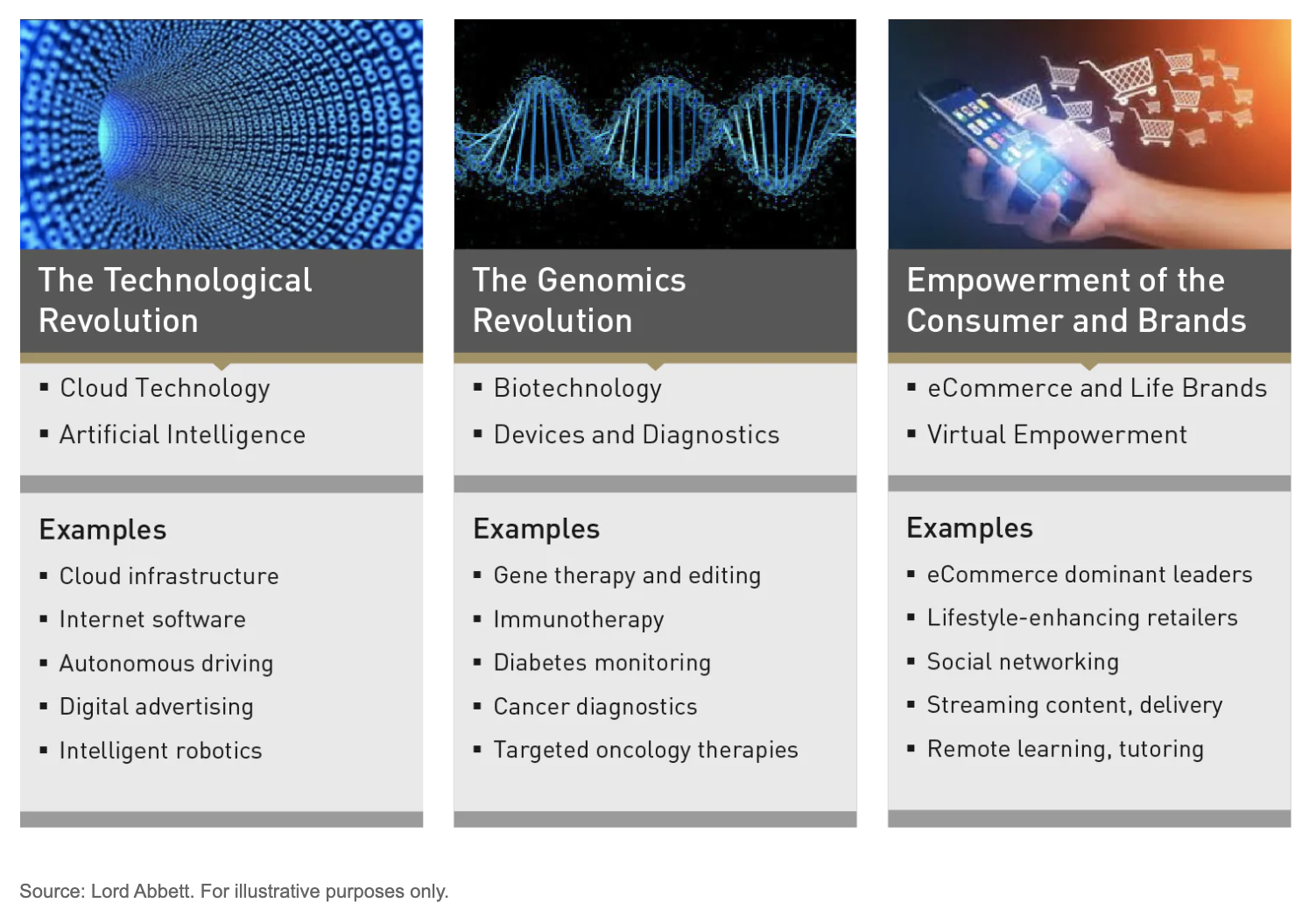

“Fast forward to today, and you see that cloud technology, artificial intelligence (AI), biotech and medical devices, e-commerce, and a new area that we've classified as ‘virtual empowerment,’” are among the industries that have been the most resilient during the recent downturn, he added.

Figure 2. Megatrends in Innovation: Three Themes Bringing Efficiencies and Disruptions

Why Innovation Could Potentially Be the “New Core”

The Innovation Growth team sees the emergence of these innovative industries as market leaders as something of a paradigm shift in equities. “In many ways, we believe innovation represents the ‘new core’ of our economy,” says Foerster. Indeed, he believes investors should not consider these areas “the way you did 20 years ago as a satellite asset class,” but as a more essential long-term holding in equity portfolios. “Certainly, their resilience during this downturn enhances their role as a core holding.”

“What's been interesting to me is to observe some of the individual stock reactions during the selloff,” says DeCicco. He pointed to the “positive performance differential between companies with secular innovative growth themes—cloud technology, biotechnology, [and] e-commerce” and more economically sensitive areas of the economy “that are going to suffer from the steep and sudden decline in demand, like banks, energy, or brick and mortar retail.”

Foerster cited a statement of his that he has been including in recent meetings with investors: “The economy is increasingly evolving into a binary story of two types of companies. You are either an innovator, or a company vulnerable to the disruptive effects of innovation.”

Innovation Equities: Three Key Groups

DeCicco listed three areas of innovation “that we think are attractive today and are likely to be well into the future”:

Cloud Computing: DeCicco notes that social distancing measures used to combat the spread of the virus have led to a surge in the number of people working from home. The transition to keep vital businesses working from remote locations with the needed computing power and security “wasn't possible until the cloud computing infrastructure was in place.”

DeCicco added that over the last five years, “cloud software spending is growing nearly 20% compared to 3% in overall information technology (IT) spending,” according to industry data provider IDC. “We believe the crisis will further galvanize this shift to cloud computing.”

E-Commerce: “Within the consumer sector, e-commerce continues to be the dominant theme,” DeCicco says. Early data points from the first wave of first-quarter earnings reports indicate that “e-commerce channels across a variety of companies, big and small, are accelerating,” he says. Another development to watch: the extension of robust and easy-to-use e-commerce technology into other service businesses. DeCicco pointed to the Zoom app, which “has allowed businesses that would not otherwise be able to provide services to carry on during this crisis.”

In terms of e-commerce adoption by other areas of retail, he noted that the grocery industry, “which is only 5% penetrated compared to 15% for other retail, is now seeing a boost that we expect will be sustained on the other side.”

Biotechnology: “Biotech companies have held up quite well relative to other sectors during this downturn,” DeCicco says. “And not just those companies that are working on vaccines or treatments for COVID-19…there has been broad-based strength in this sector.”

Which areas of biotech have caught the team’s eye? He cited companies that are “innovative with best-in-class or first-to-market medicines, addressing a major unmet need, with clearly elucidated biology and leveraging the genomics revolution.” According to DeCicco, ”these are, in our opinion, all-weather investments.”

Seeking the Innovators of Today—and Tomorrow

Hillebrecht asked about the investment approach of the Innovation Growth strategy. Foerster said one area of focus is “those companies that we believe will take market share aggressively.” He cited the cloud computing and e-commerce sectors, both of which have taken significant business from established competitors. “Even within those industries, we favor companies that are willing to reinvest heavily for future growth and capturing market share.”

“We believe that in the growth space, it requires a very active approach to potentially capture the upside, to ride winners as they are realizing their potential,” Foerster says. On the flip side, an active approach allows managers to potentially “get out of the way, to sell stocks of companies as we start to see evidence that their growth and momentum profiles no longer fit our criteria…we believe that combination gives you much better potential for what we call asymmetrical upside in the portfolio.” Another potential advantage: “Having a very open universe to look at small, mid, large, mega cap companies, rather than just established mega caps.”

DeCicco offered further details on the investment process, and the three concepts that he believes make his team’s approach unique:

- Identifying “innovative businesses, especially those companies with the potential to disrupt and take market share.” In identifying the potential of an investment candidate, his team evaluates the business model itself; the management team; the underlying industry conditions; and what they perceive as the company's competitive advantages and their sustainability.

- Finding those companies that exhibit what DeCicco calls “operating momentum.” In his view, “these are quantifiable metrics that indicate that these businesses are realizing their potential, by executing at a high level, and better than the market expects.”

- Focusing on the price momentum of the underlying stock. “We want to see that others are seeing the strong execution that we're seeing, such that it is reflected in the stock price,” DeCicco says. “To us, that concept represents recognition of a company's fundamental success.”

“We continuously optimize our innovation growth portfolios by assessing these three attributes, and the strengths of these three attributes relative to all of our investments and investment opportunities,” DeCicco adds.

A Final (Bullish) Word

Hillebrecht concluded the session by asking DeCicco about his longer-term outlook. “We think it’s a wonderful time to be a growth investor, because we believe that we're living in the early stages of the technological revolution,” he answered.

“We're positioning our portfolios now for a market that we believe will be higher six to 12 months from now. And we're very bullish about innovation investing in the decade ahead.”