In this post-COVID world, open enrollment classroom training is dead…another casualty of work from home. Three factors have contributed to the demise:

- Professionals want control over when, how, and where they receive additional training. They don’t want to commit to a training program that has a fixed date and out-of-town location.

- Professionals want to be offered a buffet instead of a set menu. They want to be able to pay an annual subscription to a training organization and then be able to mix and match different modules and courses.

- There are fewer dollars available for training. Money that used to be set aside for professional development is now being spent on the ever-growing list of industry conferences.

If you know how to use Google Maps, you should not have difficulty with Interactive MindMaps. When integrated with AI, MindMaps can provide professionals with mission critical, personalized tutoring and learning experiences on-demand, 24/7.

The best illustration of the need for a better approach to professional development is the requisite to improve the training of the more than 17.5 million men and women who serve as lay- fiduciaries. * These are the men and women who do not have a financial services background but do have legal responsibility for managing the assets of pension plans, foundations, endowments, personal trusts, and employer-sponsored health plans. In aggregate, these fiduciaries manage more than 30% of the nation’s liquid investable wealth, so their conduct has a direct impact on the fiscal health of the country.

Do you know who is responsible for training the 17.5 million fiduciaries?

No one…and that is the problem. By default, the responsibility has fallen onto the financial services industry.

Furthermore, most of the 17.5 million lay-fiduciaries struggle with understanding their roles and responsibilities. Traditional fiduciary training has failed because it is loaded with legalese, regulatory terms, and industry jargon. In addition, the subjects rarely have applicability to the day-to-day responsibilities of these key decision-makers.

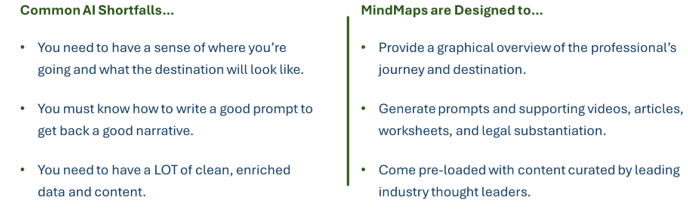

AI holds the promise of improving professional development, but first we must overcome three of the notorious shortfalls:

Even if a person is not familiar with AI, they should be able to use MindMaps. All the professional needs to do is point to or select a section of the MindMap and the appropriate prompt is generated by the integrated chatbot.

There are several advantages to this approach:

- We can reduce costs and the number of student contact hours by teaching a portfolio of MindMaps (frameworks) and then show the professional how to use the proprietary chatbot to fill in the details.

- As previously mentioned, professionals will have access to a digital instructor/coach on-demand, 24/7. Neuroscience informs us that the typical adult will forget 90% of what they were taught six months after undergoing a training program. Now we have a way to refresh mission-critical concepts.

- The chatbot built for a MindMap also can serve as an organization’s digital vault – a way to store IP, videos, articles, research papers, legal opinions, and graphics. Once in the vault, the BOT facilitates the effective distribution of critical information.

- An organization can control the chatbot narrative. To illustrate; while the DOL Retirement Security Rule works its way through political and legal challenges, organizations will be challenged with keeping their training programs up to date. As changes to the Rule are announced, the latest information can easily be uploaded into the chatbot.

Intelligent AI-driven tutoring systems are changing the face of professional development. These innovative approaches should make adult learning more personalized, inspiring, and engaging and dramatically improve decision-making outcomes. We need more effective tools to continue educating professionals long after they have finished a training program.

* The groundbreaking research on lay-fiduciaries was conducted in 2021 by the Center for Board Certified Fiduciaries, “Where are the Lay-Fiduciaries Who Have Control and Responsibility for More Than $26 Trillion in US Investment Assets?”

Related: New Year’s Resolution: Red Team Your Fiduciary Practice