The financial advisor marketing model is largely broken.

Sunken costs, execution with no real direction, no systems in place for scalability – we see it every day in conversations with clients. It’s a model that is hard to detach from and one that’s rooted in years, and years of success in a very different environment.

In a recent study, wealthmanagement.com said the majority of elite advisors (57 percent) spend 4 percent or more of their gross production on marketing. So, an advisor doing $1 million in revenue would be spending $40,000 on marketing. But in most conversations, that spend goes to a few digital tools (that go unused), some random automation, and high cost events.

There’s too little time spent on creating momentum at the top of the funnel through paid and organic marketing. This includes things like organic content marketing, paid social media, Google Ads, Search Engine Optimization (SEO), and unique partnerships. And there’s too much time spent on lead generation campaigns, like events or webinars, with little to no direction on audience, content, and cadence.

Many advisors are automating their brand building, sharing content with no context or plan, and blindly blasting lead generation campaigns to non-target lists.

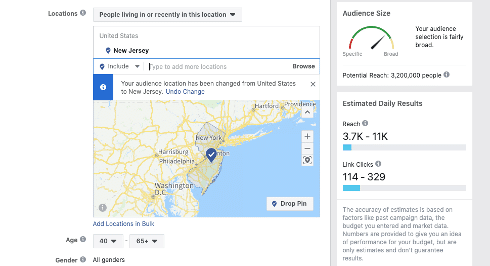

For $20 a day, an advisor in New Jersey could reach 3.2 million pre-retirees in the New Jersey area to make them aware of their brand through a unique piece of content. While we would actually recommend going a bit more targeted than this by adding additional demographic, professional, or interest filters, you get the idea. It’s powerful and cost effective.

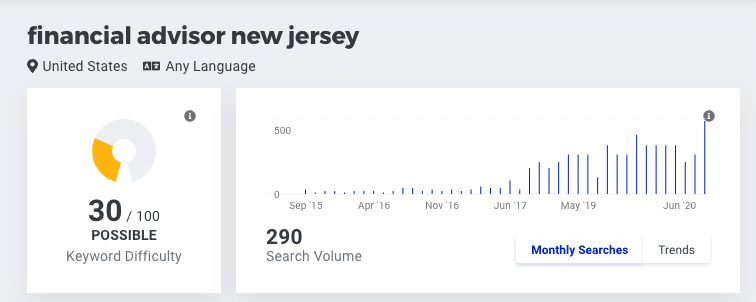

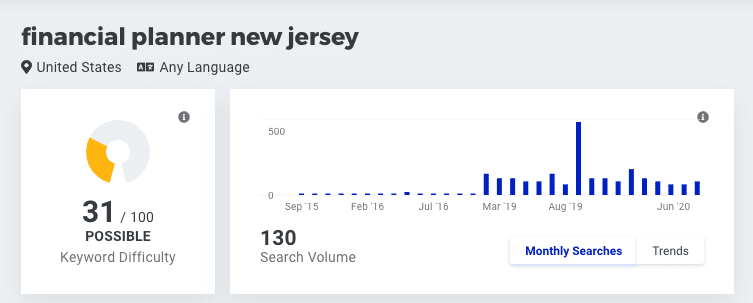

Or, say you don’t see the value in Facebook, and don’t want to spend your dollars there but still want to build a digital program. If you look at Google searches for Financial Advisor New Jersey or Financial Planner New Jersey – you’re averaging 260 and 130 respectively. These searches are extremely down funnel and an indication of someone looking for something specific.

Pairing these channels together can be very impactful – not only are you going after audiences proactively, but you’re capturing demand for audiences searching for you. And once you’re able to get your audience to your website, you’re now able to retarget them and continue to keep your brand in front. This could come in the form of continued brand marketing, or driving to an asset where they exchange contact information (i.e. webinar, free assessment, newsletter, or download).

Finally, once this person exchanges information, you now have the ability to nurture them until they’re able to turn into prospects – a clear system that flows them through specific steps based on interactions.

So, how do you build this? It takes the right model.

- Build top of funnel momentum via content marketing and paid social/search

Do this for 6 months minimum to a specific target audience, pivoting based on the data you’re getting back regarding the engagement and how they’re spending time on your website. - Create valuable mid-funnel assets for information exchange

Build 1-3 core assets to ensure you can retarget people who come to your site and convert those who come to your site organically who may be further down the funnel. This could include a webinar, newsletter, or free assessment. - Have a systematic bottom funnel flow to nurture and convert

Once you’re driving people into your practice and capturing information, it’s time to nurture appropriately. No one wants to be sold to the minute they exchange information for some type of value outside of a free assessment. Create your model for nurturing – what does it look like, how do you engage people before they’re ready to buy? Setup emails, calls, communications to warm them up. - Know your metrics and weak points, pivot appropriately

Most importantly, set a few metrics to understand your cost per lead and cost per acquisition. The average financial advisor spent $3,119 per client on acquisition according to Michael Kitces. And, I’d bet that most advisors don’t know their client acquisition costs. Know your costs, pick 2-3 metrics, and pivot based on the data.

A good marketing model isn’t complex, and it does take 6-12 months to build a model that works for your practice, but the idea that you can short the top of the funnel momentum tactics and cut straight to leads and closing is a myth. Good marketing starts strategy and intent.