Written by: Joseph Burns | iCapital Network

Investing in equities has been challenging these past few years, given the typical late-cycle risks associated with increased volatility, slowing economic growth, and now having to consider the impact of a pandemic on companies and industries across the global economy. Fortunately, certain sectors like technology and healthcare have steadily provided opportunities on both a long and short basis to help investors increase returns and minimize downside risk. This dynamic has endured over multiple market cycles and appears likely to continue for the foreseeable future.

HEDGED TECH AND HEALTHCARE STRATEGIES HAVE DELIVERED LONG-TERM OUTPERFORMANCE

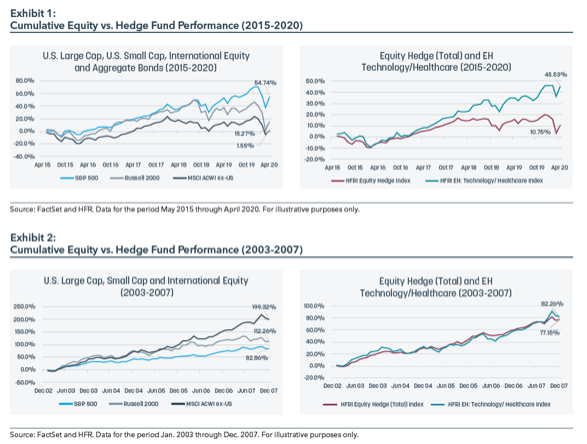

Evaluating multiple time periods across different equity markets and sectors provides useful context to help us understand which areas have outperformed historically, and the possibility of persistent outperformance or potential mean reversion as macroeconomic conditions change over time. During the past five years, we’ve witnessed a substantial return dispersion across geographies and market capitalizations. As seen in Exhibit 1, an allocation to U.S. large-cap equities five years ago has been a solidly profitable investment, whereas U.S. small-cap and non- U.S. stocks have underperformed substantially. Indeed, while the S&P 500 delivered an annualized return of over 9% since 2015, the Russell 2000 and MSCI ex-U.S. indices generated returns of less than 3% per annum over that same period (Exhibit 1).

That significant return dispersion over the past five years has had a similar effect on hedged strategies. Within long-short equities, sector-focused funds specializing in technology and healthcare have substantially outperformed the average equity hedge fund. The HFRI Equity Hedge: Tech/Healthcare Index delivered returns comparable to those of the S&P 500 Index on an absolute basis, but significantly higher returns on a risk-adjusted basis. Technology and healthcare hedge funds also outperformed during the five-years leading up to the Great Financial Crisis. During that time period, however, the S&P 500 generated a respectable 12.8% annualized return, but significantly underperformed small-cap and non-U.S. indices, which returned 16.3% and 24.5%, respectively, on an annualized basis (Exhibit 2).

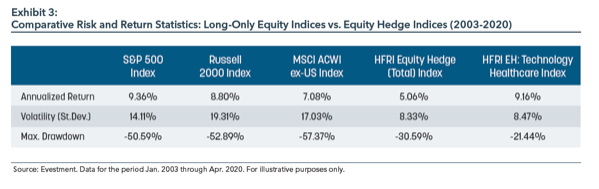

Technology and healthcare funds also protected capital better in 2008, and they outperformed over the subsequent 2009-2014 period. In fact, since 2003, equity investors have experienced a 5-year bull market; a global financial collapse; a 10-year rally with intermittent sell-offs; the fastest (30%) peak-to-trough decline in history; and, finally, double-digit gains in April 2020. Through it all, hedge funds focused on technology and healthcare have performed exceptionally well on both an absolute and risk-adjusted basis (Exhibit 3).

BENEFITTING FROM A CONTINUOUS SUPPLY OF “WINNERS” AND “LOSERS”

Why have technology and healthcare funds managed to deliver such strong risk-adjusted returns over so many different investing environments going back to the early 2000s? For hedge fund investors, technology and healthcare have long been considered the most “Darwinian” sectors across the global economy, with strong companies constantly taking market share from weaker competitors. In other industries, such as financial services, energy, and consumer discretionary, the typical price movement of equities can be tied directly to macroeconomic factors like interest rates, the price of oil, and global GDP, making it difficult for those sector funds to generate differentiated returns over time.

Additionally, multi-sector “generalist” funds often struggle during periods of high correlation, when there is little distinction between companies within and across sectors. Technology and healthcare, on the other hand, offer a constant supply of “winners” and “losers” among companies with different market capitalizations across the globe. Technology has been a steadily disruptive force in the global economy, with new entrants taking market share from incumbents. That remains very true today. Similarly, in healthcare, with a constant barrage of new drugs coming to market in areas like therapeutics and biotechnology, investors can realize outperformance through a long and short investment approach. That is why a sector-focused index in technology and healthcare has generated over 400 basis points of annual outperformance over an 18-year period versus a composite generalist equity benchmark, and why technology and healthcare invested on a long/ short basis can provide equity-like returns with substantially less volatility and downside risk over nearly two decades.

A FAVORABLE ENVIRONMENT CONTINUESFOR LONG-SHORT STRATEGIES

Looking ahead, the opportunity in hedged technology and healthcare remains very attractive. The late-cycle risks, combined with the dramatically different ways companies will either thrive or falter as the current healthcare crisis eases over time, create an ideal backdrop for investing long and short, with potential profits evenly distributed on both sides of a hedged portfolio.

In fact, today’s environment may be optimal for long-short approaches in general, because of the expanding risks associated with long-only equity exposure and the growing opportunity set on the short-side, with so many stocks trading far above their fundamental value. Recently, Stan Druckenmiller – famed investor with one of the best long-term track records in history at Soros Fund Management and Duquesne Capital Management – commented that he is as bullish on long/short equity investing as he has been in over a decade. For equity investors that want to drive long-term gains but are also wary of onboarding downside volatility at this point in the market cycle, taking a hedged approach in technology and healthcare can potentially offer higher returns with less risk. During these uncertain times, that is a powerful combination.