Written by: Kunal Shah | iCapital

Realizing attractive returns in private equity requires managers to adopt long-term strategies that drive growth.

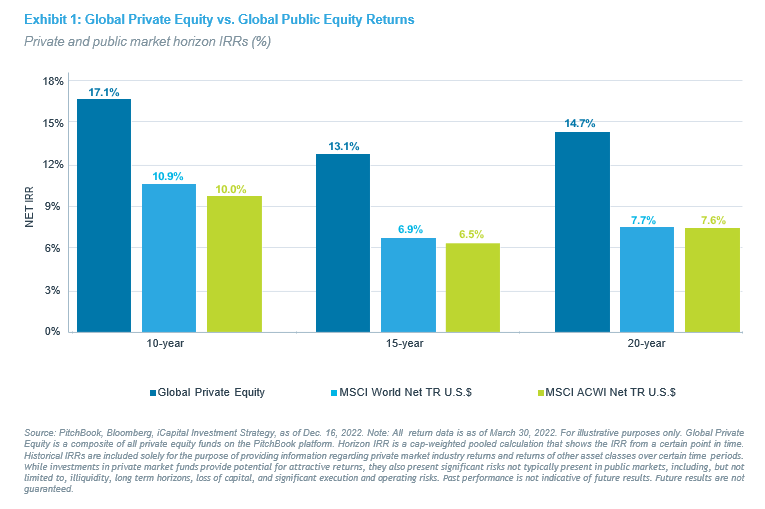

One of the main attractions of private equity is its ability to outperform public equity markets. As shown in Exhibit 1, private equity has outperformed the MSCI AWCI index by over 700 basis points over the last 20 years.

What are the drivers behind this outperformance? Private equity managers are different from public equity managers in that they are more active in managing and adding value to their portfolio companies. They do this by selecting companies that have the potential for continued growth and then implementing creative and transformative strategies and plans.

Many traditional private equity transactions are control buyouts, in which the buyer takes majority control of a firm. This comes with a significant benefit, in that the new owners can focus on actively driving significant value creation in portfolio companies by adopting long-term strategies that they can oversee and closely monitor. In fact, experienced private equity managers are almost obsessively engaged in these three to six-year strategic plans (the typical length of ownership). In contrast, investors in public companies usually hold very small positions and have little ability to influence the activities of these companies.

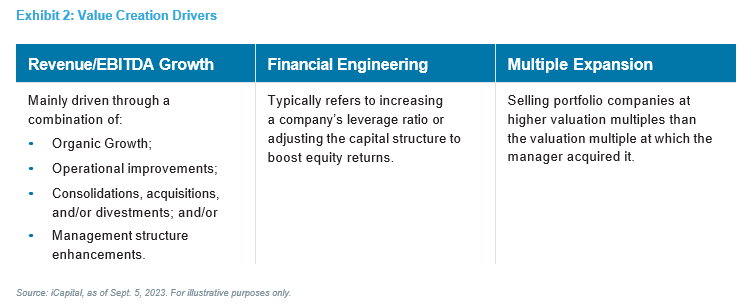

Most private equity buyout managers use a combination of three primary value creation methods:

- Revenue/EBITDA Growth;

- Financial Engineering; and

- Multiple Expansion.

1. REVENUE / EBITDA GROWTH

Revenue/EBITDA growth is mainly driven through a combination of organic growth, operational improvements, and/or consolidations, acquisitions, and/or divestments. To truly drive this growth, buyout fund managers must understand and develop a clear investable thesis before they invest in their target companies, assess market trends, and identify appealing industry sectors. This focus can help managers win deals: management teams at high-quality companies prefer sponsors who not only understand sector trends, but also have the resources to execute on those trends. To aid in the enhancement of portfolio company growth, many private equity buyout managers have developed internal investment teams organized by sectors, as well as internal teams of executives with deep domain expertise in these sectors. The knowledge gained through this sector research enables private equity firms to source investment opportunities proactively, engage in deeper due diligence, identify key risks, earn the trust of target companies’ management teams, and develop relevant business plans to unlock long-term value.

Private equity buyout fund managers spend a significant amount of time with the senior executives who run their portfolio companies. Oftentimes, they hire key senior executives who can execute strategy consistent with the manager’s long-term plan. Together, they focus on strategies such as expanding into new markets, cost/ expense rationalization, making add-on acquisitions, selectively consolidating a fragmented sector by acquiring smaller companies, oftentimes at lower entry multiples, and/or improving operations by streamlining costs and selling non-core assets. These are all levers that help drive value, and therefore the ultimate valuation at which a portfolio company will be sold.

Revenue/EBITDA growth is the most important driver and the hardest to generate consistently.

When a buyout fund manager invests in portfolio companies that consistently show improved financial performance during the manager’s ownership, that is strong evidence that the manager is skilled at making the right calls and can deliver intrinsic value. These managers are often able to accurately anticipate market trends, identify strong businesses, and implement fundamental business improvements.

2. FINANCIAL ENGINEERING

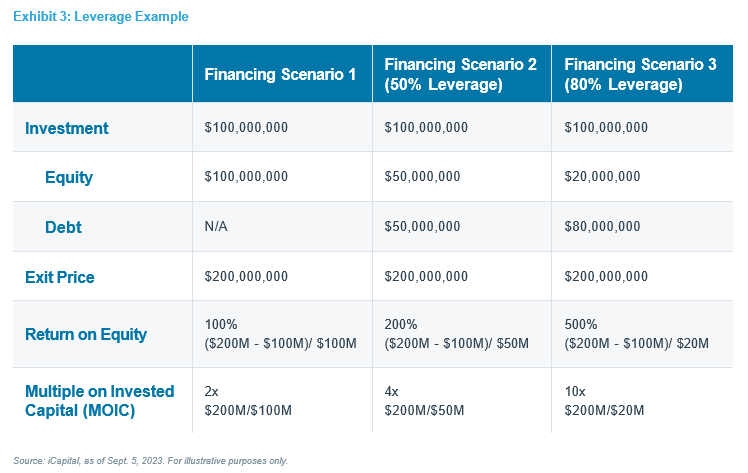

Financial engineering typically refers to optimizing a company’s capital structure through leverage or debt restructuring. Buyout fund managers will often acquire target portfolio companies using borrowed funds to provide a higher yield to equity. These borrowed funds could come in the form of bank debt or private direct loans. When applied prudently, and conservatively, leverage can add meaningful value to a transaction that also achieves the long-term growth objectives as described in the section above.

While leverage can be a useful tool to increase returns, it isn’t without risk, as leverage magnifies both potential gains

and losses. Target companies must have enough cash flows to cover the costs of financing, operating expenses, and other capital expenditures. In addition, high interest rates and elevated inflationary environments can prove challenging to portfolio companies, which face potentially slowing or even contracting growth and reduced cash flow as economic activity softens.

While applying debt in an acquisition model is an important method to create value, we generally view leverage as a commodity and not a distinct differentiator. In fact, what we look for is whether the manager has historically used a prudent amount of leverage and not overly relied on it. Financial engineering as a skillset has been somewhat commoditized over the past two decades and is less of a differentiating factor.

3. MULTIPLE EXPANSION

Multiple expansion refers to when a private equity manager sells a portfolio company at a higher revenue or EBITDA multiple than the multiple at which the fund manager originally acquired it (e.g., buying at 8x EBITDA and selling at 10x EBITDA). At the time of acquisition of a target company, private equity fund managers develop an exit strategy, with the estimated exit price being a key factor in determining a company’s valuation. While the growth potential of the target company is a critical driver of the estimated exit price, fund managers also need to consider the current valuation multiples and merger and acquisition (M&A) activities in the sector, which impact entry and exit multiples. Consistent multiple expansion, particularly throughout different economic cycles, is often a good indication that the buyout fund manager is disciplined in not over-paying for companies and knows how to optimize value by choosing the right time to sell. Multiple expansion is not easy to underwrite, as market conditions change frequently.

MARKET LANDSCAPE

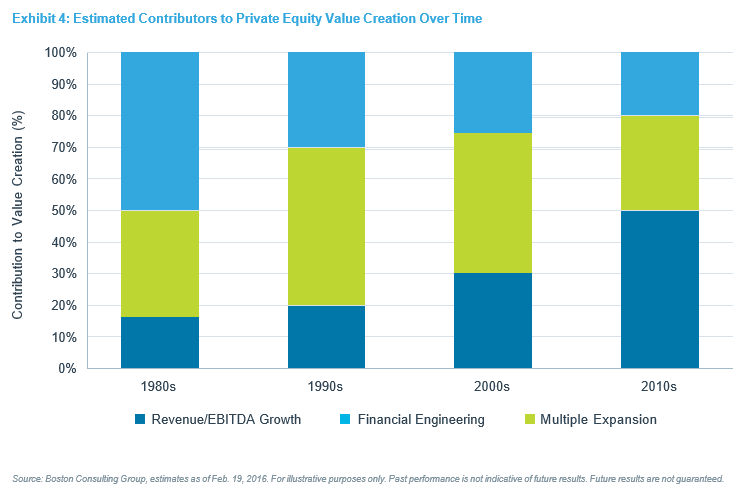

Back in the late 1980s and 1990s, private equity firms relied heavily on leverage and valuation arbitrage, with less emphasis on operational improvement to generate returns. Since then, the contribution of leverage to value creation in private equity has declined while the importance of operational improvements has increased (see Exhibit 4).

Buyout fund managers can’t expect to generate similar levels of outperformance versus public equities based solely on valuations continuing to rise. In fact, most private equity managers that we interact with report flat or declining valuation multiples in their portfolios. Hence, many managers have shifted their focus to identifying and executing initiatives that improve their companies’ revenue and EBITDA trajectory.

CONCLUSION

One of the most crucial factors in evaluating a private fund opportunity is understanding how a manager has created value in their past investments. When private equity managers acquire companies, value enhancement is typically the core objective. But the days of simply levering up and slashing costs are over. Instead, managers today rely much more on their in- house operational and sector expertise to drive revenue/ EBITDA growth at their portfolio companies. The active involvement of managers and long-term nature of private equity explains why it has been able to outperform public equities over the past 20 years. With this dynamic unlikely to change, the potential performance benefits of a private equity buyout allocation should endure.

Related: Where Next for Interest Rates?