Historically, bitcoin has been discussed in the news and among investors as a nascent and volatile asset outside of the traditional stock and capital markets.

Much of the volatility over the past few years can be attributed to sensitivity to small total market size, regulatory hurdles and generally limited penetration in mainstream stock and capital markets. While bitcoin continues to be a volatile asset, it may surprise researchers and investors as to what other major assets have been more volatile than bitcoin.

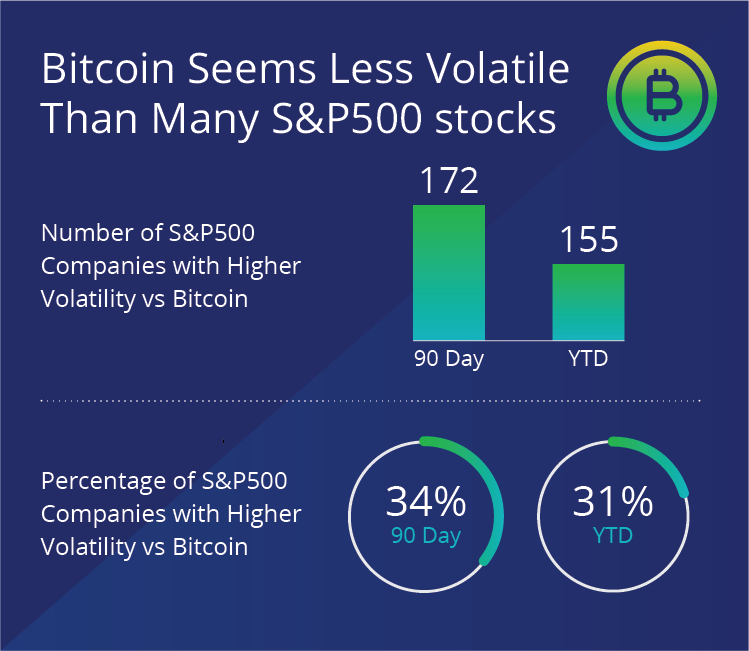

In our long-term study of bitcoin, we had compared bitcoin correlations to traditional asset classes and now see another interesting recent trend with its volatility. In our current volatility research, we compared the 90 day and year to date volatility—as measured by their daily standard deviation1 as of June 30, 2020—of bitcoin against the constituents of the S&P 500 Index. We found that bitcoin has exhibited lower volatility than 172 stocks of the S&P 500 in a 90 day period and 155 stocks YTD.

While there are no U.S. bitcoin exchange traded funds (ETFs) available today, we believe such products may show similar volatility characteristics—based on the comparison above—as many stocks in well-known indices and ETFs, such as the S&P 500 and related products.

DISCLOSURES

1 Standard deviation is a statistic that measures the dispersion of a dataset relative to its mean and is calculated as the square root of the variance.

Related: Bitcoin Price to Surge in Tandem With Gold on U.S. - China Tensions