Written by: Brad Heppner | The Beneficient Company

COVID-19 has brought new challenges to almost every industry and forced companies to rethink their way of doing business. Within finance, the pandemic has led to intense uncertainty and profound market volatility and upended traditional ways of solving problems and serving clients.

Investors of all kinds are making critical decisions about where to allocate resources, how to fund—or save for—important events, and how all of their assets and liabilities factor into these decisions. This is especially true for the alternative assets space, where individuals and smaller institutions face unique challenges when it comes to accessing liquidity on their terms. In Ben’s 2020 White Paper, we took a deeper look at the trends that brought us here and what’s next.

The Unlevel Playing Field for Individual Investors and Smaller Institutions

Alternative assets have long provided critical portfolio diversification and enhanced return potential but often require investors to lock up capital for a dozen years or longer.

- This longstanding trend has created a different set of rules for smaller investors, since long lockups aren’t a problem for large institutions. Their liquidity needs are low, and they have options they control if they want to sell an asset early. That’s not the case for high-net-worth (“HNW”) individuals and small-to-mid-sized institutions. They are more likely to need liquidity because of a change in financial circumstances, a life event, or uncertain markets, and may need it quickly.

- However, those who want to sell early are often ignored by intermediaries in the secondary market, who traditionally target large institutional clients. These brokers often have no financial incentive to work with small-to-mid-sized institutions (those with $1 billion or less in investment assets) or the HNW individuals who have $5-30 million in investable assets. Secondary-market intermediaries conduct deals worth eight or nine figures, charge high fees for complex transactions that may take 12 to 18 months to complete, and deliver full liquidity historically at discounts to Net Asset Value (“NAV”)—none of which is feasible for smaller entities and HNW individuals.

- Yet, if all investors had the same flexibility as large institutional investors to tap liquidity from their alternative assets at any time, at or near NAV, the marketplace would be more transparent, more liquid, better priced, and more accessible.

The Evolution of the Alternative Asset Space

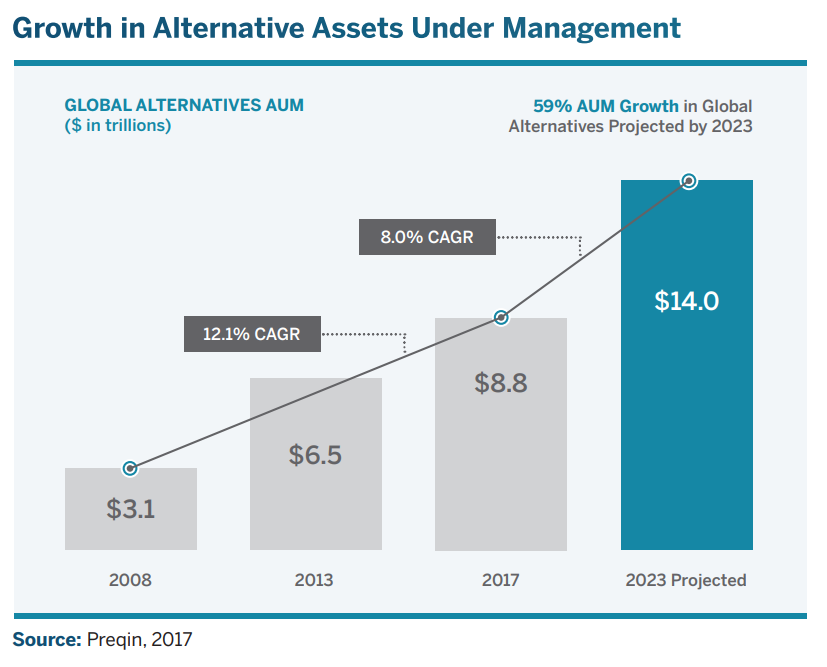

The marketplace for alternative investments has seen—and will continue to see—a significant expansion. In 2008, the alternatives market held $3.1 trillion in assets under management globally.

- In 2008, we saw that as more large institutions entered the space, private banks started to put more of their HNW individuals and small-to-mid-sized institutional clients into alternatives.

- By 2017, global alternative assets under management had grown to $8.8 trillion, representing a 12.1% compound annual growth rate in the 10 years from 2008 (Source: Preqin). Even as the overall market grew, intermediaries in the secondary market continued to ignore the liquidity needs of the increasing number of smaller entities and individuals entering the market.

- By 2023, the alternative asset space is estimated to reach $14 trillion (Source: Preqin) and to become a bigger piece of the overall investing landscape.. The space is growing as the number of publicly listed U.S. companies falls, down 36% since 2000, and down over 45% since its peak in 1996. This decline underscores the concentration of risk in public equity markets and explains why alternative assets have become a critical source of growth and diversification for a wide range of investors—not just large institutions.

The Demand for Alternative Assets is Expanding, Too

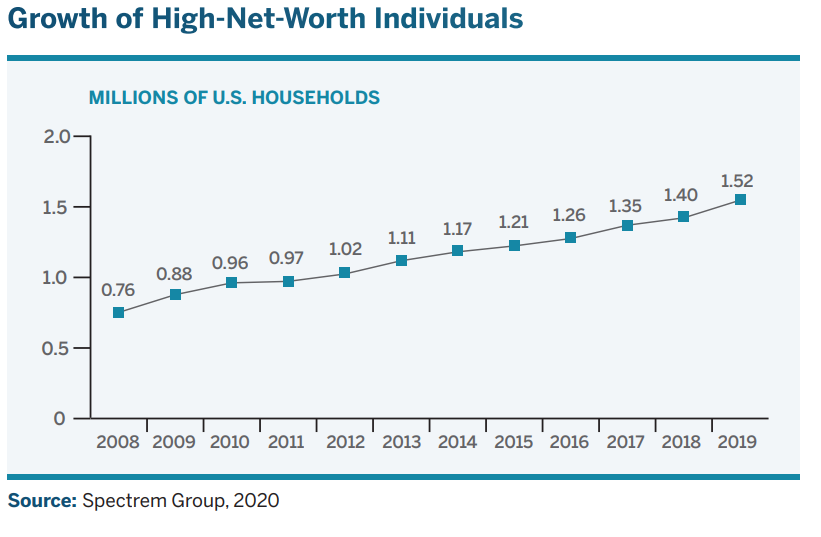

As the alternative asset market has grown, so, too, has the number of individual investors. The number of HNW households in the U.S. rose from roughly 760,000 in 2008 to over 1.5 million in 2019 (Source: Spectrem Group). Yet, as the growth of alternatives has proliferated, most investors still face very real and significant challenges to obtaining liquidity for their professionally managed alternative investments.

What’s Next, and Where’s the Biggest Opportunity for Investors?

As we continue to see growth in alternative investments and the market of individual investors expand, we must find ways to innovate and break down the longstanding barriers to liquidity. This is critical for ensuring that these investors can not only enter the market, but that they can also exit it on their terms when needed.

Learn more about how Ben is addressing the unique challenges for individuals and smaller institutional investors in Ben’s 2020 White Paper here.

Related: How the Pandemic Could Change the Real Estate Landscape