Written by: Ajit Ketkar and Eric Franco

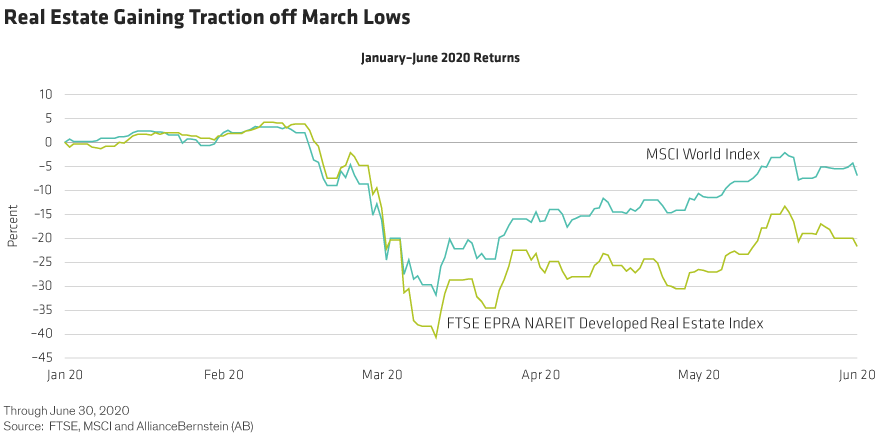

The COVID-19 pandemic upended what had been a healthy real estate market entering 2020. Global real estate securities, as measured by the FTSE EPRA NAREIT Developed Index, are down 21.3% for the year through June 30—trailing global equities—though it’s up from its March 23 low (Display). Investors remain cautious after seeing the severe impact to the lodging and retail sectors. But there’s much more to real estate and overlooking the full picture could mean missing out on the true potential.

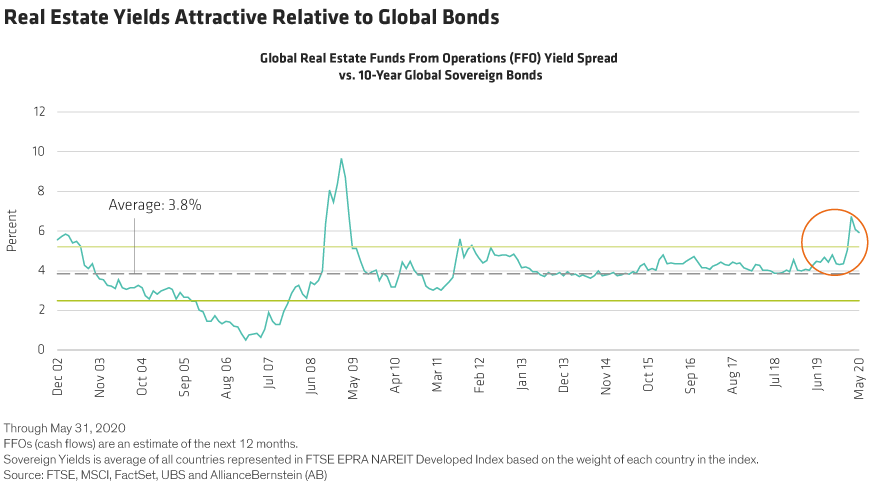

Global real estate seems as attractive as it’s been since the Great Recession of 2009 and is considerably cheaper than the wider global equity market. Historically, real estate’s forward price-to-funds-from-operations ratio has averaged about 1.15 times stocks’ forward price-to-earnings ratio. Today, it’s well below that level. And the yield advantage compared to 10-year government bond yields is considerably elevated (Displays).

Some Sectors Have Been Fairly Resilient…

Of course, simply allocating to the asset class broadly isn’t the answer, as we see it. It takes in-depth fundamental research and effective security selection to distinguish potential winners from losers. Some real estate sectors are further removed from COVID-19’s economic epicenter, either because they’re fundamentally strong enough to resist or actually able to benefit from lasting changes in behavior.

Residential Rentals – Cash-flow growth will slow as rents flatline (or barely rise) upon lease renewals. But we think this is temporary: residential’s defensive fundamentals should bring it back to normal relatively quickly. In our view, properties in the US Sun Belt, more so than coastal areas, as well as in Germany, seem the most resilient for now. US Sun Belt states have higher-than-average job creation and other demographic trends that are working to their advantage.

Industrial Logistics – Responsible for the flow of goods and data, industrial companies should benefit as clients fortify supply chains toward larger inventories and reconfigure them to be in closer proximity to customers. Last-mile logistics companies positioned to serve huge populations along the US coasts should benefit from very strong demand.

Storage & Specialties – Self-storage demand seems to be holding steady—people just aren’t prioritizing changes to their space needs. Meanwhile, some specialty sectors, such as remote data centers, are in high gear as global demand grows for cloud services and data storage. Cold storage and refrigeration services benefit from supporting a changing but bustling food industry.

…While Struggling Sectors Will Take Time to Heal

Even among some industries that bore the brunt of the pandemic’s fallout, we still see long-term potential, but there are certainly hurdles to overcome.

Lodging – This sector was among the hardest hit in the pandemic, with lasting repercussions for jobs and local communities—especially in the US. Full recovery may take years, given the reluctance to undertake nonessential travel. But comprehensive safety measures to boost consumer confidence has sparked some recent upticks in leisure bookings.

Retail – The near-term impact on retail has been severe¬—especially for enclosed malls. Demand for e-commerce in recent years has steadily weakened the bottom lines for large and small tenants alike. Malls still anchored by large retail department stores will continue to struggle, in our view. Many US open-air shopping centers were also hit hard early. While “junior anchor” tenants (e.g., high-end grocery stores or national pharmacy chains) have performed well, many smaller, service-oriented tenants were forced to temporarily close. We think government help and landlord cooperation will help the majority of these tenants survive, allowing open-air shopping centers to recover.

Office Buildings – The near-term impact of empty offices from the work-from-home wave is mitigated for now. Most landlords have long-term leases, and the creditworthiness of larger tenants to meet these obligations is generally strong. The road ahead, however, could be a different story. If telecommuting were to become broader and more permanent, it would cause long-term harm. But the virtual office debate isn’t settled. More employees may like telecommuting, but many companies still place a high value on on-site brainstorming, group training and collaborative cultures.

Senior Housing – Occupancy rates and applications are down at senior living facilities, though some CARES Act aid is earmarked to help US institutions survive. But time will tell, so we think investors should remain cautious in this area.

Since the start of the coronavirus pandemic, negative perception continues to weigh heavy on global real estate. But it’s actually a diverse asset class with many sectors—not all of them impacted to the same degree by COVID-19-related shutdowns. We think investors would be well served to take a closer look at the select opportunities it has to offer.

Related: Opportunities for Investors in Both Public and Private Infrastructure