It’s been interesting to see two major firms – admittedly FinTech firms – commit to crypto in the past month: PayPal and Square.

The fact that such big processors are committing is a sign of the times and a move towards many organisations embracing the cryptocurrency world.

If you didn’t see it:

- PayPal steps into the crypto space by allowing customers to buy, hold, and sell cryptocurrencies

- Square just bought $50 million in bitcoin

Interestingly other firms are branching out into bitcoin and cryptocurrencies as a key part of their treasury operations. For example, Microstrategy increased its bitcoin holdings to $425 million and Mode – full disclosure: I’m on their advisory board – has allocated 10% of their cash reserves to bitcoin.

Mode stated that the reason for the move was to protect investors’ assets from currency debasement and inflation and to diversify away from low-interest instruments in order to maximise the returns from their recent £7.5 million funding round. This makes Mode the first public company in the UK to officially announce a significant purchase of Bitcoin as part of its treasury investment strategy.

What’s going on? Is bitcoin growing up? Are cryptocurrencies a serious option? Will treasury move from the dollar to BTC?

I’m not sure to be honest. These moves are interesting, but it doesn’t mean that everyone is reconstructing to be aligned with the crypto world. What it means is that the crypto world is becoming more interesting, however.

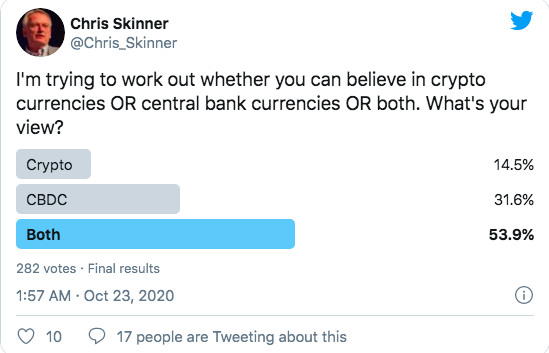

And it kind of leads into a debate between those who believe in crypto worlds versus those who believe in CBDC worlds. Which camp do you fall into? Or, more importantly, do you believe in both? Or neither?

I asked this question on twitter, but didn’t give the option for neither, and found it interesting that many believe both options offer a future alternative.

And several responders noted that I should have offered the choice: none of them.

The key core question here is: What do you believe in? Do you believe in the currency as an asset? What is that asset? What is it backed by?

This is a debate I have often on this blog, and it always comes back to the same thing: if the asset is backed by nothing and no-one, is it an asset? If it is backed by gold or by the Federal Reserve or by a bunch of millennials, which is worth more?

That’s the challenge: what is the asset you are buying and, more importantly, is it therefore an asset class?

Treasury operations are committed to ensuring they have the greatest spread of asset classes and, traditionally, would invest across property, oil, gold, currencies and more for those reasons. If you then start to move investments into alternative areas, such as cryptocurrencies, what is that asset class?

I ponder these questions regularly as it’s challenging us all. The challenge is this:

The cryptocurrency industry is well over a decade old with more than 5,500 different cryptocurrencies and a market capitalisation north of $350 billion.

Whilst undoubtedly there are a number of questions to consider, there are also a number of people who aren’t trying to find answers. The final thing worth pointing out is that this also impacts those who have no interest in buying or holding crypto assets, and even less interest in predicting whether the treasury will move to BTC. Yet these people are now starting to invest in companies that are related to cryptocurrencies, such as Mode, Square and Paypal.