Written by: Arkadiusz Sieron, PhD

US nonfarm payrolls disappointed in November. What does it mean for gold?

First, let’s examine the facts. As the chart below shows, total nonfarm payrolls in November 2020, rose by just 245,000, following much larger gains of 711,000 in October. What is important here is that the US economy added significantly fewer jobs than expected – economists surveyed by Bloomberg forecasted 466,000 additions. Moreover, the civilian labor force participation rate decreased from 61.7 in October to 61.5 in November.

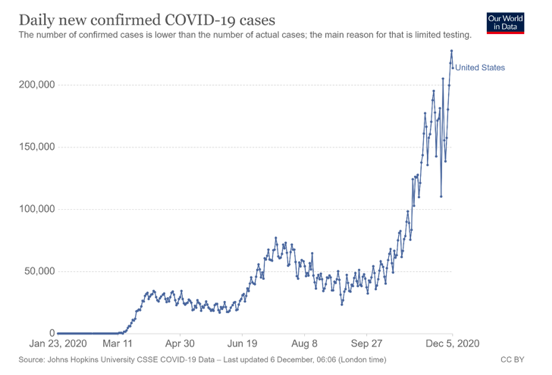

On the positive side, the unemployment rate edged down from 6.9 to 6.7 percent, as the chart above shows. Although the rate is down by 8.0 percentage points from April’s high of 14.7 percent, it’s still 3.2 percentage points higher than it was before the pandemic started. And the nonfarm employment in November was below its February level by 9.8 million, or 6.5 percent, so there is still a long way ahead to a full recovery in the labor market. Actually, the weakening rate of improvement is a signal that the labor market will struggle during the winter wave of the epidemic . As the chart below shows, the daily new cases of COVID-19 in the U.S. are still above 200,000.

You see, at such high levels of infection, the labor market’s rebound will slow down further in December. Many people are not looking for a job because of the coronavirus , and strengthened lockdown measures have limited the ability to find a job for those who don’t fear the pathogen.

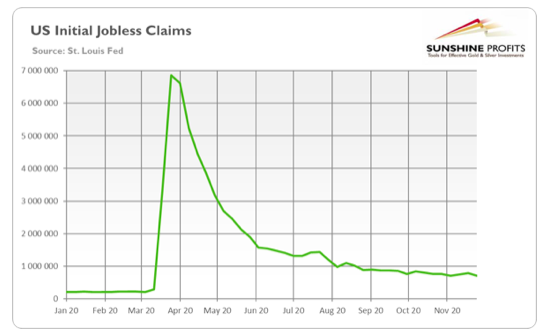

Although there might not be a double-dip recession, a lot of time will pass before the economy will fully recover. As the chart below shows, the initial claims have stayed at an elevated level of 700,000-800,000 (more than three times higher than just before the pandemic) since October.

Implications for Gold

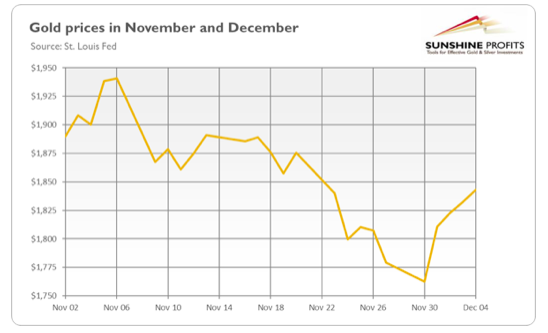

What does it all mean for the yellow metal? Well, gold’s initial reaction to a weak employment situation report was rather modest. As the chart below shows, the price of the shiny metal increased from $1,832 to $1,843 on Friday (December 4). However, the weak economy should support gold prices .

Moreover, the slowdown in the labor market increases the odds for the fiscal stimulus deal. Indeed, Congress should feel more pressure to act in providing the new package, especially considering that at the end of the year, a few unemployment benefit programs will expire, thereby aggravating the income situation of many Americans. The fresh fiscal aid can be agreed upon by the current White House and Congress, but even if not – don’t worry, dovish Janet Yellen , nominated as Treasury Secretary, is ready to act generously and to promote a strong fiscal response.

The disappointing nonfarm payrolls can also prompt the Fed to further strengthen its accommodative stance in the coming months to sail the US economy through the pandemic storm until the vaccines will come to the rescue.

The increased chances of more cheap money from the US central bank and Treasury should support the price of the yellow metal. They boosted the equities on Friday, that’s for sure. It seems that we are observing the return of “the worse, the better” in the financial markets. According to this logic, bad news is positive for Wall Street, as it increases the odds of more liquidity coming into the markets. Therefore, there is a risk that the improved risk sentiment will create downward pressure on the price of gold.

However, gold could also benefit from additional aid in the long run , as monetary and fiscal stimuli would add to both the Fed’s balance sheet and the fiscal deficits . Increased money supply and the public debt should benefit the shiny metal, as a more dovish central bank and Treasury imply lower real interest rates for longer, with a higher risk of inflation and debt crisis .

If you enjoyed today’s free gold report , we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today . If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Related: What Does Biden Imply for Gold?