Written by: PacLife | Pacific Life

The good news: Retirees are living longer. The bad news: That may mean retirees will have to fund more years of retirement.

Life expectancy in the United States has risen significantly in recent decades. On average, a man who is currently 65 years old can expect to live until age 83, while a 65-year-old woman is projected to live to 85.6, according to the National Center for Health Statistics.1 Meanwhile, the wealthiest Americans, who generally outlive the poorest by 10 to 15 years, may live even longer, according to the medical journal The Lancet.2

While increasing longevity is welcome, funding more years in retirement presents some financial challenges. Here are some things to keep in mind as you plan for a long retirement.

Understanding the three phases of retirement

Increasing life expectancy means your retirement could last 30 years or more. With this significant time horizon, retirement isn’t just a static state; instead, it may consist of three distinct phases, each with its own financial implications.

While many anticipate spending less in retirement, the first decade of retirement often brings a period of increased spending. In the first 10 years or so, it’s common for retirees to spend time and money on travel and other hobbies they didn’t have time for while working.

After pursuing these adventures, retirees tend to become less active and more family focused in the second decade of retirement. It’s also common for retirees to begin encountering health problems that keep them home more. Spending tends to decrease, as retirees spend less on travel and entertainment, and many decide to downsize their homes.

The third decade of retirement is often a period when health tends to decline, leading to even less discretionary spending, though health-related costs often rise.

Thinking about retirement as a long period with different parts can help you create a realistic plan that accounts for the possibility of increased spending immediately postretirement while preserving a healthy amount of savings to cover rising health-care costs down the road.

Planning for health care

In fact, the cost of health care in retirement presents one of the biggest unknowns for retirees. While Medicare will cover a portion of your medical expenses, you’ll need to consider out-of-pocket medical expenses as you fund your retirement, especially since Medicare does not cover the cost of long-term care.

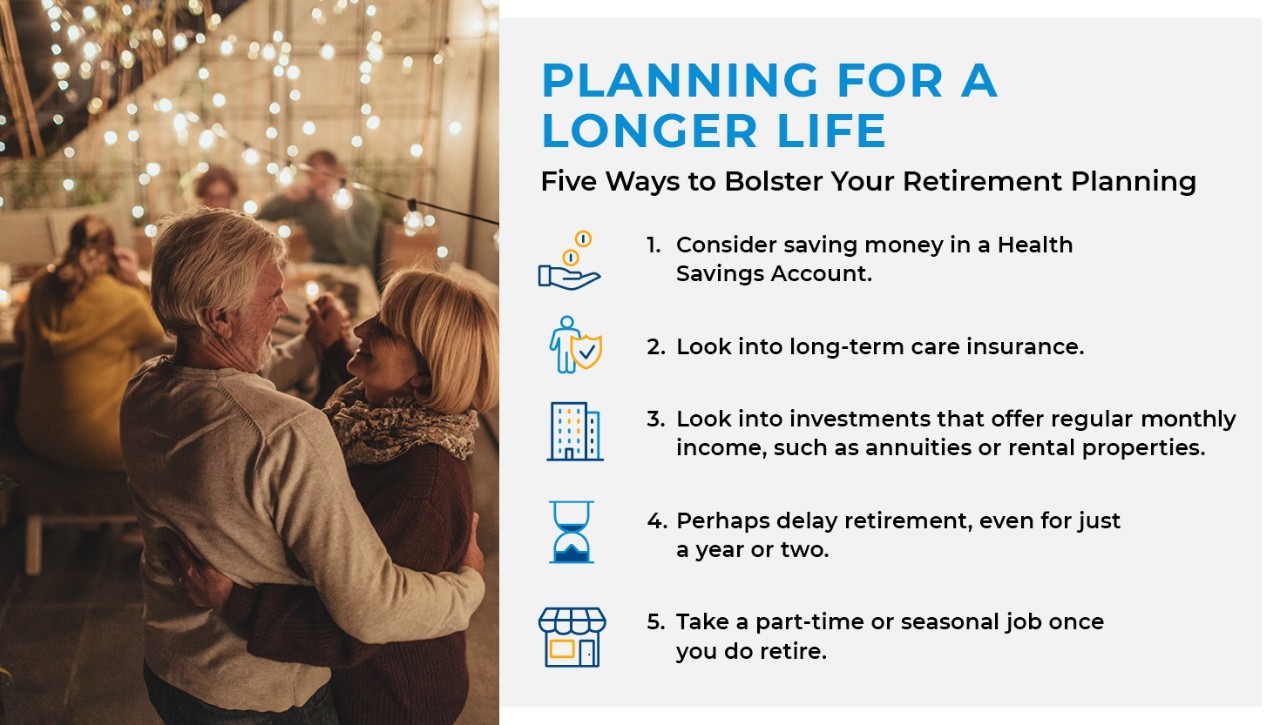

Consider saving money in a health savings account if you’re eligible, investigating long-term care options and keeping on top of preventive health care now—all of which can help address your health-care costs in retirement.

Regulating your retirement income

To buffer the dips and spikes in your postretirement spending, you may want to consider strategies to provide steady income streams beyond your Social Security benefits. Consider such investments as annuities that offer regular guaranteed income or rental properties that may provide you with cash flow. Some people are also reconsidering a total retirement, especially early on. Launching an encore career in a field you’re passionate about or taking a part-time or seasonal job can give your retirement savings more time to accumulate and provide satisfaction and fulfillment along the way.

Living in an era of improving medical technology and longevity means you may be able to enjoy retirement longer than you think. By creating strategies to address the financial challenges of each stage of retirement, you’ll be able to reap the rewards of all your hard work and planning.