Written by: David Knowlton | Advisor Asset Management

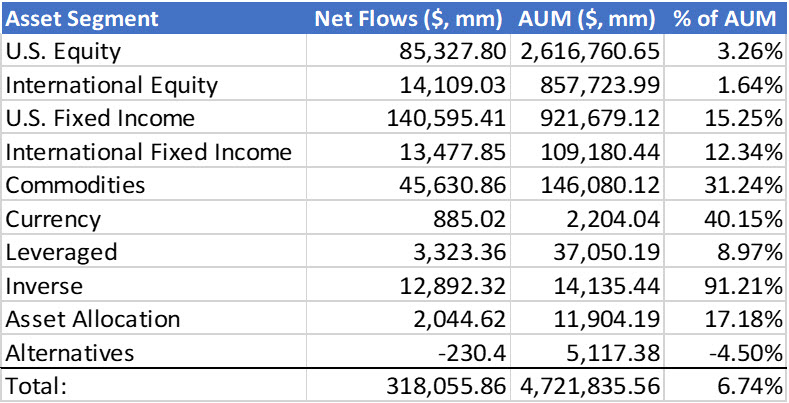

Despite all the headwinds facing global markets in 2020, the U.S. Exchange-Traded Fund (ETF) market is thriving. ETFs have netted $318.1 billion of inflows through the 3rd quarter, up from $195.8 billion at the same point in 2019. To put this in perspective, 2020 inflows are on pace to challenge 2017’s record-setting inflows of $476.1 billion – and this is all amidst a global pandemic.

Figure 1: Asset Class Inflows Year-to-Date

Source: ETF.com | Past performance is not indicative of future results.

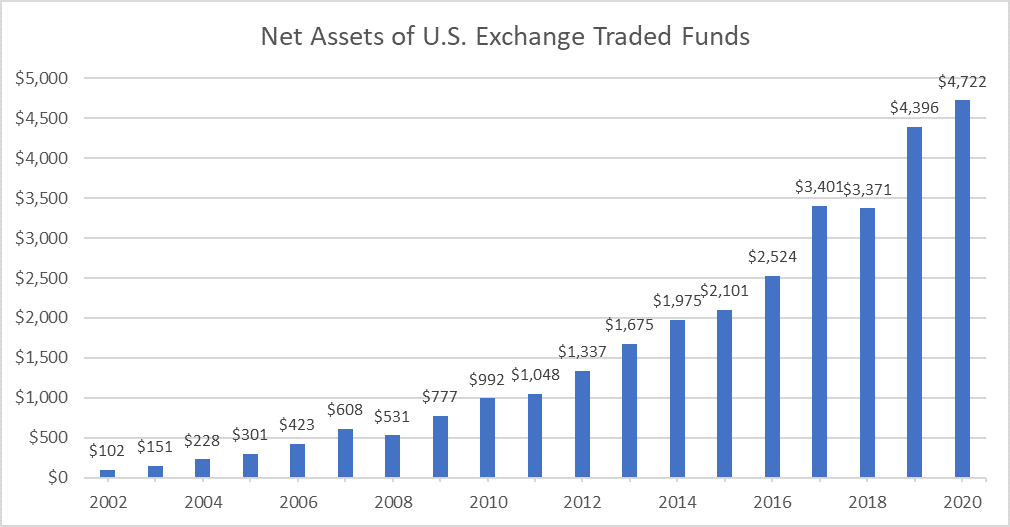

Assets Under Management (AUM) in U.S.-listed ETFs have been on a parabolic rise since the late 2000s. In the past 10 years, U.S. ETF assets have grown 385% and currently sit at $4.7 trillion.

Many of the long-term trends fueling the growth of the ETF industry – migration from active to passive funds, high-cost funds to low-cost funds, the ever-growing acceptance of fixed income ETFs – are still intact, but a new set of growth catalysts are starting to emerge.

Given that 97% of the entire $4.7 trillion U.S. ETF market is comprised of rules-based strategies, it’s no surprise that many think all ETFs are passively managed. The truth is, an ETF is just a wrapper, like a mutual fund or unit investment trust.

The first active ETF was launched over a decade ago. Today, there are 432 actively managed ETFs available in the U.S. This number may seem large, and it certainly has grown in recent years, but ETFs have not been widely accepted as an optimal fund structure for active managers. Specifically, traditional mutual fund sponsors who fear fee compression and daily disclosure requirements have decided to sit ETFs out. That is until, maybe, now.

Figure 2: U.S. ETF AUM Growth

Source: Statista 2020, ETF.com | Past performance is not indicative of future results.

A major milestone for the ETF industry was the launch of the first Active Non-Transparent ETFs this past April. Precidian Investments began licensing their ActiveShares ETF model, kicking off a new chapter of innovation in ETF product development.

Winding back the clock, the SEC approved five different fund structures in 2019 aimed to improve active management within the ETF wrapper. These fund structures, more commonly known as Active Non-Transparent ETFs (ANTs), allow active managers to take advantage of the benefits of the ETF wrapper while also providing the protection a mutual fund offers around their intellectual property. While all five models vary in structure, they all aim to shield their full portfolio holdings, daily. This seems misleading, but all five structures must also disclose their portfolio holdings on a quarterly basis just like their mutual fund counterparts. This feature is believed to relieve some concerns active managers have with ETFs and finally get them off the sidelines. Collectively, these structures have attracted some of the largest asset managers in the mutual fund industry, and these ANTs just might continue the trend of marching assets from active mutual funds into ETFs.

Another major adoption in 2020 was the SEC’s “ETF rule” that was approved at the end of 2019. In short, this rule allows all passively managed and active transparent ETFs to bring products to market without separately applying for exemptive relief, a key requirement that differentiates ETFs from mutual funds. The SEC’s motivation for this rule was to “level the playing field,” so to speak, which lowers the barrier to entry for new ETF issuers and increases competition.

In a year of turbulence for global markets, the ETF industry has continued to deliver bright spots. New market structure and innovative product development may pave the way forward for asset managers to enter the ETF market. Bringing additional asset managers to the ETF industry could promote increased competition, more investment solutions, potentially lower fees, and might spark new catalysts for continued AUM growth. All features that benefit the end investor which, ultimately, is the primary goal of the asset management industry.

Related: The Surge in Online Sales Continues

CRN: 2020-1005-8607 R

For informational purposes only and not a recommendation to purchase or sell any security. Investors should consult their financial professional.