There are lies, darned lies and statistics.

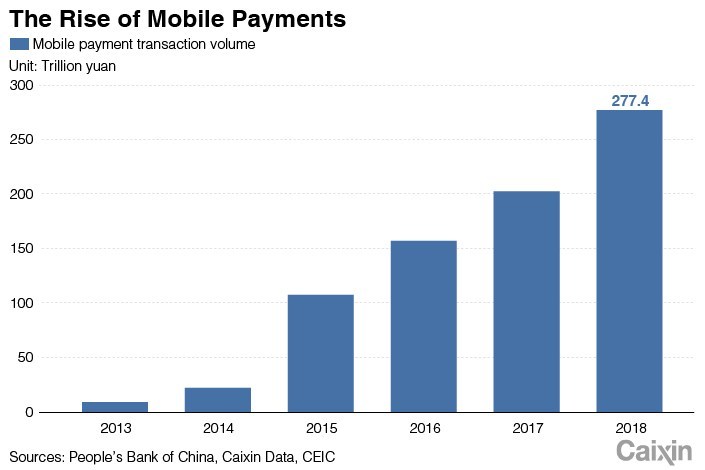

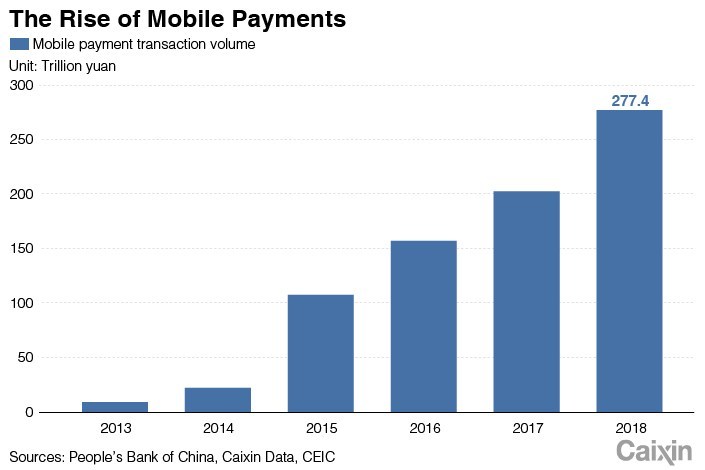

I often quote numbers in my presentations and get pretty annoyed if they’re wrong. I also prefer to take official sources rather than estimates. So I quote that last year China processed USD$40 trillion (277 trillion yuan) of mobile payments, as reported by

the People’s Bank of China …

… only to see other sources quoting far less than this. For example, this excellent article

T he cross-bor der payment war of WeChat Pay and Alipay estimates the number ot be more like 153 trillion yuan (USD$22 trillion). Either way however, it’s a lot.Then I also quote the total investment in FinTech last year being double that of 2017 at $111.8 billion. That’s according to

KPMG. Interestingly

Accenture thought it was half that number ($55.3 billion), whilst

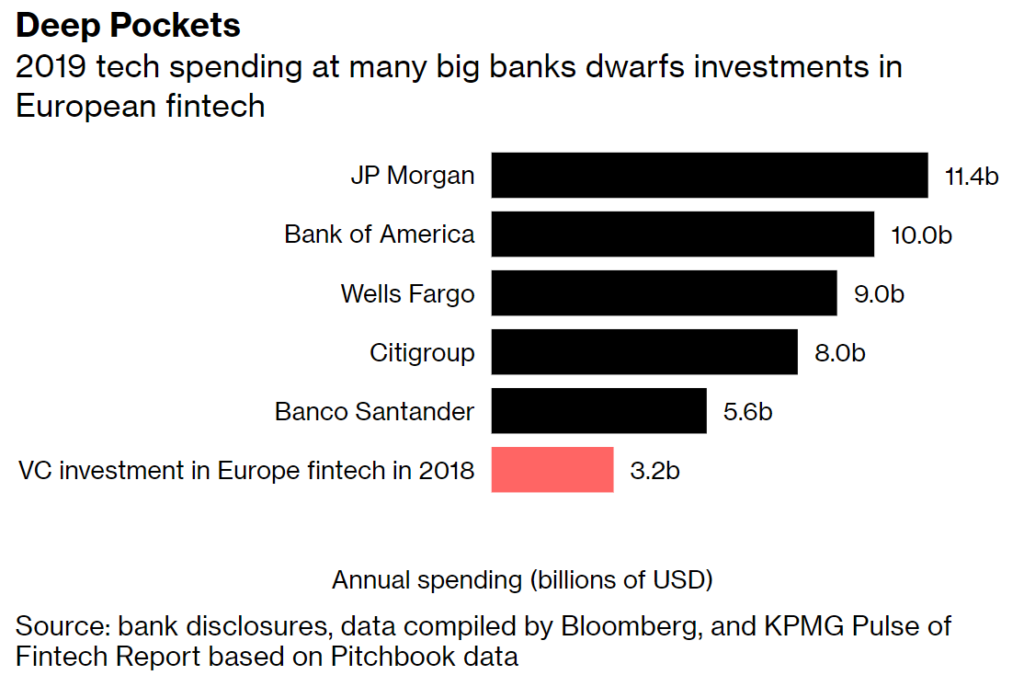

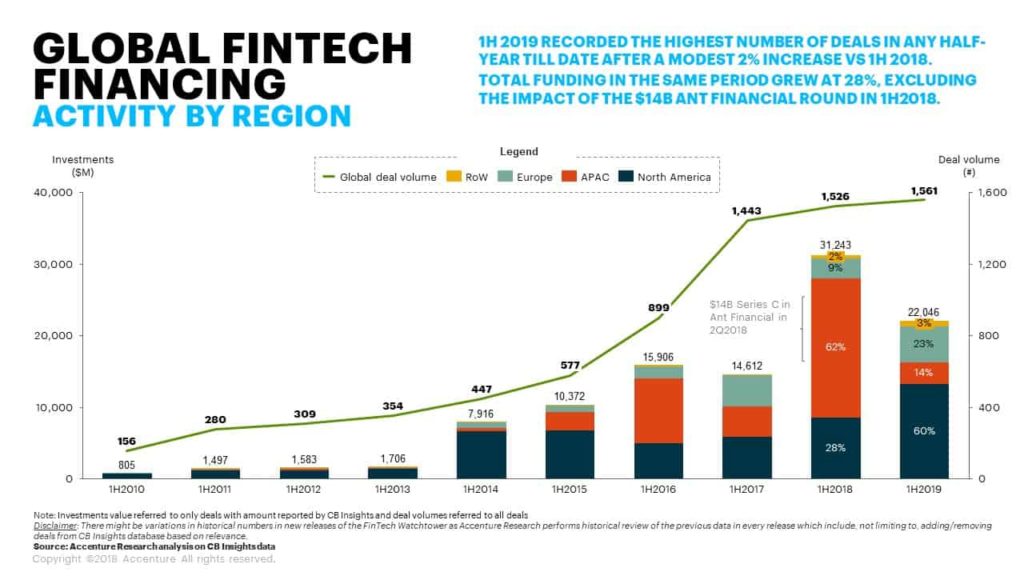

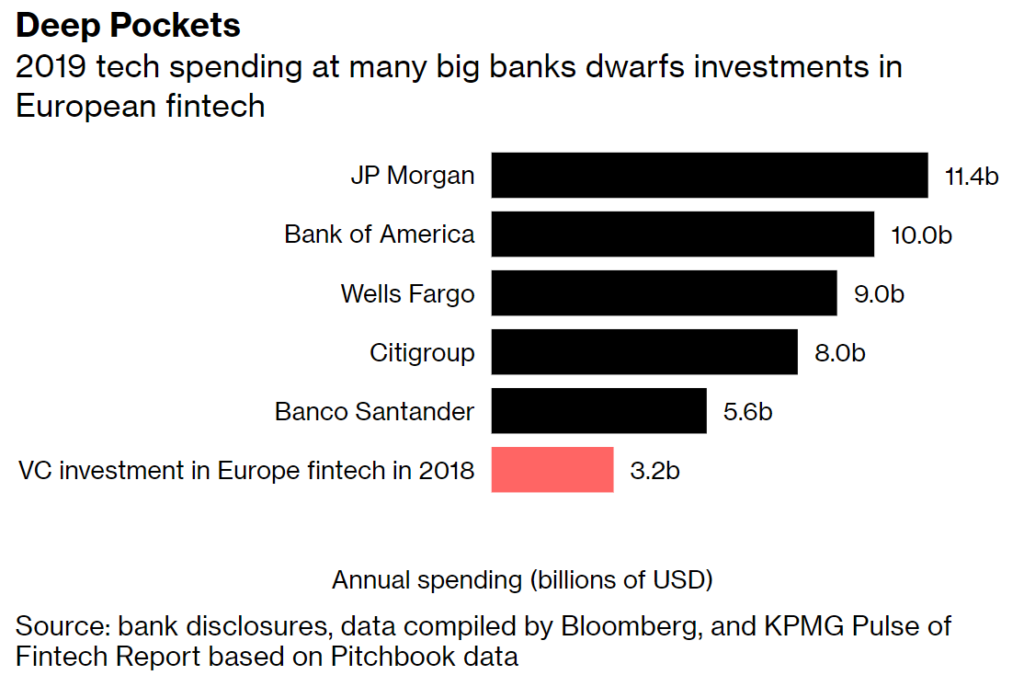

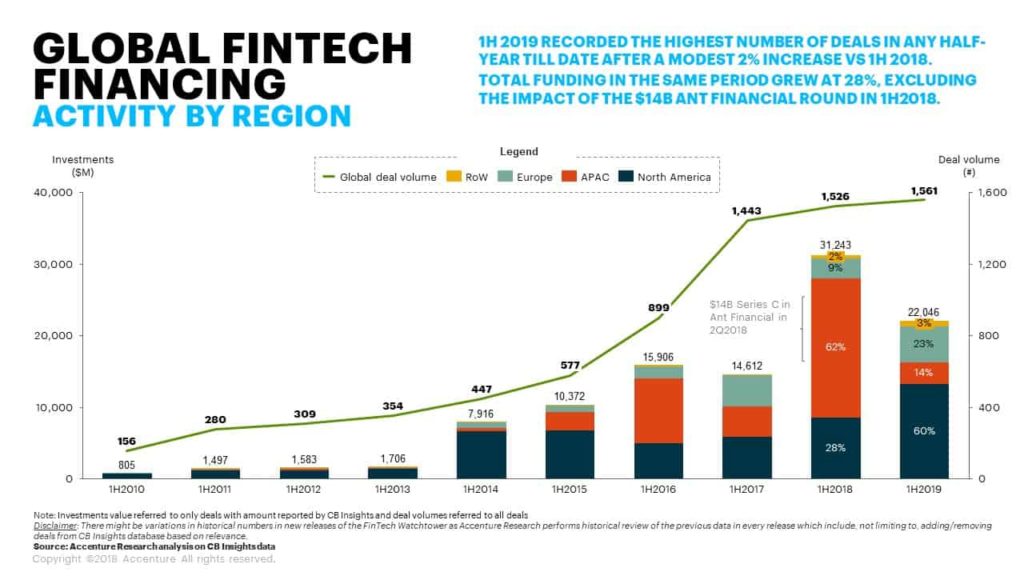

CB Insights said it was less than $40 billion. The only fact they all agree upon is that the numbers doubled in 2018 over 2017, but that’s no surprise as 2018’s figures were distorted by the $14 billion funding round of Ant Financial.These figures are important as we have the large banks investing double-digit billions each in technology every year. If the global figure is just $40 billion therefore, in context, it’s not a great deal even if it is double the previous year. It’s just four years of a big banks total spending on technology.

Therefore, when I saw the latest statistics being reported by CB Insights and Accenture on

this year’s FinTech investment trends, I take them with a pinch of salt.CB Insights say that the number of global FinTech deals covered 838 funding rounds worth $15.1 billion in the first six months of 2019. They also note that the number of venture capital (VC) backed FinTech deals dropped to the lowest number since Q4 of 2016. It’s no surprise that the numbers are down as China’s marketplace is not as active as in the first half of 2018.Accenture states that the total value of Fintech deals in the six months ended June 30 was $22 billion, compared with $31.2 billion during the same period of 2018. This represents a decline of 29%. Minus Ant Financial, global Fintech funding in the first six months would have risen by 28% indicating significant growth. The reports also note that the UK and USA are leading the markets still.

In the US, deals jumped by 60% to $12.7 billion. UK investment nearly doubled to $2.6 billion. Digital banking is the new shiny with names like Monzo and Starling raising large funding rounds ($144 million and $211 million respectively). Other markets of note include:

German Fintechs more than doubling in the first half of 2019, to $829 million from US$406 million in the same period last year. Digital bank N26 led with $300 million raised in January. The Insurtech Wefox raised $125 million in March. Funding in Sweden increased over four-times to $573 million FinTechs in France raised $423 million in the first half of 2019, 48% more than year prior Asian FinTech hub Singapore is having a strong year, as investment quadrupled to $453 million Australia did well too, as deals tripled to $401 million China and India experienced volume declines of 49% and 21%, respectively.Whatever numbers you use or quote, take note.

Related:

Are These FinTech Unicorns Worth It?

… only to see other sources quoting far less than this. For example, this excellent article T he cross-bor der payment war of WeChat Pay and Alipay estimates the number ot be more like 153 trillion yuan (USD$22 trillion). Either way however, it’s a lot.Then I also quote the total investment in FinTech last year being double that of 2017 at $111.8 billion. That’s according to KPMG. Interestingly Accenture thought it was half that number ($55.3 billion), whilst CB Insights said it was less than $40 billion. The only fact they all agree upon is that the numbers doubled in 2018 over 2017, but that’s no surprise as 2018’s figures were distorted by the $14 billion funding round of Ant Financial.These figures are important as we have the large banks investing double-digit billions each in technology every year. If the global figure is just $40 billion therefore, in context, it’s not a great deal even if it is double the previous year. It’s just four years of a big banks total spending on technology.

… only to see other sources quoting far less than this. For example, this excellent article T he cross-bor der payment war of WeChat Pay and Alipay estimates the number ot be more like 153 trillion yuan (USD$22 trillion). Either way however, it’s a lot.Then I also quote the total investment in FinTech last year being double that of 2017 at $111.8 billion. That’s according to KPMG. Interestingly Accenture thought it was half that number ($55.3 billion), whilst CB Insights said it was less than $40 billion. The only fact they all agree upon is that the numbers doubled in 2018 over 2017, but that’s no surprise as 2018’s figures were distorted by the $14 billion funding round of Ant Financial.These figures are important as we have the large banks investing double-digit billions each in technology every year. If the global figure is just $40 billion therefore, in context, it’s not a great deal even if it is double the previous year. It’s just four years of a big banks total spending on technology.  Therefore, when I saw the latest statistics being reported by CB Insights and Accenture on this year’s FinTech investment trends, I take them with a pinch of salt.CB Insights say that the number of global FinTech deals covered 838 funding rounds worth $15.1 billion in the first six months of 2019. They also note that the number of venture capital (VC) backed FinTech deals dropped to the lowest number since Q4 of 2016. It’s no surprise that the numbers are down as China’s marketplace is not as active as in the first half of 2018.Accenture states that the total value of Fintech deals in the six months ended June 30 was $22 billion, compared with $31.2 billion during the same period of 2018. This represents a decline of 29%. Minus Ant Financial, global Fintech funding in the first six months would have risen by 28% indicating significant growth. The reports also note that the UK and USA are leading the markets still.

Therefore, when I saw the latest statistics being reported by CB Insights and Accenture on this year’s FinTech investment trends, I take them with a pinch of salt.CB Insights say that the number of global FinTech deals covered 838 funding rounds worth $15.1 billion in the first six months of 2019. They also note that the number of venture capital (VC) backed FinTech deals dropped to the lowest number since Q4 of 2016. It’s no surprise that the numbers are down as China’s marketplace is not as active as in the first half of 2018.Accenture states that the total value of Fintech deals in the six months ended June 30 was $22 billion, compared with $31.2 billion during the same period of 2018. This represents a decline of 29%. Minus Ant Financial, global Fintech funding in the first six months would have risen by 28% indicating significant growth. The reports also note that the UK and USA are leading the markets still.  In the US, deals jumped by 60% to $12.7 billion. UK investment nearly doubled to $2.6 billion. Digital banking is the new shiny with names like Monzo and Starling raising large funding rounds ($144 million and $211 million respectively). Other markets of note include:

In the US, deals jumped by 60% to $12.7 billion. UK investment nearly doubled to $2.6 billion. Digital banking is the new shiny with names like Monzo and Starling raising large funding rounds ($144 million and $211 million respectively). Other markets of note include: Related: Are These FinTech Unicorns Worth It?

Related: Are These FinTech Unicorns Worth It?