Talking of start-ups , I’m often asked: how do you spot a successful start-up? Not sure why they ask me, as I haven’t started a start-up, but I guess it’s because I’m seeing 100s of start-ups out there.

For example, there were 800 contenders on the shortlist for the Fintech50 this year, and that’s just the shortlist in Fintech.

Tech City claims there are 40,000 tech companies in London alone, with 45,000 more planned to join them over the next ten years. So near 100,000 companies employing 300,000 people and generating billions of investment and entrepreneurial vision. Great. Same in Silicon Valley. There are various estimates, but Quora gives you the number of a million tech startups in the USA employing 5 million people. Of these start-ups, Silicon Valley is where it’s at as the area attracts 14,000 to 19,000 startups per year , compared to the American metro average of 4,000.

Wow! Startups everywhere. Which will succeed?

You can probably tell by just watching Shark Tank or Dragon’s Den, shows that reflect the rise of start-up entrepreneurialism over the past decade.

In these shows, they always rattle the financial numbers, which is a mono-focus. They say they invest if they like the guys, which is a subjective focus. They sometimes want to jump in because they like the concept, product or idea, which is an instinctual focus.

I have four criteria by which to judge a start-up: business model, technical capability, financial structure and managerial acumen.

First, is the thing they are doing fundamentally different and will it fly? An example of this is P2P lending. It is different and it will fly as long as they manage credit risk effectively. Credit risk is a technical capability, which leads to second point: is this going to work technically?

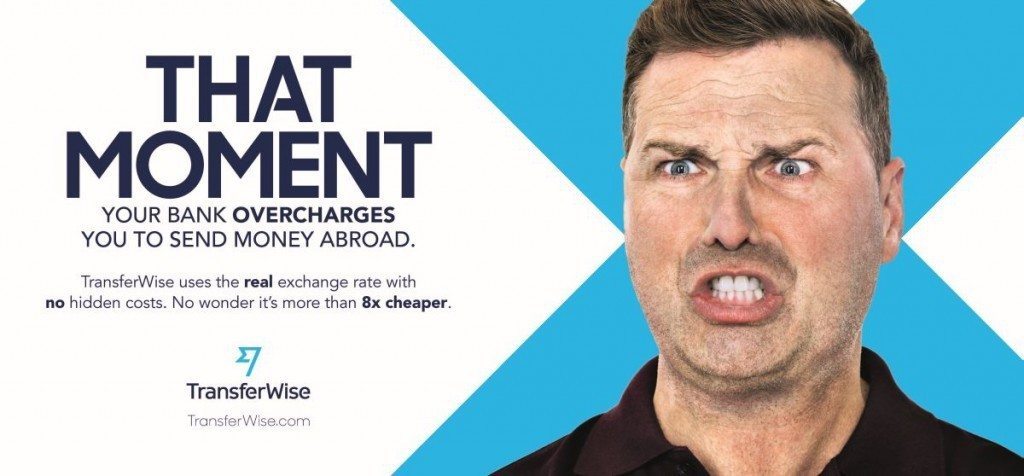

A lot of people are cynical about TransferWise because the concept began with swapping data about money across borders, and that does not work. It does not work because finding two people at the exact same second in two spots worldwide who need the exact same money swapped is highly unlikely to work. As a result, many have trashed the idea of TransferWise. TransferWise is making heavy losses as it aims for growth but, even so, it’s difficult to justify a $10 million business being worth over $1 billion .

According to Nick England, a 15 year veteran of the international currency exchange (FX) sector and founder of VFX, a currency exchange handling over $50 million a day, TransferWise is just “ smoke and mirrors ”. I agree with him to an extent, but he bases his comments on the idea that TransferWise is based upon being a peer-to-peer currency exchange which he claims is conceptually broken. But P2P exchange is not TransferWise’s business. TransferWise run three-quarters of their FX trade through Currency Cloud and do this in order to offer a low-cost, high tech FX system, rather than a P2P exchange. They have also changed direction somewhat. For example, the latest announcement of their partnership with German neobanks Number26 is fascinating.

Number26 aims to create a pan-European mobile first bank , and is backed by heavy guns like Peter Thiel. Teaming up with TransferWise, backed by Richard Branson, TransferWise will be the seamless money transfer service plugged into Number26 – you don’t use TransferWise visibly in the mobile app – to allow transfers from Euros to U.K. pounds, U.S. dollars, Swedish krona, Indian rupees, Australian dollars, Hungarian forints, Swiss francs, Polish zloty and additional currencies in the near future .

Cool.

So what Thiel and Branson are investing in is the potential here, and there is huge potential for the low-cost, high-volume market of FX, a $5 trillion daily volume marketplace.

Then there are the financials. This is where you have the hardest job because companies like TransferWise, along with all the other Fintech and Tech start-ups, are investing in long-term growth opportunity at the expense of short-term profit. This is why many of them run at loss-leader rate for their early years until they eventually establish themselves as the One. Facebook, Google, Apple and Amazon are all the One’s of their time, with Amazon being the most notable loss leader of all.

Amazon’s pretty much never made a cent of profit:

And yet according to Forbes, Amazon is the eighth most innovative company in the world; the thirteenth most valuable global brand ; the 458th largest company in the Global 2000 ; #80 for Sales ; #435 for Assets ; #34 in Market Value ($175 billion) and one of America’s Best Employers (#329).

Is this madness?

For any other market maybe, but the recognition of brands like Google, Facebook, Apple and Amazon is they are gateway companies. They own their space and are continually expanding that space. Until their space is complete, they have to reinvest to fend off any new market entrants.

Equally, Amazon is not just one company but a bundle of companies from Amazon Web Services (AWS) to books and a whole load in between. Some of these companies make huge profit, some make small margin but huge volume, and some are start-up growth companies in the network. Therefore, for a better view of Amazon’s model, you need to look under the hood , and what you seen is Amazon re-investing profits in start-ups. That’s a great model and one that the Thiel’s and Branson’s understand which is why they invest in blockchain and P2P and TransferWise.

So finally you need to look at the guys who run the company.

Do they have the managerial, financial, technical and business acumen to create a Unicorn?

If not, can you mentor them to fill the gaps. Bring in a good CEO who can do the financials and operations, whilst they build the business and technical structure.

What better example of this than Google? Serge and Larry, the founders, had no idea how to monetize Google until they brought in Eric Schmidt. Serge and Larry, researchers by nature at the time, had gained VC investments and had grown to 200 employees by 2001, but didn’t know where to take the company to build it into what it is today. Luckily, Schmidt did and a great read, if you have the time, is this Ivey Business Journal analysis of what happened. Without Schmidt, it’s unclear where Brin and Page would have been today.

Anyways, there you have it. Bridge the gaps by finding the right team of talent and, as long as the idea and vision of the start-up is fundamentally clear, you will win.