I’ve said for years that the mobile network revolution includes everyone. Anyone who can find a friend with a mobile telephone can talk, trade and transact. Many have mocked my message, but the message is consistent: technology has transformed our planet.

This is evidenced by that there are almost four billion more mobile connections than people worldwide today, and most of those phones are smart. Forget your 2G SMS system – today is all about everyone walking around with the internet in their pocket or purse.

Sure, some of those mobile subscriptions may be dual accounts for a tablet and a phone or, equally, a mobile for your dog or cat but, either way, mobile connections are ubiquitous. Funnily enough, people have often said to me that my view of access to the mobile network was too optimistic and yet the world’s poorest households are more likely to have a mobile phone than a toilet (seven year old news).

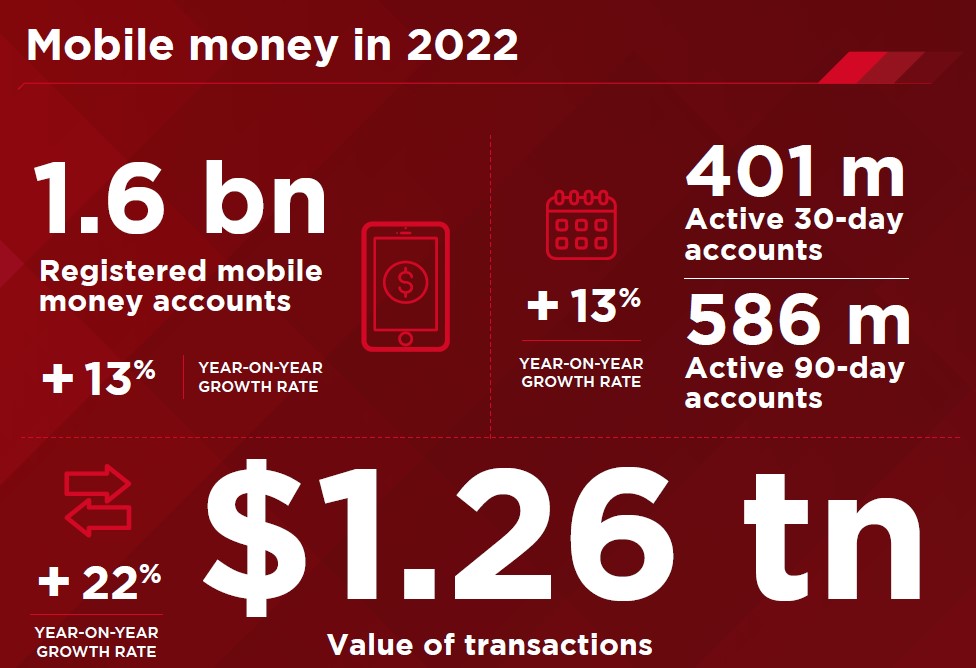

So, almost everyone worldwide can get access to a smart mobile telephone. What do they do next? Connect the phone to a bank account. Today, according to the GSMA, there are 1.6 billion registered mobile money accounts. During the pandemic, there were 400 million new accounts added. The economic impact of mobile money is then remarkable as the whole world can trade, transact and talk. Having said that, there are still 1.4 billion people globally who don’t have access to financial services. Hmmm …

Either way, we are much nearer today than we ever were before to everyone on planet Earth being included in the network and, more importantly, in the financial network. This is evidenced by India as a great example of how technology has transformed a country of over a billion people. Since 2010, millions of the population have gained access to finance thanks to Aadhaar, UPI and the India Stack although, having said that, there are still millions missing out.

According to the World Bank, India is among seven countries home to half the world’s 1.4 billion adults without access to formal banking.

So, what’s the point?

The point is this: the mobile telephone has provided anyone, anywhere, anytime with access to trade, talk and transact. It allows a goat farmer in the middle of nowhere to sell milk, wool and leather to anyone, anywhere, anytime. In other words, the critical point is that the network includes everyone and offers everyone opportunity. If you’re not aware of this, what are you doing?

Further reference points relating to this blog include Efi’s update on LinkedIn and a couple of articles:

Related: What Happens to Crypto When You Die?