Written by: Scott DiMaggio, CFA

As promised, the first quarter of 2024 has been a bumpy ride for bond investors. Markets continue to experience heightened volatility as participants pay close attention to every new economic data point, trying to divine the timing of the first central bank rate cuts. But investors who are overly focused on data surprises may lose sight of the bigger picture: Central bank rate cuts are coming, and with them a major opportunity for bond investors.

Look Beyond Data’s Day-to-Day

Not only are monthly macro data such as payrolls and inflation subject to large revisions and seasonal adjustments, but their components can be volatile. We think it’s more important to look at macro trends over time.

In our analysis, such trends strongly favor lower policy rates in the months ahead. Headline inflation in the euro area is falling faster than expected, and the European Central Bank may start to cut rates this summer. In the US, where progress has slowed on the disinflation front, we expect the Federal Reserve to hold off on easing until June at the earliest.

In the meantime, government bond yields remain very compelling, with AAA-rated 10-year German Bunds currently yield 2.3% and the US 10-year Treasury now yielding 4.2%.

Take Advantage: Anticipate the Action

For bond investors, these conditions are nearly ideal. After all, most of a bond’s return over time comes from its yield. And falling yields—which we expect in the second half of 2024—boost bond prices. That boost could be especially big given how much money remains on the sidelines, looking for an entry point. More than $6 trillion is sitting in money-market funds, a relic of the “T-bill and chill” strategy made popular in 2022, when central banks were aggressively hiking interest rates.

Historically, as central banks eased, cash flooded out of money markets and back into longer-term debt. The resulting surge in demand for bonds from such shifts in flows helped to reinforce the drop in yields that accompanies central bank rate cuts. Because the amount of cash sitting on the sidelines today is unprecedented, the potential surge in demand for bonds is exceptionally high.

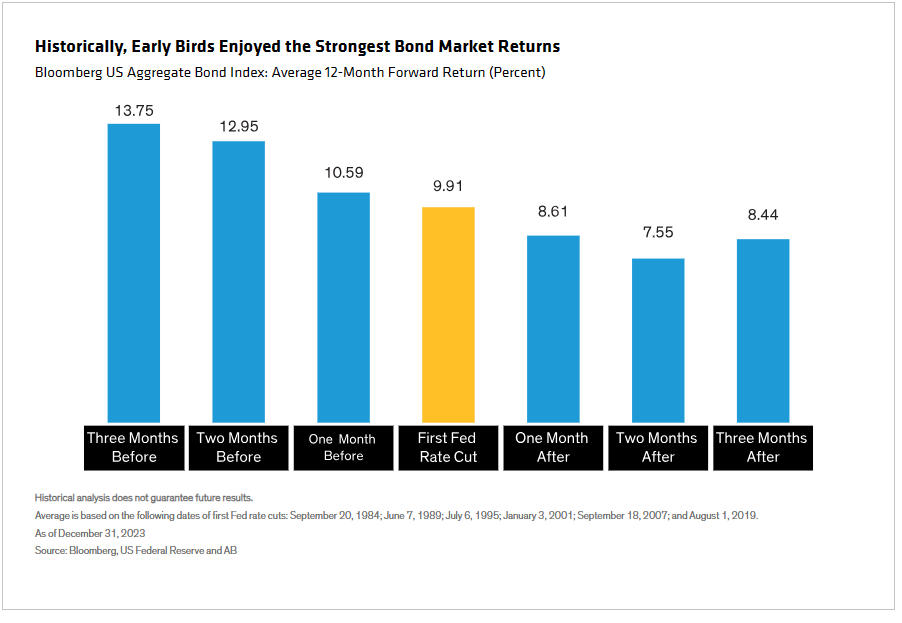

To avoid missing out on the potential returns this represents, we think investors should aim to get ahead of the shift from cash to bonds. That means making the switch now, because government bond yields often fall—and prices rise—before central banks take action. Historically, in the three months prior to the first Fed rate cut, the yield on the 10-year US Treasury fell an average of 90 basis points. That’s why past investors captured the biggest returns when they invested several months prior to the start of the easing cycle (Display).

Survey the Longer-Term Landscape

While taking a step back from day-to-day variability in data helps us get a better view of the medium term, it also helps us survey the longer-term landscape. And that landscape is changing.

For the past 40 years, global deflationary forces have prevailed, facilitating a regime of low equilibrium inflation. But mounting pressures from three powerful macro megaforces—deglobalization, demographics and climate change—point toward higher structural inflation and increased inflation volatility in the coming decade.

Indeed, over the next 10 years, we think it’s more likely that 2% becomes a lower bound for inflation, rather than a central-bank target. It’s highly likely we’ve already entered this new regime, though evidence of it has been masked by recent disinflation from cyclical highs.

Higher inflation implies higher nominal yields, and higher inflation volatility implies steeper yield curves. Over the past decade, term premiums have mostly evaporated. In the next decade, we think term premiums will increase to compensate investors for the risk of holding longer-maturity bonds in an environment of less-certain inflation expectations.

After more than two decades of exceptionally low rates and under-allocations to fixed income, a new regime of higher equilibrium inflation, higher nominal yields and higher volatility could reshape how investors allocate capital over the long run, with allocations to active fixed income and inflation strategies playing a bigger role than in recent years.

Strategize for Today’s Environment

In our view, bond investors can thrive in today’s favorable environment by applying these strategies:

1. Get invested. If you’re still parked in cash or cash equivalents in lieu of bonds, you’re losing out on the daily income accrual provided by higher-yielding bonds, as well as the potential price gains as yields decline. And, as noted above, yields have generally declined in the months before the first central bank rate action. That’s why it’s so important that bond investors get off the sidelines and get invested now.

2. Extend duration. If your portfolio’s duration, or sensitivity to interest rates, has veered toward the ultrashort end, consider lengthening your portfolio’s duration. As the economy slows and interest rates decline, duration tends to benefit portfolios. Government bonds, the purest source of duration, also provide ample liquidity and help to offset equity market volatility.

3. Hold credit. Though spreads are on the tighter side, yields across credit-sensitive assets such as corporate bonds and securitized debt are higher than they’ve been in years, giving income-oriented investors a long-awaited opportunity to fill their tanks. Because corporate fundamentals started from a position of historic strength, we’re not expecting a tsunami of corporate defaults and downgrades. Plus, falling rates later in the year should help relieve refinancing pressure on corporate issuers.

But credit investors should be selective and pay attention to liquidity. CCC-rated corporates and lower-rated securitized debt are most vulnerable in an economic slowdown. Long-maturity investment-grade corporates can also be volatile and are currently overpriced, in our view. Conversely, short-duration high-yield debt offers higher yields and lower default risk than longer debt, thanks to an inverted yield curve.

4. Adopt a balanced stance. We believe that both government bonds and credit sectors have a role to play in portfolios today. Among the most effective strategies are those that pair government bonds and other interest-rate-sensitive assets with growth-oriented credit assets in a single, dynamically managed portfolio. This kind of pairing also helps mitigate risks outside our base-case scenario of weak growth—such as the return of extreme inflation, or an economic collapse.

5. Protect against inflation. Given the heightened risk of future surges in inflation, the corrosive effect of inflation and the affordability of explicit inflation protection, we think investors should consider increasing their allocations to inflation strategies now.

6. Consider a systematic approach. Today’s environment of weakening economic growth also increases potential alpha from fixed-income security selection. Active systematic fixed-income investing approaches, which are highly customizable, can help investors harvest these opportunities.

Systematic approaches rely on a range of predictive factors, such as momentum, that are not efficiently captured through traditional investing. Because systematic approaches depend on different performance drivers, their returns will likely differ from and complement traditional active strategies.

Get Invested to Get Ahead

Active investors should prepare to take advantage of shifting market dynamics as the year progresses. Above all, we think investors should get off the sidelines and fully invest in the bond markets so as not to miss out on today’s high yields and exceptional potential return opportunities.

Related: How Does Global “Friend-Shoring” Affect Chinese Manufacturers?