Try as I might I just cannot remember the first time I received or sent a text. Or an email.

But I do remember being a young communications specialist in the navy and looking in wonder at the technology we had at our disposal….it was awesome. We could type messages directly to people right on the other side of the world….if they had a telex machine…and they could receive it within mere minutes. Who would have thought communication electronically on a one-to-one basis would even be possible at that speed? You could even send a message to someone in a plane, or a ship! Awesome.

Well, at the time it was state of the art. Hard to believe, but true nevertheless.

Some years later and I do remember being quite against the idea of getting a cellphone for a quite a while…and yet now I’d need surgery to remove me from my smartphone. My oh my, how our attitudes change over time as we become comfortable with new technology, huh?

These things have been running through my mind as I read a huge number of articles about what is now labelled “Robo-Advisers“. The robo’s threaten to use automation to replace human expertise and provide real time product and advice solutions directly to consumers.

“Woe is us” is the refrain of the moment amongst many financial services professionals. I am sure that the same lament was heard from farm labourers when the first steam powered machine trundled around a paddock….or from scribes when the first commercial printing presses clattered into action.

“Woe is us” was the refrain of switchboard operators too. The old switchboard operators are now the fastest growing demographic for new social media accounts, they all have smartphones, and can all “text speak” with their grandkids. They adapted.

But this Robo-advice thing, it can’t work. I mean, financial advice is such a personal experience for every consumer. No machine can ever listen and understand the way humans do. Doing stuff online is so impersonal and one-dimensional, and just completely lacking in eye contact…like Online Dating. It will never work because that just can’t replicate how humans connect.

Unfortunately 76% of adult consumers would appear to hold a different view.

That’s awkward.

Let’s just consider the online dating world for a moment.

A decade ago it was pretty much unthinkable that people would sit at home in their lounge room and look at pictures and bio’s of total strangers without getting into trouble with the law. Frankly it seemed pretty creepy, didn’t it?

But now we find that over three quarters of single adult Americans have tried online dating. That is a pretty overwhelming indication from a sophisticated consumer-driven society that they are ok with going digital to find happiness and harmony and perhaps a mate-for-life. Taking charge of the situation and then actively going looking for what you want is actually a trait that we mostly admire in people. Online dating works. And the more comfortable people get with any new or different communications medium, the more they use it. Like texting or Facebook for example.

Why would we think that these same consumers won’t go digital to find a more convenient or cheaper deal on some insurance or a passive strategy mutual fund?

You better believe they will. It will take off like Netflix. Except it will much much bigger. Maybe even bigger than Facebook.

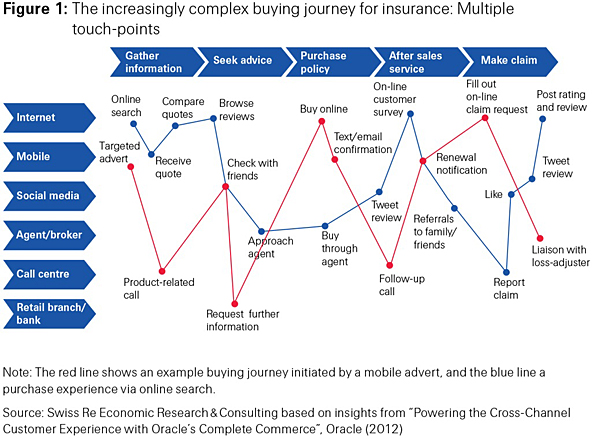

A superb infograph courtesy of Swiss Re highlights just how complex the purchase of insurance has become, and an insurance purchase is arguably one of the more sophisticated and difficult financial products to try and purchase.

How consumers access information has changed forever. How consumers assess the merit of product solutions is rapidly changing. How they access, consider and utilise advice is already a blend of technology-based solutions and human interaction.

Of course Robo-advice models will work.

And they will take business from some humans. Only a few centuries ago scribes had to abandon their trade when printing presses went live and made books available on a (relatively) mass scale instead of being individually crafted works of art available only to the very wealthy. Not much work is around for scribes these days though. They should have adapted.

The same fate awaits those in professional services who fail to acknowledge that we are witnessing a fundamental shift in consumer buying behaviour. For any professional who wishes to be in business in 5 years time, the question now is not “how do I compete with Robo-Advice?“, but “how do I incorporate a robo-advice offering successfully into my business?”

It isn’t a matter of competing head-on with a demand-driven technology solution. That is a war most professionals simply cannot win. It is a case of working out how to make the demand-driven technology solution work for our clients in a way that still enables us to be the people that educate and coach the right behaviours and strategic choices for them.

Robo-advice presents us with the classic “adapt or die” dilemma. When you look at it that way, adapting and learning to live with it doesn’t seem a bad choice.

Like the Online Dating concept, Robo-Advice solutions will get traction and become a normal everyday choice that consumers try and use.