A genuine danger in practice development is promoting a competent financial adviser to a role which they are unable to perform well in. In any organisation there is a real risk that a person is encouraged to rise to their level of incompetence.

This is just as true for the self employed Principal of a professional services firm as it is for the staff member in a large corporate. Actually, I believe that it is THE reason why so many advice firms amble along doing the same thing year after year: the Principal was an adviser who has been “promoted” to their level of incompetence.

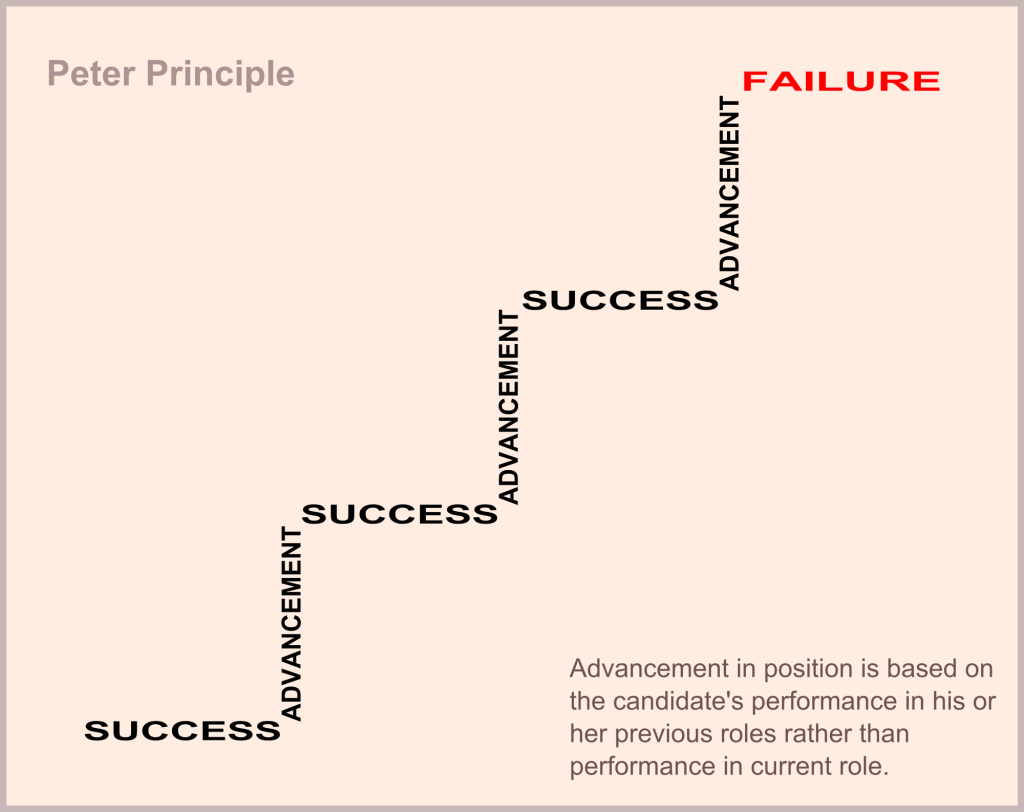

This concept is explained in a book which influenced me enormously some years ago: The Peter Principle. This is the concept in brief:

“It holds that in a hierarchy, members are promoted so long as they work competently. Sooner or later they are promoted to a position at which they are no longer competent (their “level of incompetence”)”

When we think about how the typical advice firm evolves, it usually goes like this:

- Adviser enters business, studies hard, and becomes technically skilled

- Adviser does the hard yards in the real world for some years and becomes an excellent relationship manager as well as being technically skilled.

- Adviser works out how to make a very good living by generating enough prospective clients to keep very busy, so hires some support staff.

- Adviser looks to leverage business knowledge and time and starts bringing other Advisers into the practice, and becomes largely a business manager…

….and, then comes The Peter Principle.

“…anything that works will be used in progressively more challenging applications until it fails…”

“Fail” is a bit harsh…rising to a level of incompetence is not necessarily failure as such. It is also not necessarily the end of development and acquisition of skills – as long as the person recognises they have moved to a role which is beyond them with their existing knowledge and skill set.

New knowledge and new skills can, and usually are, acquired all the time. That is especially true of financial advisers who as a rule are in a continual search for new knowledge and skills anyway.

There is no doubt that advisers, especially those who are Principals of an advice firm, are generally intelligent and adaptable. The danger is that often they do not recognise, or perhaps acknowledge, that they have hit a level of incompetence as business managers. Their competence as advisers remains superb, but the role of Principal of a firm requires different skills and knowledge areas. Their incompetence is in a different arena.

Business coaching can help at this point, as can appointing consultants – and they are two quite different functions. The real solution is finding a Mentor. Somebody who has walked a similar path, successfully, and whom you respect and are willing to be guided by.

The danger of being a competent adviser is that you find yourself one day running a complex business instead of just advising clients, and don’t recognise that this is the point where your knowledge and skills need further development. The most obvious warning signs are usually unhappy staff; adviser recruits who don’t stay for long; constant cashflow problems and ongoing “crisis management”. And stress. Lots and lots of stress. That is a really strong signal that the level of incompetence has been reached, and that external help is required.

Recognise your own competencies, and the areas where there is danger of not being competent, and then get a coach or a mentor. It will be the key to creating new competency and learning how to move the business beyond crisis management. It negates the danger of promoting a competent adviser into an incompetent manager.

Related: The Gordian Knot of Getting Referral Business for Advisors