There is a sale that Financial Advisers have to make, before they make a sale. The first sale that has to be made is YOU.

Advisers often tell me they are struggling to get potential clients to engage. The increasing compliance and documentation of advice, and the need to establish professional credentials and spell out all the advice and help and guidance we can provide, seems to have led many advisers away from a basic professional relationship rule: People will not buy what you can do until they trust you, or rather, trust the process.

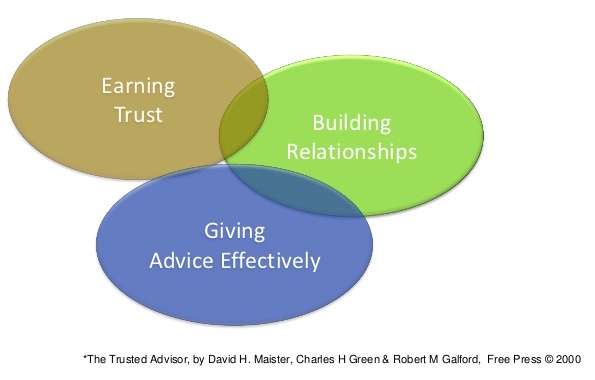

Before moving onto the things that we have to do professionally when engaging clients – the agenda, scoping, disclosure, the fact-finding and so on – we have to get them to buy into us. One of the all time great thinkers of professional services outlined it brilliantly in “The Trusted Adviser”. Maister’s book is a must read (as are quite a few of his!), and I feel that some of the critical points he makes have been lost in the compliance and professional standards noise.

Effective advice cannot be delivered without the client buying into the process and understanding the purpose of it. They will not do that though until they have decided that they can trust you AND your professional competence. Trust at this stage of the engagement is not a question of whether they can trust you with their money, but a question of whether they can trust you with their thoughts. Some of the things that they think about but don’t even necessarily share with family and friends.

Trust in you therefore is the first sale. The second sale that must be made is selling potential clients the process, and to do that we have to capture their imagination and show them how the process creates desirable outcomes. In my experience beginning those first meetings with a blank screen, or blank sheet of paper, and then using visuals to explain the value that planning and advice can deliver is the critical step. It creates context for the advice and the compliance process, and relevance for all the boring bits that must follow during the formulation of detailed financial advice.

So there are TWO sales before the sale of the actual personalised advice. Sell you first. Then sell the merits of the advice process. Perhaps because the prospects had already agreed to meet, the advisers assume that the clients have bought into the idea of advice already….most times the prospective clients have not quite bought into the advice process. They have agreed to meet and discuss it because they are open to the possibility that the advice process might help them, but that doesn’t mean they are entirely sure.

Get the first sale right, followed by the second sale, and then you can give effective advice. Then you have a client.

Related: What on Earth Do Consumers Think Financial Planners Actually Do?