The Risk For Those About To Retire

If there were ever a time to be analyzing market history from 20 years ago, it is now. That’s because there has been no period in modern investment history that has witnessed some of the things that are happening now. No, I am not talking about Covid-19.

The stock market has become something like a game of chance to many people. You can read plenty of stories of how we got to this point. I am focused, as usual, on what we can learn about the present and the future based on what has happened in the past. And do you know why?

Markets change over time, but basic human emotions don’t.

That’s why. Greed and fear still drive so much of what moves stock prices. In the long-run, perhaps things like earnings and economics play a bigger role. But for most investors today, the time involved (decades) for markets to get to “fair value,” and then only briefly, is too long to wait.

So much of what I write about can be summed up as follows: I have learned how to balance reward and risk in large part from living through the market’s history since the 1980s. Investing did not become “popular” like it is today until the late 1990s. Then, investors were burned. But they came back. In many cases, just in time for the Global Financial Crisis. Then, they came back again. This time, the bull market lasted a full decade. And, here we are.

I get it. Investor time frames have been squeezed for 20 years. So, the best thing a humble investor/writer like me can do in the midst of a pandemic is clear. This is when we use market history. Not to direct us, but to inform us, so we can balance reward potential the risk of a major loss in value.

And that brings us back to 20 years ago

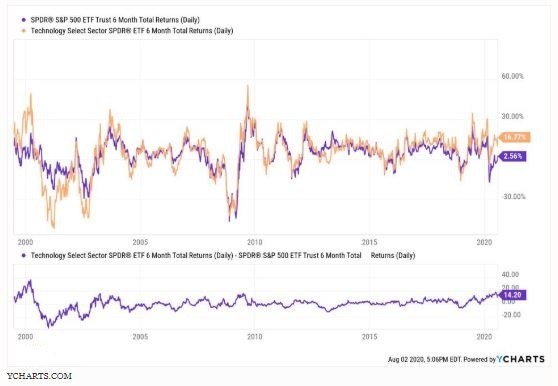

Here is a quick summary of 2 years in the stock market. There are 2 items tracked through all of 1999 and all of 2000. The S&P 500 is pictured, alongside the technology sector of that very same S&P 500.

During this time, tech was easily the biggest sector of the S&P 500, occupying well over 20% of its value. Just like today. Investors were feeling pretty excited about tech stocks. Just like today.

This was a tale of 2 years. 1999 was all about tech, as you can see in orange. It went on a relentless tear higher. The tech index nearly DOUBLED in 15 months. During that same time, the broader S&P 500 gained over 25%. But the math is more intriguing than that.

However, the rest of 2000 was not a very happy time for tech investors. Look at the right half of the chart in orange. That nearly 100% gain in 15 months from 1999 to early 2000? It was all gone in 9 months.

Actually, it was more than all gone. The 2-year return of the S&P 500, INCLUDING a near-double to start the period, was negative 4%. This is like having a 12-0 lead in a baseball game in the 7th inning, and losing.

Naturally, this dragged the overall S&P 500 down with it. That more than 25% return evaporated quickly, and the index completed the 2-year period up less than 9% in total.

The amazing one sector stock market

You see, during that time, the technology sector was about 25% or so of the S&P 500. If we do a back of the envelope calculation, if 25% of your portfolio goes up by 100%, that adds how much to your total return? Answer: about 25%.

Look at those figures in the first paragraph just below the chart. The S&P 500’s entire gain over this time was the result of gains in the tech sector. So, the rest of the market essentially added nothing, positive or negative. It was a one-sector profit story.

Big deal, so what?

Why am I so jacked up about this thing that happened 20 years ago? Because it is happening again, right now!

The tech sector has been outperforming the broad S&P 500 by a margin only surpassed by…you guessed it…the 1999-2000 period. Does that mean that tech is done? NO. It just means that the risk of having a lot of tech in your portfolio has grown large.

This is also an issue for investors in S&P 500 Index funds. After all, tech is 1/4 of that fund’s holdings. Even if tech falls and the rest of the market hangs in, that only means you will not lose too much. My point: expecting tech to continue to carry the day is a bigger risk than at any point in the last 20 years.

Retiree risks

My deep concern for investors in retirement or nearing retirement is that they are not taking this type of risk seriously. This is either despite or because of what just happened in early 2020 and late 2018. The market fell hard both times (33% in 5 weeks in 2020, and 15% in 3 weeks in December of 2018).

But those declines turned out to be fleeting. The market recovered very quickly. My fear is that this has conditioned investors to think this will happen again and again.

But as history shows, there comes a point where you poke the bear in the eye too many times. At some point, the bear attacks and doesn’t let up so easily.