On Friday the S&P 500 was the highest since mid-December - will the short-term uptrend continue?

The S&P 500 index gained 2.28% on Friday, as investors reacted to better-than-expected monthly jobs data release. The broad stock market’s gauge broke above its recent trading range and it went the highest since December 15, as the daily high was at 3,906.19.

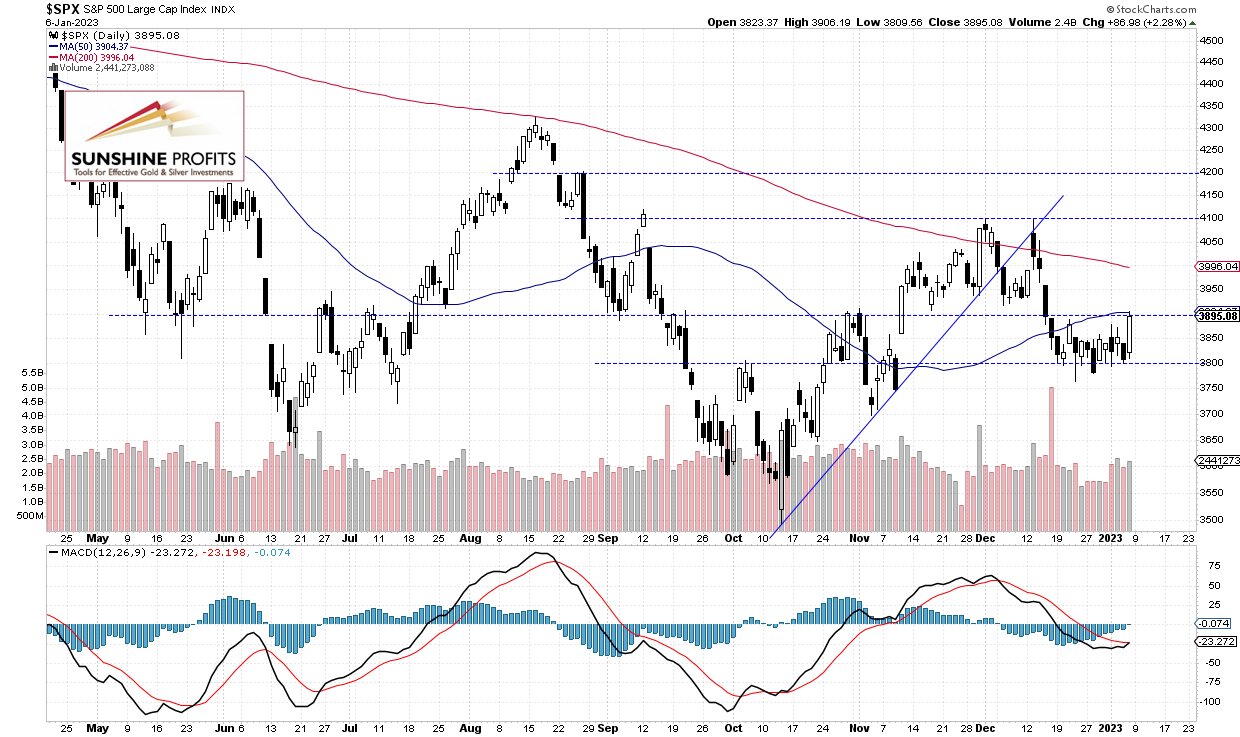

The broad stock market is expected to open 0.5% higher this morning, so stock prices will likely extend their short-term advance. There may be a selling pressure and some profit-taking action as the market gets closer to the resistance level of around 3,920-3,930, marked by the previous local lows, as we can see on the daily chart:

Futures Contract Trades Along 3,930

Let’s take a look at the hourly chart of the S&P 500 futures contract. It is slightly extending a short-term advance this morning after breaking above the 3,900 level. The next resistance level is at 3,950-4,000, among others.

Conclusion

Stock prices are expected to extend their Friday’s gains this morning. We may see a profit-taking action at some point, however, the market broke above its recent trading range and it looks bullish in the short-term. Investors will be waiting for tomorrow’s Fed Chief Powell’s speech, the Consumer Price Index release on Thursday and a coming quarterly corporate earnings season. We will have reports from the banking sector on Friday before open.

Here’s the breakdown:

- The S&P 500 index will likely extend its Friday’s advance this morning.

- Stock prices broke above its recent trading range, which is bullish.

- In my opinion, the short-term outlook is bullish.

Related: Stocks to Gain on Better Economic Data – Is This an Uptrend?