Written by: Marc Ado | Swan Global Investing

The Defined Risk Strategy as a Capital Preservation Solution

Where the DRS Fits: Part 4

Across Swan’s client base, there are some who utilize the Defined Risk Strategy (DRS) as an alternative to fixed income. Traditionally, bonds have played two roles within a portfolio: generation of yield and protection of principal. However, the worldwide “new normal” monetary policy of ultra-low or even negative interest rates and massive liquidity injections into the financial system has parched savers of yield. These days, savers are forced to choose between yield or protection of principal—they cannot have both.

With its emphasis on not losing big and superior bear market performance, the DRS could seek to fill the capital preservation role in a portfolio that bonds have been fulfilling.

The DRS and Capital Preservation

Morningstar has two alternative fixed income categories: Multi-sector bond and Non-traditional bond. Multi-sector bonds have a broad mandate where a strategy can go into high yield, foreign developed, emerging debt, etc. Non-traditional is even broader. It includes the previous, but it can also do things like derivatives, interest rate swaps, and credit default swaps. Also, Multi-sector tends to be more strategically allocated whereas Non-traditional tends to be more tactically allocated.

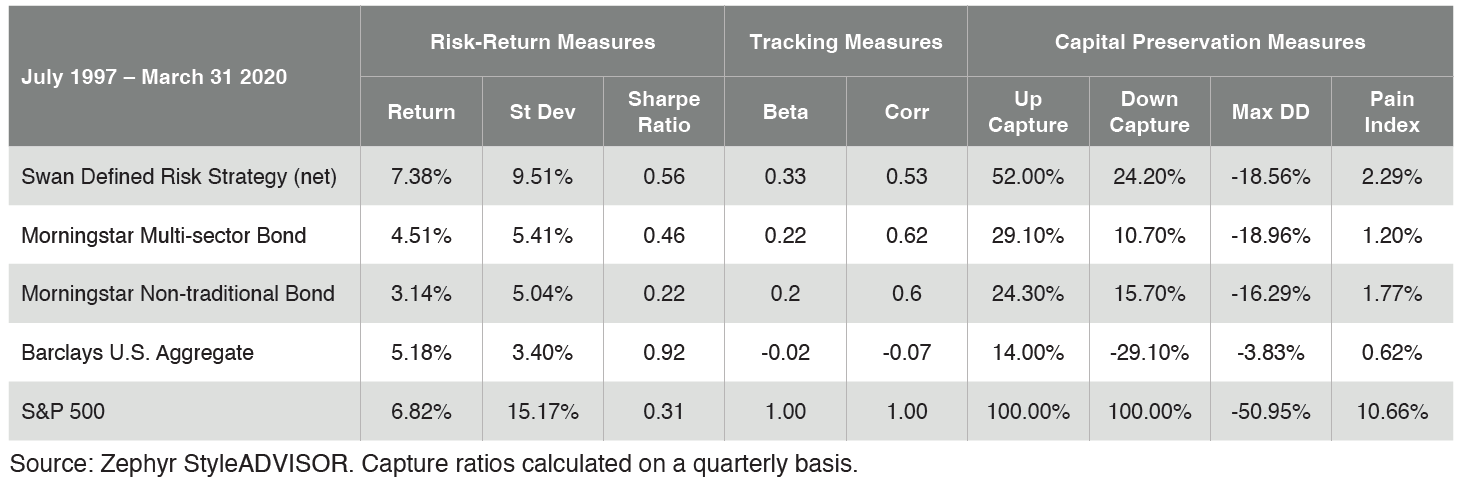

Against the category averages for Multi-sector Bond and Non-traditional Bond, the DRS performs quite well. In terms of absolute return, DRS outperforms traditional and alternative fixed income by a wide margin. The volatility of the DRS is certainly higher than any of the bond options, but the DRS’s superior Sharpe ratio of 0.64 indicates the additional risk was more than adequately rewarded with additional return.

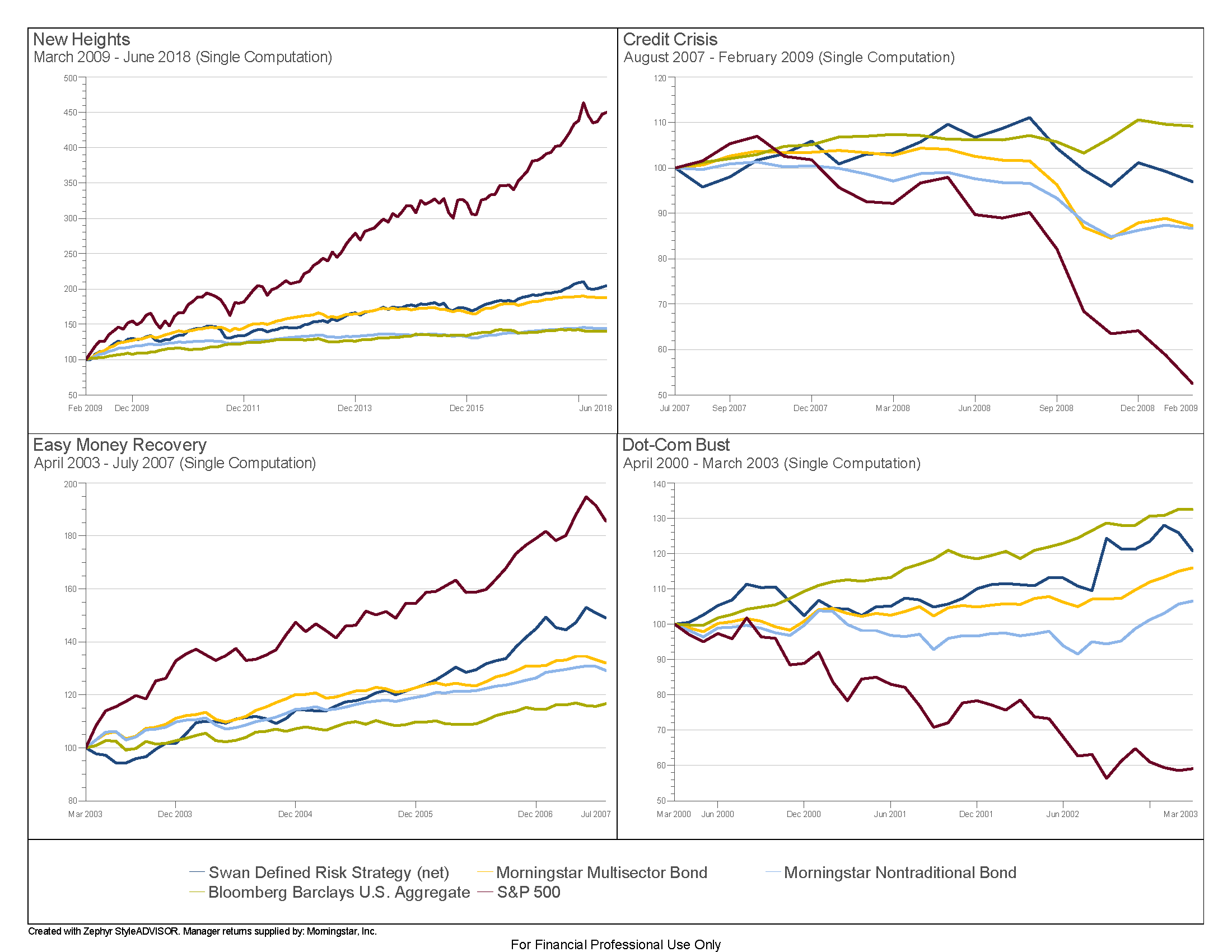

The point of this exercise, however, is to see how the DRS might perform in a capital preservation role alongside the alternative fixed income options. The betas of the DRS and the alternative fixed incomes to the S&P 500 index are all low, and the correlation of the DRS to the S&P 500 is actually lower than the alternative fixed categories. The maximum drawdowns are similar. Compared to the multi-sector bond, the DRS has a lower drawdown and only slightly more than non-traditional bonds. The DRS has compelling capital preservation stats with historically strong upside capture and return performance. Based on these results, one can make the case that the DRS could be utilized as a fixed income alternative for preserving capital.

While the above table indicates that traditional investment grade bonds represented by the Barclays U.S. Aggregate are the least correlated to the S&P 500 and offer the best downside protection, that might not always be the case going forward. It is questionable whether investors are truly aware of the magnitude of the risks embedded in traditional investment-grade bonds.

Risk-Free Return or Return-Free Risk?

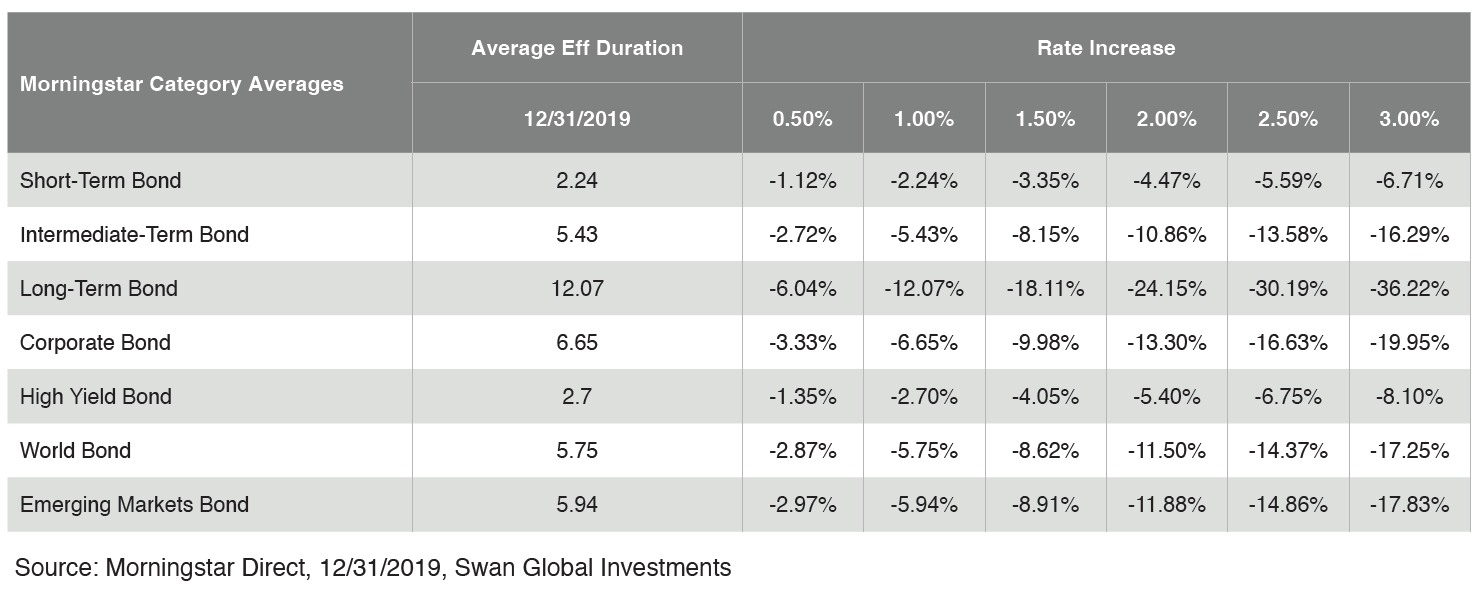

When investors make the decision to move into non-investment grade or alternative fixed income, they are willingly taking on more credit and liquidity risk. But the biggest risk to investment grade bonds is, of course, interest rate or duration risk. Just like systematic, market risk is the 800-pound gorilla in the equity markets, interest rate risk is the primary driver of bond returns.

According to Morningstar, the average durations (i.e., interest rate sensitivities) for different fixed income strategies are in the table below. Given different levels of interest rate rises, the expected losses across these strategies are as follows:

While negative numbers are seen across the board, the above table of duration and return doesn’t truly highlight the magnitude of interest rate risk hanging over the market. According to a recent Bloomberg article, Goldman Sachs estimates that bond holders stand to lose $1 trillion if rates rise unexpectedly by just 1%:

“Lurking in the bond market is a $1 trillion reason for the Federal Reserve to go slow on interest-rate increases. That’s how much bondholders stand to lose if Treasury yields rise unexpectedly by 1 percentage point, according to a Goldman Sachs Group Inc. estimate. A hit of that magnitude would exceed the realized losses since the financial crisis on mortgage bonds without government backing, Goldman Sachs analysts Marty Young and Charles Himmelberg wrote.”

Over the last few years, some market watchers have made the joke that investment-grade bonds were once risk-free return, but today, bonds are return-free risk. That statement doesn’t seem too far off the mark these days, and it is one of the reasons why some practitioners are using the Defined Risk Strategy in place of bonds in their portfolios.

Related: How We Are Thinking About Municipal Credit in This Environment