Written by: Jack Manley

Shortly after October’s surprisingly soft U.S. inflation print, stocks, bonds and the dollar reacted quickly and fiercely. Of course, “soft” in this case is a relative term – inflation still stands at multi-decade highs; but compared to expectations, the move lower in both headline and core CPI was enough to convince markets that perhaps the long-discussed Federal Reserve (Fed) “pivot” was closer than expected.

This Fed “pivot” is crucial for a change in the direction of these assets: it pushes expected future bond yields lower, resulting in positive performance from duration; it pushes the expected discount rate for future earnings lower, resulting in improved earnings expectations; and it suggests that the growing interest rate differential between the U.S. and the rest of the world will finally stabilize, if not narrow, reducing the relative demand for U.S. dollar-denominated assets.

For many investors, the “pivot” promise from October’s CPI print elicited a sigh of relief. Given that stock prices are higher, bond yields are lower and the dollar has softened in the weeks after the inflation reading, it would appear that markets have reached a turning point. However, investors would be wise to interpret these moves realistically and realize that while the long-term story remains intact, the short-term view still isn’t rosy.

For one, it is unlikely that the October CPI print will materially change the Fed’s thinking. Inflation remains far too high relative to its target range, and while headline inflation has been softening for several months, the decline in core price growth is a more recent phenomenon (and more relevant for the direction of rates). For this reason, it seems likely that the Fed will move forward as initially expected – a 50 bp hike in December followed by a 25 bp hike in February. Those investors hoping for a pivot sooner will likely get their hopes up.

Beyond this, there are other factors that are influencing stocks, bonds and the dollar. Geopolitical tensions remain elevated, which is inherently dollar-positive, and are unlikely to improve in the near-term; the U.S. faces a recession in 2023, which will be damaging to earnings and could force equity markets lower; China continues to battle COVID, which is a setback for manufacturing; and energy prices are elevated, a threat to global growth.

All told, it is too early to call the bottom (or top) for these markets, and more than anything, investors should expect volatility through the next several months. That said, it is important to also look at the bigger picture: stocks and bonds are so cheap, and the U.S. dollar so expensive, that investors should take comfort in the strong long-term valuation tailwinds. Ultimately, this makes the case for being a long-term investor, avoiding market timing and embracing active management.

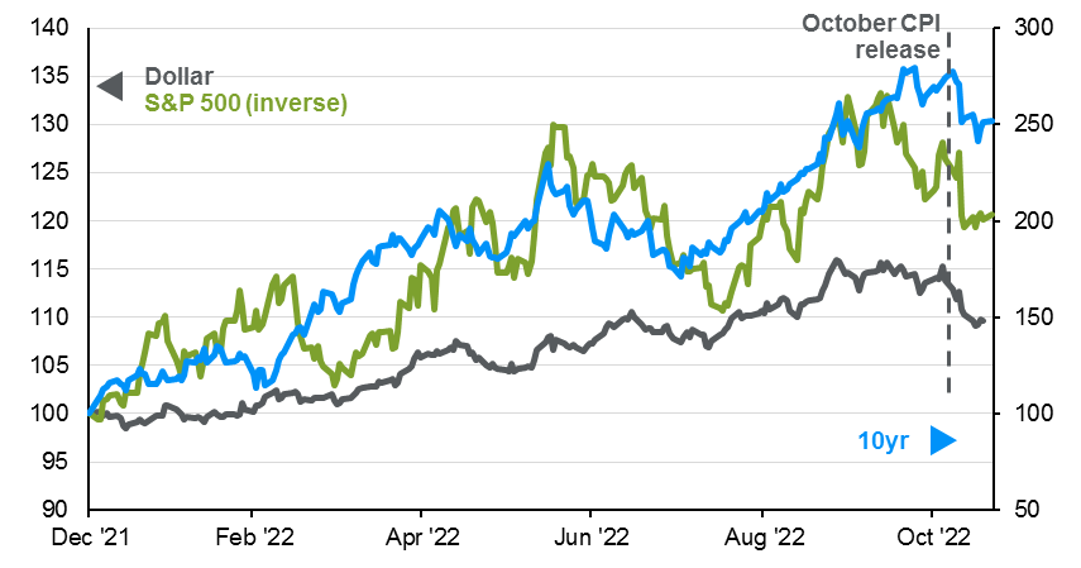

Stock prices, the dollar and yields may have reached a turning point

Source: FactSet, J.P. Morgan Asset Management. Series reflect daily changes in the nominal trade-weighted exchange rate index, S&P 500 price returns and the constant maturity 10yr treasury yield. Data are as of November 21, 2022.