Written by: Samantha Azzarello

Behavioral Finance Series

Behavioral finance incorporates elements of psychology to explain the actual behavior of investors and the subsequent effect on markets, in contrast to traditional finance which posits purely rational investors and efficient markets. In a series of posts, we will go over the most common behavioral biases investors fall prey to and put them in the context of history or current market events.

What is loss aversion?

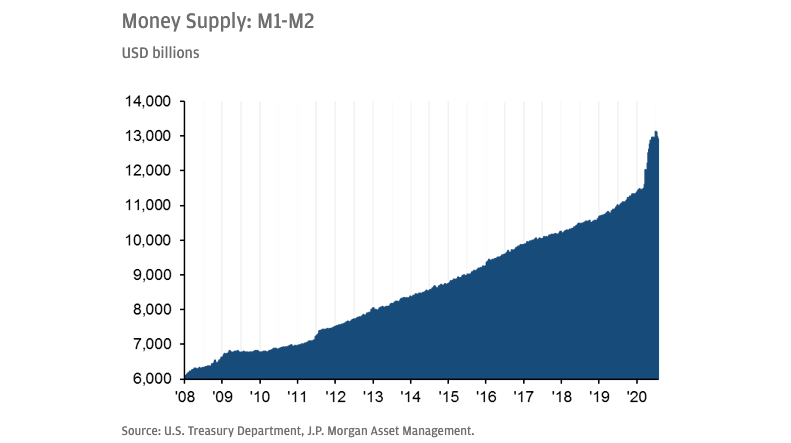

Loss aversion is the preference to avoid losing compared to gaining an equivalent amount. Simply put, it is better to not lose $1000 than it is to find $1000. While cash has a place in an allocation, large amounts on the sidelines, like we see in the chart below, are indicative of missed returns, eroded purchasing power and loss aversion.

Loss aversion for investors

Research shows the pain from losing money is twice as great as the pleasure of winning money, and the fear of losses can influence decisions. In a portfolio, loss aversion may present itself in a few ways including large cash allocations or holding onto losing positions (in order to not realize the loss).

Holding cash and finding a reason to not invest in equities is an example of loss aversion seen frequently. Cash feels comfortable and not subject to loss, yet we know that inflation erodes purchasing power of cash holdings every year in a sneaky but impactful way. While cash has a place in an allocation, large amounts on the sidelines, like we see in the chart below, are indicative of missed returns, eroded purchasing power and loss aversion.

Holding onto losing investments is another manifestation of loss aversion. While many of us are long-run investors, it can be necessary to “cut our losses” with an investment that has had changes to its outlook. Unfortunately, even when fundamentals or new information suggest it’s time, loss aversion means it can be difficult for investors to sell and realize the loss. The behavior of avoiding losses means we hold onto losing investments for longer than necessary, even when realizing the loss is the best, most thoughtful course of action.

How can we address loss aversion?

It starts with investors weighting potential volatility and losses equally with the potential benefits and rewards. While investing in equities does entail stomaching volatility, over the long- run investors have been rewarded for investing in equities. In fact, equity markets have moved higher in 30 of the last 40 years (that’s 75% of the time).

With respect to holding onto “losing” positons, we can use pre-commitment through stop-loss orders to create sell discipline and provide a way to make sure losing positions are handled early and not let to run and accumulate.

Lastly, checking in with the powerful reasons as to why we invest is also helpful, which includes transforming and growing income into wealth, along with reaching our financial goals. Overall, investors should consciously be aware that loss aversion may be a weakness in their investment decision making.

Excess Cash held on the sidelines

While cash has a place in an allocation, large amounts on the sidelines, like we see in the chart below, are indicative of missed returns, eroded purchasing power and loss aversion.

Related: Will Tensions Between the U.S. and China Keep Rising?