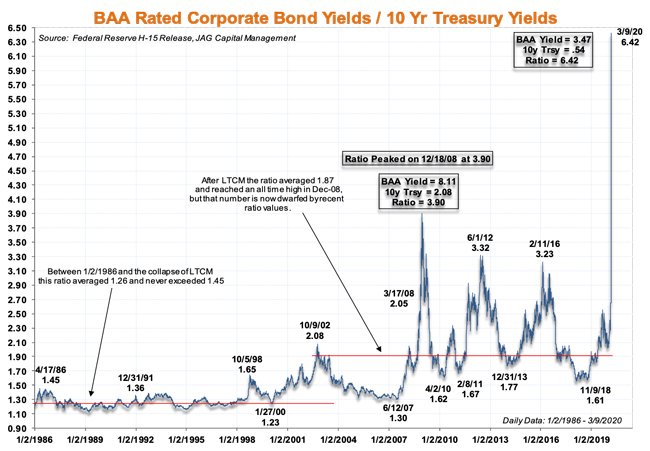

Coronavirus fears have driven an epic cascade of capital into risk-free assets like US Treasuries. 10-year Treasury yields have collapsed from 1.9% to less than .6% since the end of 2019. Meanwhile, investment-grade credit spreads have widened. The result? A truly extreme relationship between BAA-rated bond yields and Treasury yields. As of 3/9/2020, the average BAA-rated bond yielded 3.47%, more than 6.42x the yield on 10-year Treasuries. This ratio is now more extreme than it has ever been, far outstripping the previous highs of 3.9x during the Great Financial Crisis.

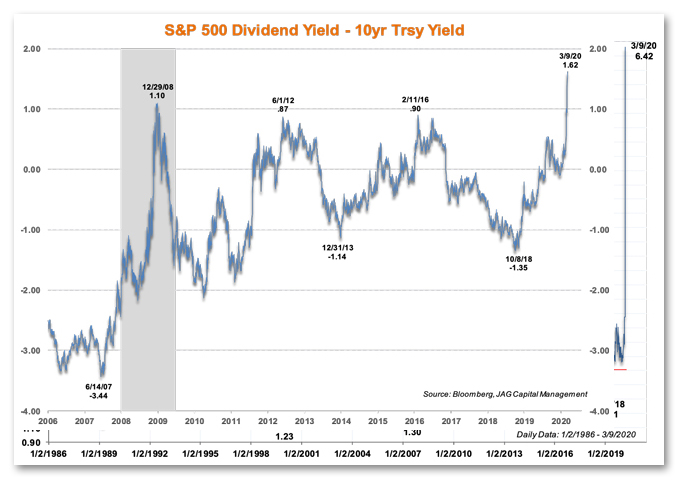

Meanwhile, the near-20% correction in the S&P 500 has left the blue-chip index with a dividend yield of nearly 2%, a huge premium to the tiny cash flows provided by Treasuries.

To us at JAG, these two charts highlight how incredibly expensive the “flight to safety” trade has become. Back in 2008, the BAA/10 Yr chart reflected outlier metrics in both the numerator (BAA yields were >8%, and credit spreads were extremely wide) and the denominator (Treasury yields had collapsed to then-historically low levels of c. 2%). Stated another way, in late 2008, the BAA/10 Year yield ratio pointed to the potential for equity-like returns in investment-grade credit. While we do not anticipate such extraordinarily high returns for investment-grade bonds in 2020-2021, we do think that credit looks extremely attractive relative to Treasuries for those with intermediate- to longer-term investment horizons.

Similarly, while we have no special insight into the near-term path for the stock market, the fact that the S&P 500 offers much more than 2x the yield of the 10-year Treasuries probably indicates that opportunities are developing for longer-term equity investors. At the same time, we think the “safety trade” into intermediate- to long-duration Treasuries could prove to be anything but “safe” for long-term bond investors.

Related: The 3 Cs of Trading Markets in Turmoil

DISCLOSURE:The views and opinions expressed in this article are those of the contributor, and do not represent the views of Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.