Low rates and a volatile stock market threaten a popular strategy. Time for a new “40.” And maybe a new “60” too.

I am a huge fan of investing in the stock market. But the bottom line is that returns need to be engineered more than they used to. That, and the bond market woes that are here to stay are bound to put the 60/40 portfolio right there with the 8-Track tape player, the phone booth and McDonalds MCD’ french fries before they changed the recipe.

If so-called “60/40” investment portfolios, which allocate 60% of their assets to stocks and 40% to bonds, were an animal, I am quite certain they would be cats. This standard, cookie-cutter, overused and overrated and over-simplified approach to investing billions of dollars of hard-earned money has been on the ropes for a while.

After all, interest rates are at or near all-time lows. That means that bonds are likely to produce long-term returns that are very low positive or are negative. Stocks, meanwhile, are another story. I don’t think you need much of a reminder there. Whether your concern is bear market or just a lot of volatility, the bloom is also off the stock market rose, after a strong but wind-aided (thanks, Fed!) decade of strong returns.

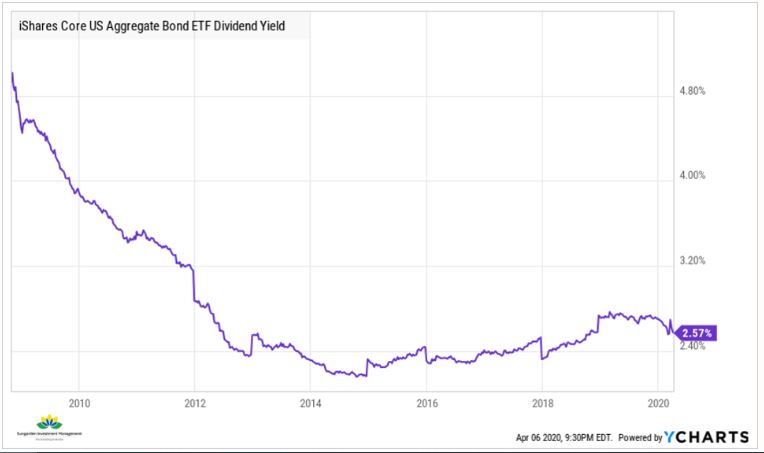

The above chart shows one of many reasons I have long since moved on from any temptation to use a “traditional” 60/40 portfolio, or anything that would include a dedicated allocation to bonds. A glass-half-full 60/40 investor would brag that in the recent decline of about one-third of the S&P 500’s value in 5 weeks, they “only” lost about 23%.

But last I checked, that’s still like turning $500,000 into about $385,000. In 5 weeks! I just don’t know too many retired or pre-retired investors that would want to go anywhere near that possibility.

Here is a good look at the yield on the most commonly-used bond index. It stands at about 2.50%, but that includes a dose of BBB bonds, which may be candidates for downgrade to “junk” ratings. There are too many problems in the bond market for me to cover here. Suffice it to say, low rates and a poor credit conditions are a toxic mix.

Time for a new “40”

Despite recent assurances from the Federal Reserve, the bond market is a mess. It is less liquid, loaded with risky debt, and the yields on the “safe stuff” is at zero or below. I strongly favor an approach that uses bonds only for tactical purposes. I’d rather have more of a portfolio in stocks, and hedge that stock portfolio with straightforward vehicles. Those include inverse ETFs, options and cash.

Time for a new “60” too?

Generating returns in the stock market used to be about buying “great companies” and holding them until you could pass them on the next generation with a “step-up cost basis” which would allow them to reduce taxes. I think that’s likely to be more nostalgic than prevalent going forward.

The stock market has too many modern elements that get in the way of good old-fashioned fundamental investing. That has included hedged funds, index funds, algorithmic traders and more recently, managing through a global pandemic. This brings so many new uncertainties that make the traditional buy-and-hold thing far more dangerous than at any time in our lives.

60/40 if you dare. But take some time to consider the new realities of investing and financial market conditions.