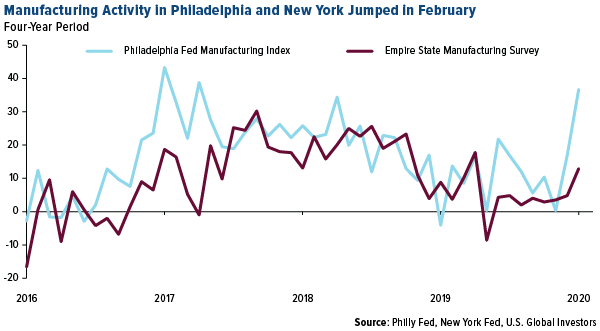

U.S. factories rebounded strongly in February, suggesting the manufacturing recession may finally be behind us after the industry contracted for six straight months. The Philadelphia Fed Manufacturing Index jumped an incredible 20 points to 36.7, its highest reading since May 2017, while New York’s Empire State Manufacturing Survey rose more than eight points to 12.9, a nine-month high.

We won’t get the Institute for Supply Management’s (ISM) U.S. manufacturing purchasing manager’s index (PMI) until the start of March, but I see the positive regional surveys as a sign that the PMI could beat expectations.

The news also bodes well for President Donald Trump’s reelection bid. The weak U.S. PMI, under pressure from the U.S.-China trade war, has been the one significant drawback in an otherwise solid economy and stock market.

But now we may find ourselves in a “out of the frying pan and into the fire” scenario: The “Phase One” trade deal between China and the U.S. was signed last month just as we began to see the first reports on the novel coronavirus, now known as COVID-19. As of Monday morning, the virus had spread to more than 77,000 within China, and as many as 2,200 outside the country. And although the recovery rate looks promising—more than 24,000 people have survived infection in China, compared to 2,500 deaths—there’s concern that people may be underestimating the risk.

A $1.1 Trillion Hit to the World Economy?

In a note to clients last week, analysts at Oxford Economics said they believe that the threat COVID-19 poses to the world economy is currently underappreciated. In a worst-case scenario in which the infection escalates into a full-blown pandemic, as much as $1.1 trillion could be wiped from the global economy in the first half of the year alone.

Again, this is a worst-case scenario, but consider the economic effects if most major cities around the world were placed on lockdown as Wuhan is right now. Lower discretionary spending, lower demand, lower productivity and lower investment would all be likely consequences.

The U.S. and eurozone would enter, as Oxford Economics lead economist Adam Slater puts it, “technical recessions.”

I’m not as much of an alarmist as Oxford is, but as I told Daniela Cambone last week, COVID-19 is already bigger than SARS and, in many ways, it more closely resembles 9/11 because travel has been suspended. Wuhan, China, where the virus originated, is home to more than 11 million people. That’s four Chicagos. Shipping lines and ports have been impacted. Alphaliner, a shipping consultancy, estimates that 46 percent of scheduled departures from Asia to North Europe have been cancelled in the past four weeks.

Seeking Safety: Gold Miners at 52-Week Highs

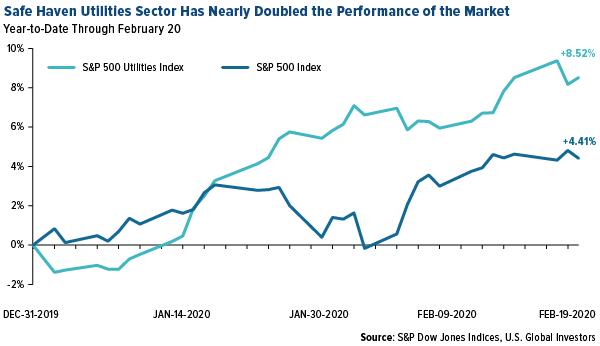

It’s for this reason we’re seeing investors rotate into perceived safe havens and defensive stocks, starting with utilities. Energy producers were up 8.5 percent year-to-date through February 20, nearly double the performance of the S&P 500 Index over the same period.

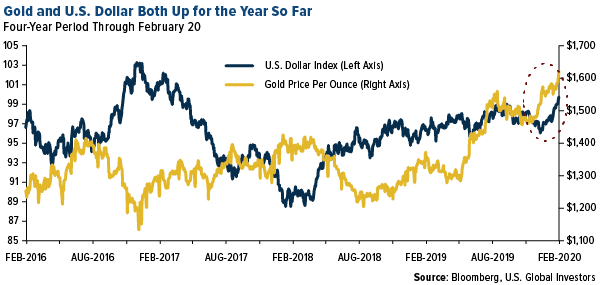

Gold, which I believe to be the ultimate safe haven, rose for the ninth straight day on Friday, crossing above $1,650 an ounce for the first time in seven years. This comes in defiance of a stronger U.S. dollar, which has been edging closer to the psychologically important 100 mark relative to other world currencies. It’s rare to see both assets go up at the same time—the four-year chart below makes that clear—but COVID-19 has spurred the flight to safety and quality, of which gold and the greenback can be considered.

Gold mining stocks have also broken out, with several hitting new 52-week highs last week, including Newmont Mining, Barrick Gold, Yamana Gold and Kinross Gold. Gold royalty and streaming companies, including Franco-Nevada and Wheaton Precious Metals, also hit fresh 52-week highs. Junior miners weren’t left out of the rally, either. The MVIS Global Junior Gold Miners Index climbed to a 52-week high, up more than 58 percent from its recent low in May.

For more on gold mining stocks, watch my interview with SmallCapPower’s Mark Bunting by clicking here!

DISCLOSURE:The views and opinions expressed in this article are those of the contributor, and do not represent the views of Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.