Written by: Stephen Duench | AGF

One of the defining aspects of the equity market so far this year has been the outsized returns of growth stocks. In June alone, the S&P 500 Growth Index gained almost 10% more than the S&P 500 Index, marking its best month of outperformance against the broader market in 14 years, according to AGFiQ data.

But what is perhaps just as remarkable—and yet less recognized —is the fact that growth can now be characterized by its defensive attributes as much as anything else.

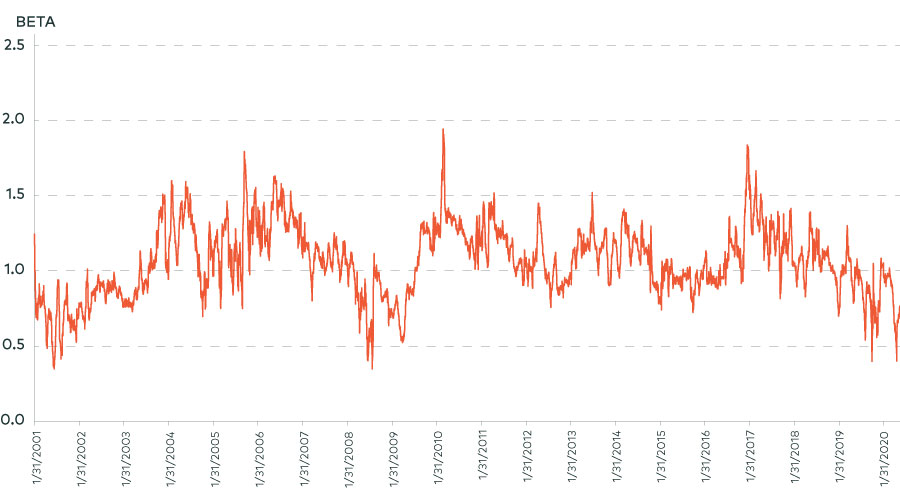

Indeed, our analysis shows several factors that are synonymous with growth stocks have recently experienced significant deviations in their market betas, which, in the past, have hovered near or at 1 on average. For example, momentum and forward earnings growth currently have rolling three-month betas of 0.65 and 0.69, respectively, but these scores were also as low as 0.59 and 0.5 in early June.

Three-Month Rolling Beta of Forward Earnings Growth

In other words, both factors have become far less volatile in relation to the overall market than would normally be the case. And while it isn’t unheard of for growth-like characteristics to have betas that are well below 1, it is rare—especially when taking into consideration the current betas of other factors like value and dividend income that have increased just as uncharacteristically to current scores well above 1 in recent weeks.

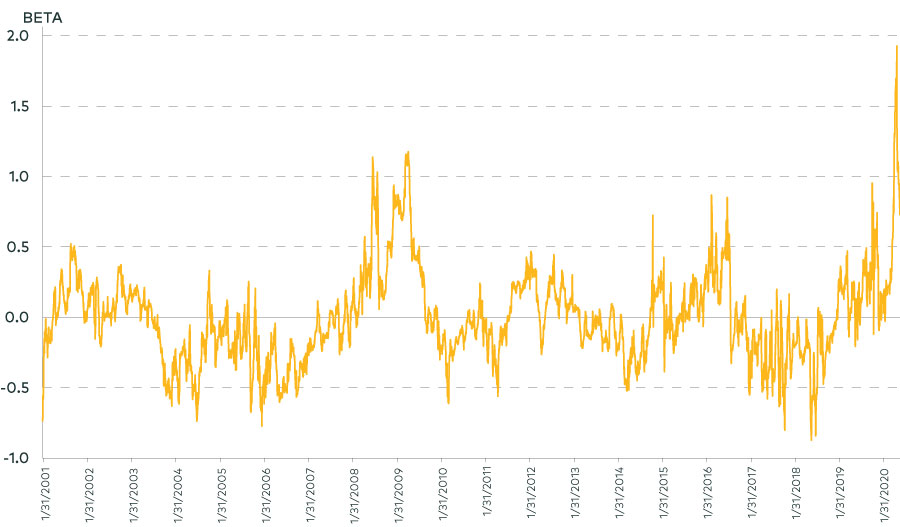

Beta Spread between Forward Earnings Growth and Deep Value

As a case in point, the beta spread last month between forward earnings growth and deep value was the most extreme its been in over two decades. Moreover, the only other time it was anywhere close to this divergent was in the early part of 2009, right before the value-fuelled start to the bull market in equities following the Great Financial Crisis.

Of course, that doesn’t mean growth’s reign as an outperforming, defensive juggernaut can’t continue, but like most other market deviations of this magnitude that have come before it, there’s a high probability that it will end sometime soon rather than later.

To learn more about our quantitative capabilities, please click here.

Related: Why the Market Rally Has Lost Steam