Written by: Stacey Morris | Alerian

With MLP index yields at all-time highs, several management teams are utilizing this downturn as a buying opportunity, reflecting confidence in their underlying businesses. Today’s short post details recent insider purchases across midstream.

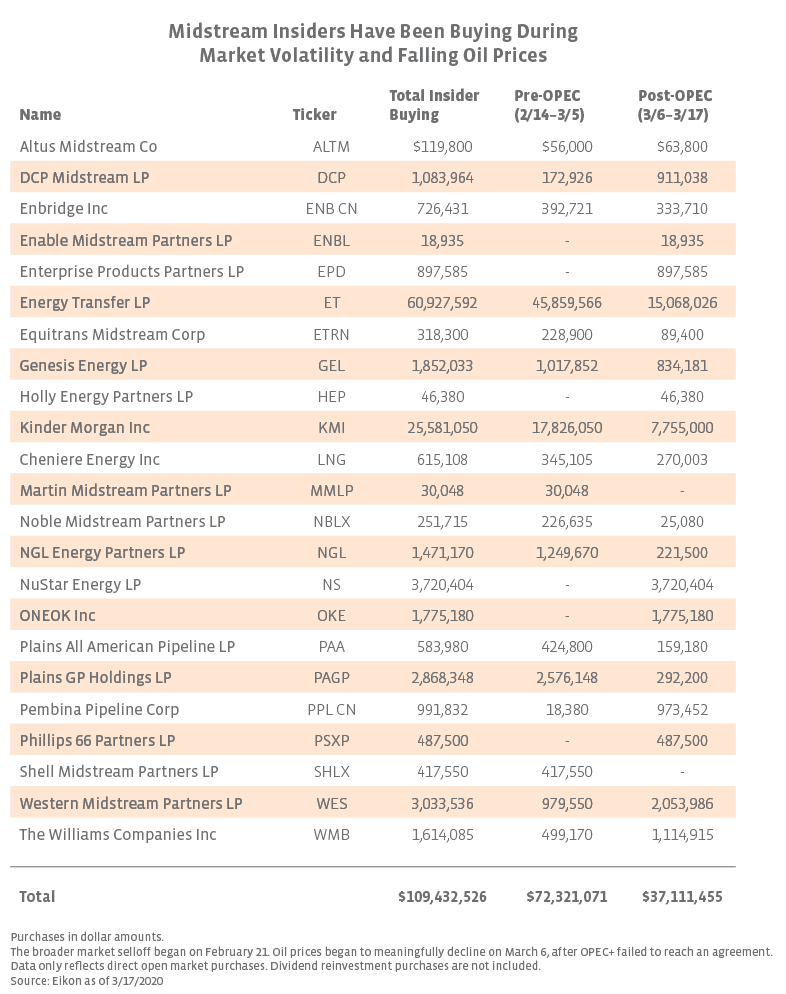

Despite the fee-based nature of their businesses, midstream companies have been pressured in recent weeks as the sell-off in oil prices has raised concerns around the financial health of producer customers and depressed the near-term outlook for US energy production. Additionally, MLPs have been pressured by closed-end funds deleveraging (example). Deleveraging involves funds repaying debt with proceeds from selling their positions in MLPs, which further pressures MLP unit prices. Despite this market turmoil, one bright spot has been midstream insider buying. The table below outlines insider buying since mid-February for the constituents of the Alerian Midstream Energy Index (AMNA), our broadest midstream index. Of 49 constituents (accounts for recent constituent changes), 23 have had insiders purchase shares since mid-February. Of note, significant buying has occurred since OPEC and its counterparts failed to reach an agreement, which marked the beginning of oil’s latest price decline.