This morning’s jobs report was so strong that the Fed Funds rate curve started to price in the odds of a hike this year. While the increased probability is miniscule, the significant shift in expectations is hard to ignore, as investors are responding to consistently hot data amidst heightening geopolitical tensions. Levels of hiring, wages, and unemployment in March were sturdy and hardly consistent with a central bank that should be cutting. The likely result is that we’ll see increasing dissidence among Fed members opposing rate cuts with certain policymakers already pushing back against Chair Powell’s obsession with monetary policy accommodation.

Hiring Accelerates with Broad-Based Gains

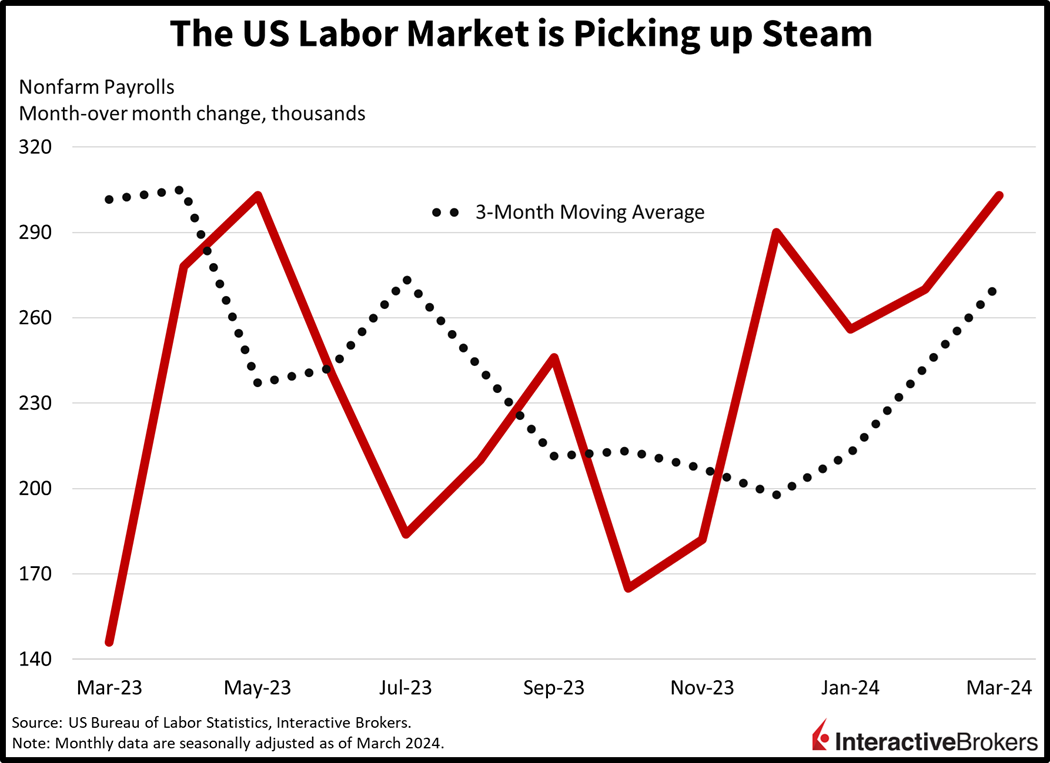

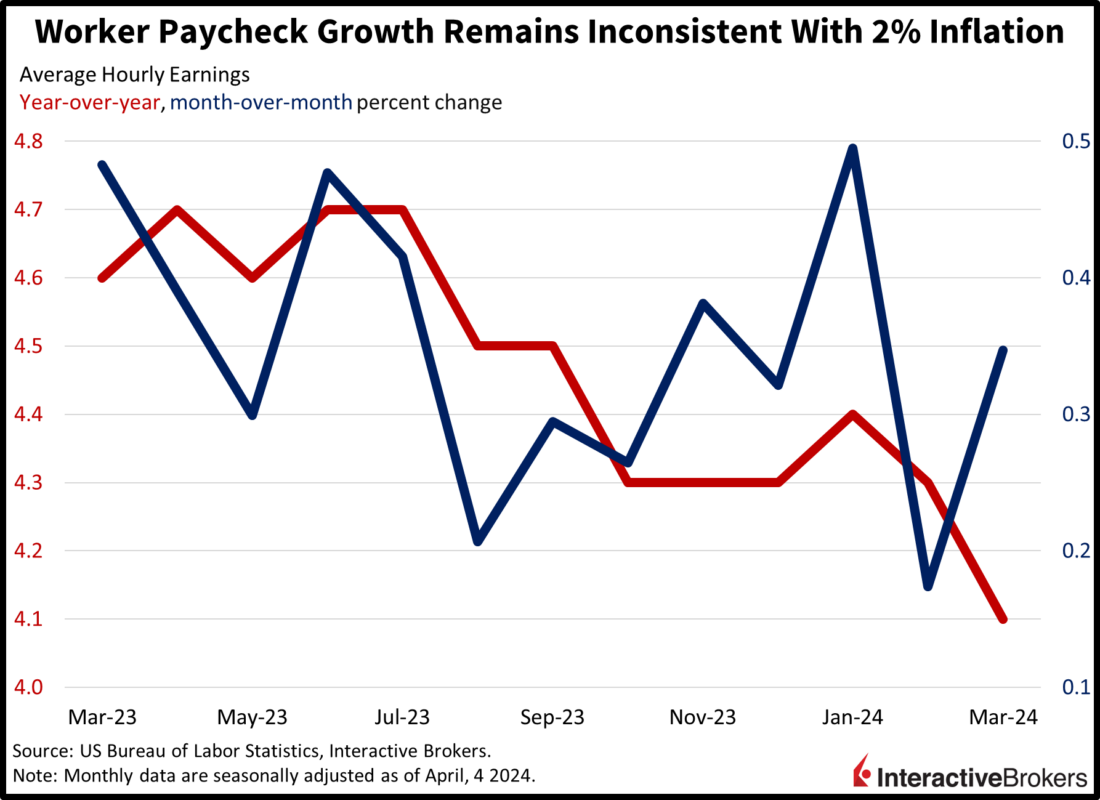

The US labor market is clearly picking up steam with March payrolls increasing at the fastest rate in 10 months. The US economy added 303,000 jobs last month, trouncing expectations of 200,000 and accelerating from February’s 270,000. The unemployment rate also reflected tighter-than-expected labor conditions, with the figure dropping from 3.9% to 3.8% month over month (m/m); forecasters anticipated an unchanged number. Worker paychecks continued growing, with average hourly earnings climbing 0.3% m/m and 4.1% year over year (y/y), matching estimates.

Employment gains were broad-based, with nearly every major category adding headcounts, even with increases being concentrated in non-cyclical industries. Leading the March charge were the education/health services, government, leisure and hospitality, and construction sectors, sporting roster growth of 88,000, 71,000, 49,000 and 39,000. The retail and other services groups added 18,000 and 16,000 while all other gaining sectors saw payrolls increase below 10,000. The utilities segment experienced a negligible decline while information was unchanged during the period.

The labor force expanded at a brisk pace last month, pushing the unemployment rate down while causing labor force participation to increase, according to this morning’s jobs report from the Bureau of Labor Statistics. The 469,000 new labor force entrants drove the participation rate to 62.7%, 20 basis points (bps) higher than in February. Also in March, recent immigration increases helped to expand the supply of domestic labor. Workers didn’t just benefit from greater labor demand via wages, as the average work week also increased.

Economy Shows Signs of Higher Inflation

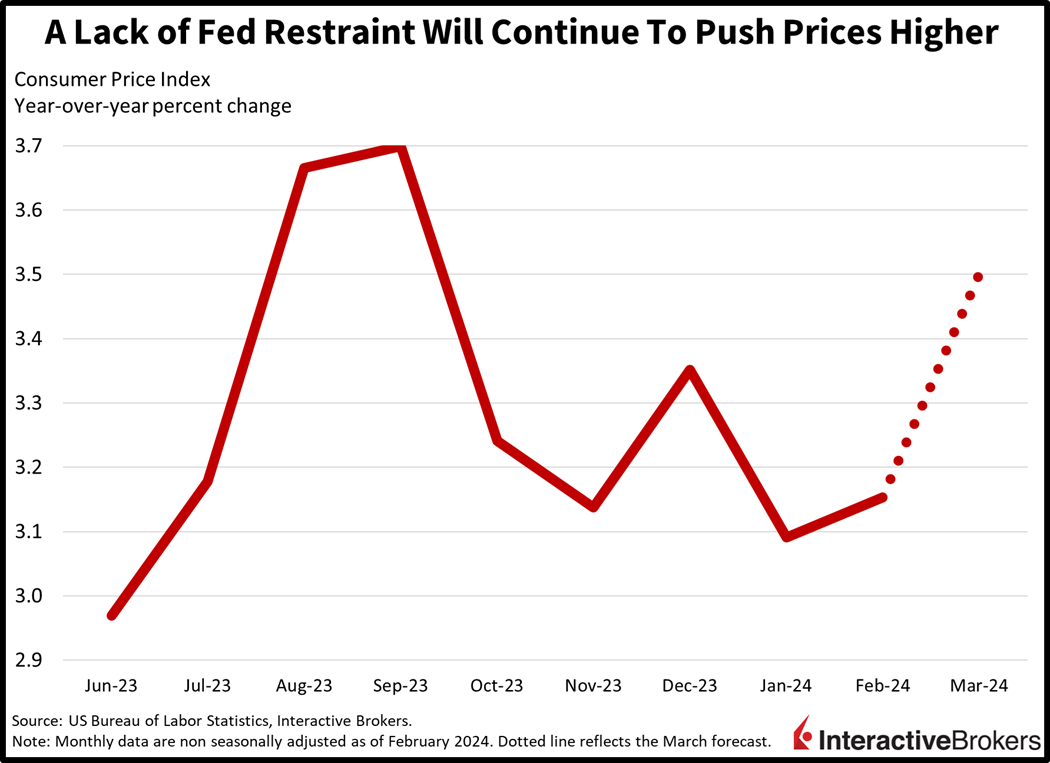

This morning’s employment data alongside hot jobs and inflation numbers in January and February point to an economy that may be overheating. While Powell has remained committed to dovish talk while pointing to rate cuts right around the corner, other members of the central bank, including Regional Presidents Kashkari, Bostic and Goolsbee, have warned of a potential case of few, if any, rate reductions at all this year. Market players are in agreement, with coinflip odds for a cut in June while the door to more hikes has been opened, albeit slightly. The risks of entering the second half of the year without rate relief is particularly troublesome with an upcoming presidential election, with the central bank potentially being perceived as increasingly political if it makes any moves then. In the interim, I’m expecting more hot data to hit the wire in the coming days, starting with next week’s Consumer Price Index (CPI), which is likely to inch higher to 3.5% y/y, the fastest rate since September. Oh and by the way, we have yet to see a 2 handle on CPI, with the figure bottoming at 3% last June, 10 months ago.

Geopolitical Turmoil Spikes

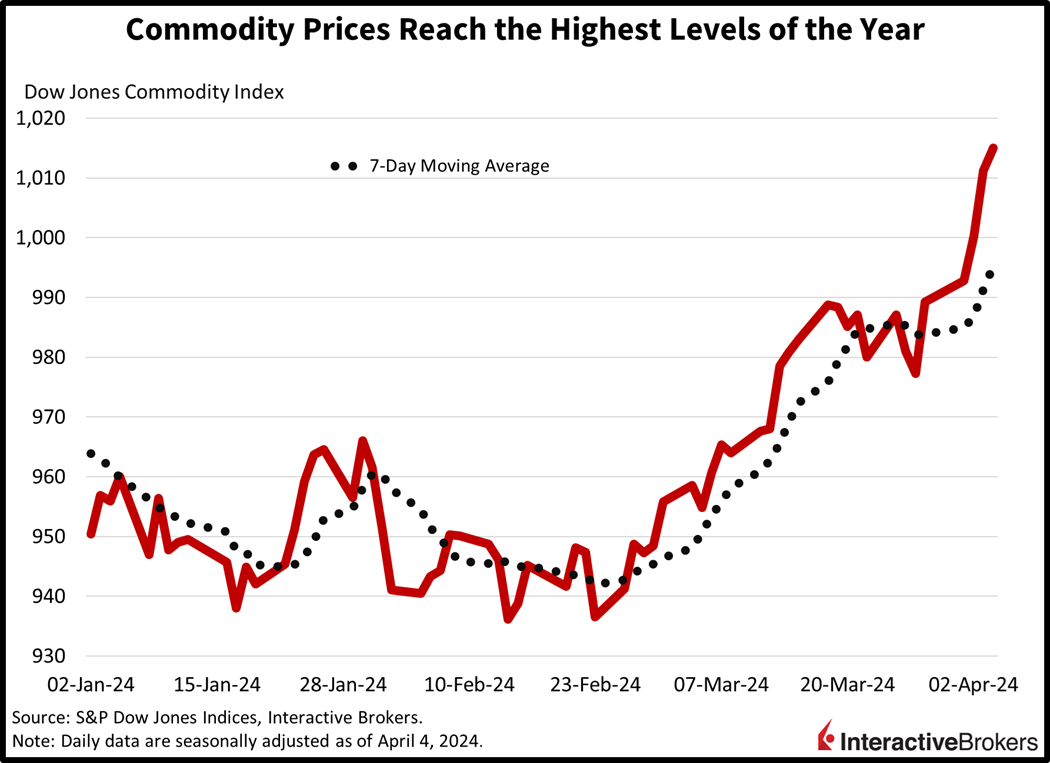

Geopolitical risks have increased with tension between Iran and Israel escalating and the US alleging that China is engaging in unfair labor practices. Meanwhile, the Israel-Gaza conflict and the Ukraine-Russia war are continuing with little expectations of a resolution of either conflict. A missile strike on the Iranian consulate in Syria by an unidentified aggressor earlier this week has caused Israel to put its embassies on high alert and cancel home leave for its troops. The actions come after Iran accused Israel of carrying out the strike and has vowed revenge. Meanwhile, Ukraine’s drone strikes against Russian refineries are stoking fears of potential shortages of the energy commodity. The strikes, which have targeted at least 12 oil facilities, are believed to have knocked out 10%–15% of Russia’s refinery capacity. Some analysts estimate that the country’s oil processing declined by 20% last month. Russia is likely to struggle to bring the refineries back on-line as sanctions that were imposed after the country attacked Ukraine are making it difficult for Moscow to secure parts and equipment for repairing the facilities. WTI crude oil is up 0.7%, or $0.59, to $87.35 per barrel as traders brace for the possibility of supply constraints against the backdrop of buoyant demand. In another development, US Treasury Secretary Janet Yellen told Chinese leaders that its manufacturing overcapacity could flood global markets with inexpensive goods, undermining American companies as well as businesses in Mexico and India. In recent months, this overcapacity has resulted in deflation of Chinese manufacturers’ final prices. Yellen said the US hasn’t ruled out imposing additional trade restrictions if China doesn’t address the issue.

Aggressive Equity Sectors Rally

Markets are mixed with stocks recovering from yesterday’s abrupt debacle while bonds are selling off. The dollar is higher as a result of loftier rates which have climbed in response to this morning’s hot Jobs Report, hawkish Fed speak this week and fresh year-to-date prices for oil and copper. For stocks, the offensive growth segments are leading, with the Nasdaq Composite and S&P 500 indices outperforming, climbing 1% and 0.8%. The Dow Jones Industrial and Russell 2000 benchmarks are up a milder 0.5% and 0.2%, meanwhile. Sectoral breadth is positive with every sector higher except for utilities, which is down 0.2%. Industrials, technology and communication services are higher than the rest, with all three segments up 0.9%. Yields are soaring with the 2- and 10-year Treasury maturities trading at 4.72% and 4.38%, 7 bps higher on the session. The Dollar Index is up 14 bps to 104.36, as the greenback gains relative to the euro, pound sterling, yen and Aussie and Canadian dollars. It is down slightly versus the franc and yuan though. WTI crude oil is up 0.7%, or $0.59 to $87.35 per barrel.

More Dissidence at the Fed?

These data underscore an economy that is expanding quite nicely, which has benefitted from the dramatic loosening in financial conditions we’ve experienced since last fall. While the Federal Reserve has been inching towards an accommodative posture, persistent batches of hot data continue to challenge its price stability goals. Geopolitics are also a threat to the inflation objective, with conflicts in the Middle and Far East pushing up the price of oil and other commodities. Finally, the combination of robust hiring, accelerating price pressures and elevated economic growth rates have generated dissidence among central bank members, as some are looking to reduce rates later rather than sooner. Do you see the light at the end of the tunnel?