Written by: Paul Rejczak

Stock Prices pulled back and the S&P 500 went below the 4,000 level again. Is this a downward reversal?

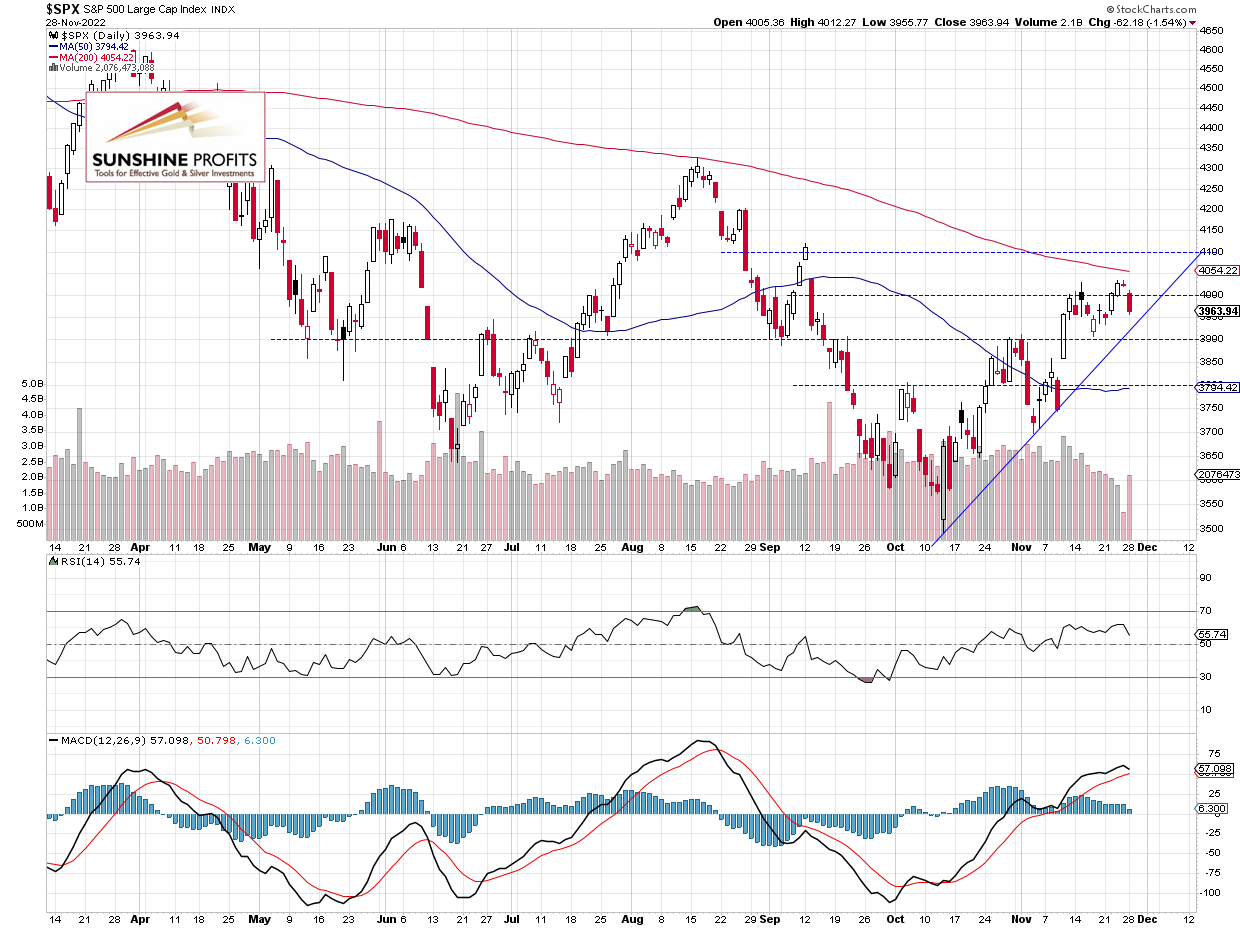

The S&P 500 index lost 1.54% on Monday, as the broad stock market retraced most of its last week’s advances on a renewed interest rates’ uncertainty, among other factors. On Friday the index reached a local high of 4,034.02, and yesterday it went back below the 4,000 level. Stock prices have been fluctuating since November 10 rally.

This morning the S&P 500 is expected to open 0.1% higher, so we may see some more short-term uncertainty. The index went below the 4,000 level, but it continues to trade above an over month-long upward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract Trades Below 4,000

Let’s take a look at the hourly chart of the S&P 500 futures contract. It is trading below the 4,000 level this morning. It still looks like a consolidation within an uptrend, as there have been no confirmed negative signals so far. (chart by courtesy of http://tradingview.com):

Conclusion

Stocks will likely open slightly higher this morning. The market may retrace some of its yesterday’s decline of 1.5%. There have been no confirmed negative signals so far. It looks like a correction or a consolidation within an uptrend. Investors will be waiting for the important CB Consumer Confidence release at 10:00 a.m.

Here’s the breakdown:

- The S&P 500 index pulled back below the 4,000 level yesterday.

- It still looks like a consolidation or a relatively flat correction within an uptrend.