Written by: ReSolve Asset Management | ReSolve Asset Management

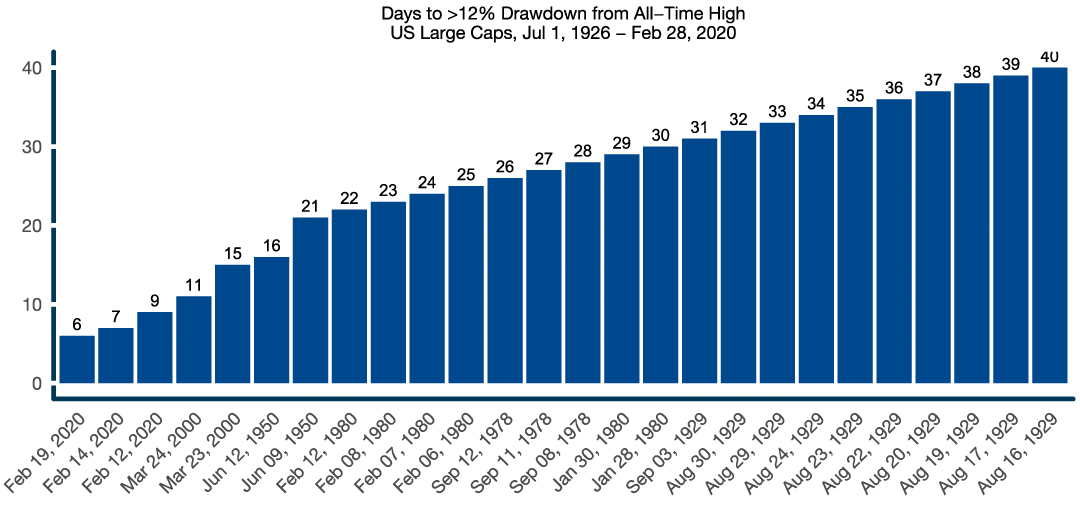

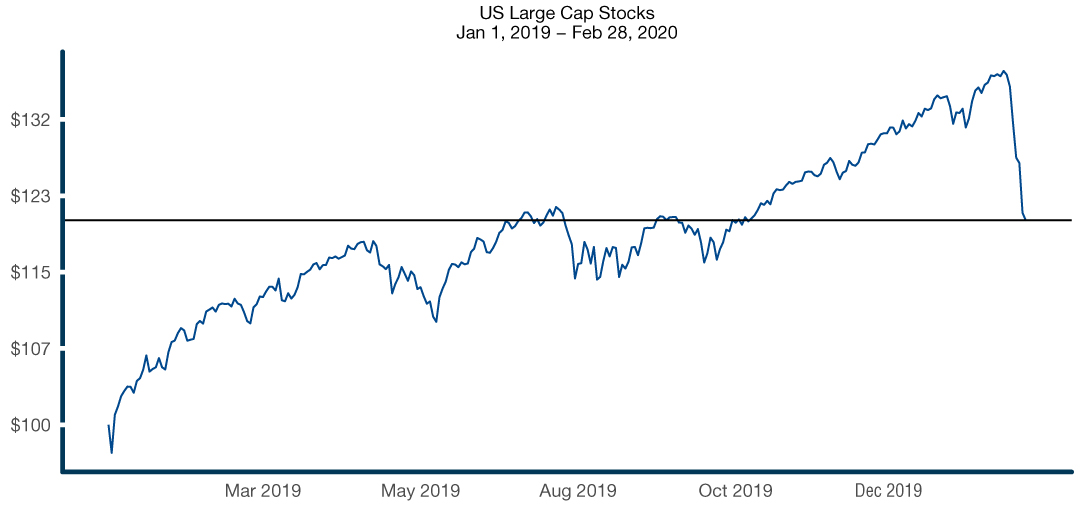

The last few weeks have been some of the toughest in recent memory for investors, as we have observed an intense global market selloff that began in late February and continued into early March of 2020 (as of the writing of this report). Equity markets have experienced the steepest losses since 2008, at the depths of the Global Financial Crisis. As fears surrounding the outbreak of the COVID-19 Coronavirus caught up with capital markets, we take stock of the events that have taken place over the past 2 weeks, while analyzing how prolonged bear markets have unfolded in the past and how tactical strategies have responded.

While we cannot help but look back to previous market corrections to draw analogies, we are reminded that history can generally be a good guide, but it is almost always specifically wrong with regards to the most recent event. The map is not the territory and this time is no different. The recent selloff wiped out many trillions of dollars in global market cap and has been the fastest decline in history for the US stock market. The shock took place after a sharp rise in equity prices – in what has been the longest-ever bull market.

While many tactical strategies have experienced significant losses during this period, some have provided investors with their purported crisis alpha. Taking a step back and looking across the category over the last few years, it`s clear that strategies that have excelled in the last two weeks have struggled to produce any meaningful gains over the past several years, while many strategies currently enduring a drawdown have actually performed well and kept up with equity markets.

Where have they been?

Having managed tactical strategies for clients for almost 15 years, there are two sources of anxiety in these situations that can often drive investors to take action that magnifies the harm inflicted by the market itself. These adverse reactions are typically driven by the following burning concerns:

1. I’ve lost money; I thought your strategy was designed to make money in bear markets.

2. I’ve lost money; I’m fearful that this is the beginning of a massive bear market and I have no confidence your strategy will be able to navigate this type of market.

Regarding the first concern, times like these provide an opportunity to remind investors that tactical strategies like Trend Equity, Managed Futures or otherwise are generally designed to market surf their way through changing economic regimes. This doesn’t always mean that they’re ahead of the curve. In fact, tactical strategies will often be caught offside in the first leg of an abrupt selloff, especially where a market has provided a significant contribution to recent returns.

Surfing markets is by no means a linear endeavor; it is a choppy process with many ups and downs before catching the next prospective wave. As such, these types of corrections in tactical mandates should be seen as the risk premium investors pay as they strive to achieve outsized long-term returns.

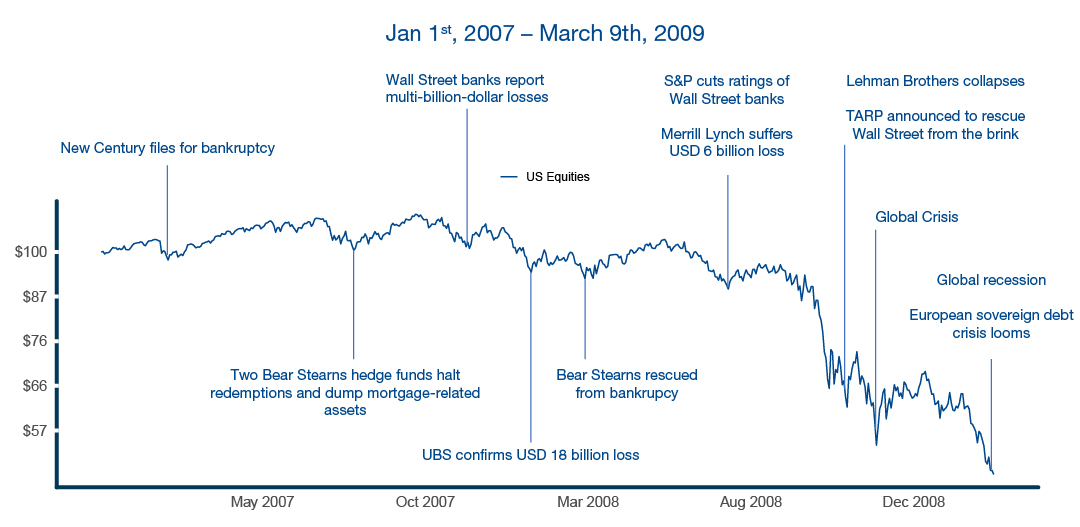

As for the second concern, there is wide speculation that this could be the beginning of a prolonged bear market for equities, which is certainly a possibility. As such, it’s worth spending a few minutes working through a case study examining the trajectory of the most recent bear market – the 2007-2009 Great Financial Crisis (GFC).

The Anatomy of A Bear Market

If we have indeed entered the jaws of a new bear market, the example below makes clear that last week may be the initial phase of a prolonged series of drawdowns and recoveries:

Source: ReSolve Asset Management. Data from Tiingo. US Equities are represented here by the Vanguard Total Stock Market Index Fund (VTI) ETF. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

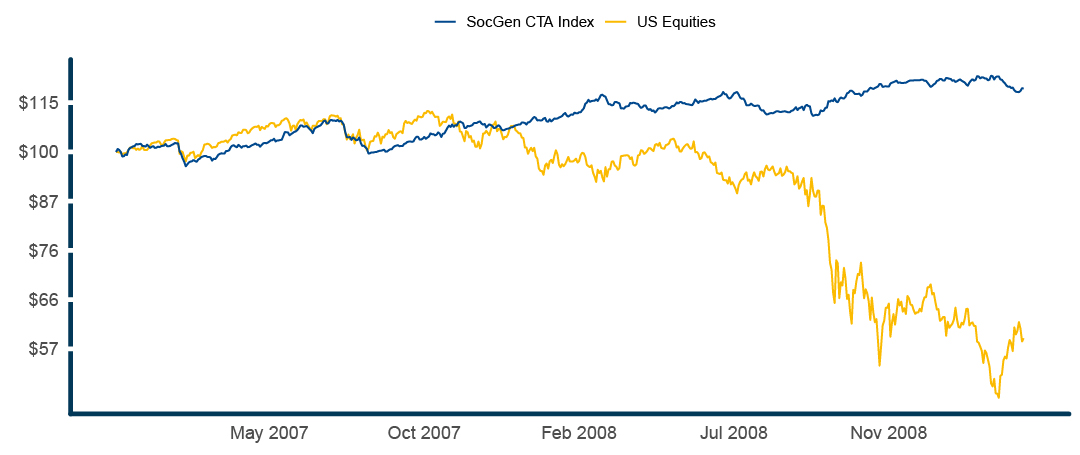

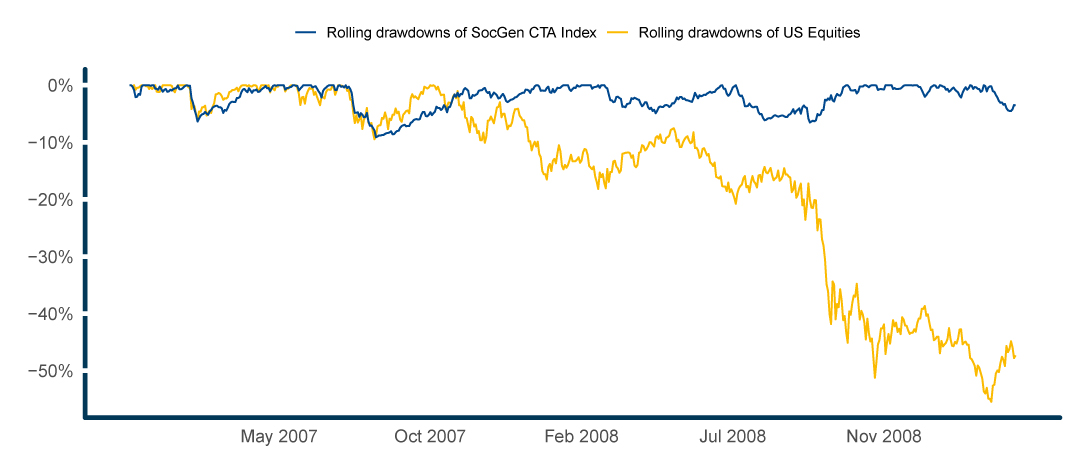

In the context of the full bear market cycle illustration, it is instructive (and confidence-inspiring) to take a look at how CTA’s generally navigated the full 2007-2009 GFC bear market:

Analysis by ReSolve Asset Management. Data from CSI Data and Bloomberg. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

The figure above shows that CTAs did their job – over the course of months rather than weeks – by adapting and protecting throughout a two-year stock market drawdown.

Within the context of the recent market correction, the drawdown and recovery chart below paints an even more compelling picture:

Analysis by ReSolve Asset Management. Data from CSI Data and Bloomberg. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

Note that the SocGen CTA Index suffered the first two major drawdowns in 2007 – to an uncomfortable degree – alongside US equities as the bear market narrative and price action unfolded. At the time, the balance of trend indicators was still skewed toward the assets that had produced the best returns over the recent past. And indeed, those assets went on to recover multiple times to new highs. Note in Figure 4 that the Index recovered and hit new highs after both corrections.

More importantly, as the bear market deepened in 2008, the CTA Index was able to keep larger drawdowns at bay. Despite an uncomfortable hit in Q3 2008 as Lehman Brothers collapsed and governments were slow to respond to the unfolding crisis, the Index recovered fairly quickly as CTA managers transitioned into markets that are designed to flourish in times of market duress, like gold, Treasuries and cash along with all the respective shorting opportunities.

A History of Shocks

Economic cycles will often take countries through the upswings of development, growth and prosperity to the gloom of inflation, stagnation and recession over the course of many years. This well-known Boom-Bust Cycle can take many forms, but it is usually interrupted by a shock to the system. The wars in the Middle East and oil embargos of the 1970s. The inflationary fears of the 1980s. The savings and loans crisis of the early 1990s. Sometimes, a bizarre sequence of shocks – like the Dotcom Crash in 2000 followed by the 9/11 terrorist attacks in 2001 – will result in a particularly acute crisis, the response to which (in this case, very loose monetary policy for an extended period) can sow the seeds of the following downturn. It is arguable that the actions taken to attenuate the stress in 2001 sowed the seeds for the excesses of 2008 and the GFC.

Which brings us to today. The coronavirus pandemic and subsequent crash in oil prices appear to have dealt a significant blow to a fragile global economy. The current selloff in global markets, which began in late February 2020, may just be a prelude to a larger bear market cycle or a bump along the road in a continuing upward trend for global asset prices.

What’s unclear is what the new and emerging trends in asset classes will be. During major corrections significant changes in leadership often occur and many investors are too distracted by the trends of old to see the new opportunities unfolding before their very eyes, Whether it was the commodity and emerging market trends that emerged out of the 2000/2001 bear market or what ended up being the most enduring US bull market run in US history out of the ashes of the GFC. The reality is market dislocations set the stage for the next investment opportunities. Tactical mandates serve not only to preserve capital during the transition, but to also systematically allocate capital to new and evolving opportunities, which arise from the market’s dislocation. Remember, investment trends/paradigms are born in despondency and disbelief but die on euphoria and elation.

Is the Horse Out of the Barn?

One predictable and flawed protestation we’ve seen over and over – especially from investors who had been contemplating an allocation to tactical strategies prior to a first correction – is that “once the horse is out of the barn, there’s no point in investing”.

A simple thought exercise should serve to overcome this “fight or flight” conclusion. Let’s walk through two potential paths forward for global markets:

- As a result of coordinated government action, medical response, or other circumstances, markets realize that the economic fall-out from coronavirus is more manageable than expected. Risk appetite returns, the economy recovers, and the bull-market is extended for another few years.

- As a result of government incompetence, emergent effects of the virus, feedback impacts into credit and other corners of the market, or other circumstances, stocks enter a new bear market, which wipes out 5-10 years of cumulative gains.

In both cases opportunities will emerge among global asset classes.

If scenario 1 plays out tactical managers are designed to recognize the signs and lean into equity risk allocating to the emerging successful asset classes, which may be a continuation of the previous paradigm or something new. This will position investors for gains on a resurgent equity rally.

If scenario 2 plays out tactical strategies have the ability to recognize the signs and emphasize markets designed to thrive in typically challenging periods of deflationary or inflationary stagnation. Allocating to assets like gold, cash and/or sovereign bonds can preserve and even grow capital during times of economic distress.

Inevitably, market risk appetite will recover, and new opportunities will emerge, as often happens after periods of global shock. Perhaps we will enter a period of commodity leadership, or maybe foreign developed stocks will come alive after a decade of near hibernation. Whatever the outcome, tactical strategies can pivot and profit in the arising market regime.

The only strategies that have been capable of responding to what is – by a wide margin – the fastest drawdown in equity market history, are tail protection strategies and pure Trend-Followers. The former is a consistent money-loser while latter strategies have struggled to produce meaningful returns for the last 11 years.

Keeping up with equity markets when they are shining means taking the risk of the first hit when tides turn – especially when it happens so quickly. It is the trade-off we make, the risk premium we pay to earn higher long-term returns. Investors can take comfort in understanding the character of these strategies during such times and tactical strategies’ ability to adapt to continued shocks to the system.

Related: How To Prepare Your Investment Portfolio For The Next Bull Market

DISCLOSURE:The views and opinions expressed in this article are those of the contributor, and do not represent the views of Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.