Written by: Monica Kingsley

Another day, another attempt at the Feb highs, and the upper knots of S&P 500 candlesticks give the daily chart a bearish look. How justified is that – are stocks about to move seriously lower?

In today's analysis, I'll present the outlook based on the many charts featured.

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

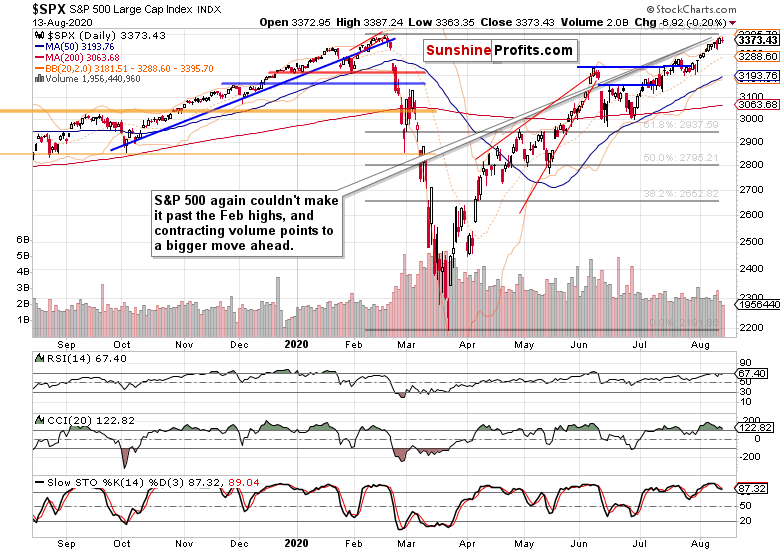

The S&P 500 didn't make it far yesterday, and both the upswings and downswings have been rejected. The volume declined, which means that most market participants are largely sitting on the sidelines.

However, this could cbange in a heartbeat. Will the bears be as strong so as to send the bulls packing?

According to the credit markets, it's a close or not so close tie – have your pick.

The Credit Markets’ Point of View

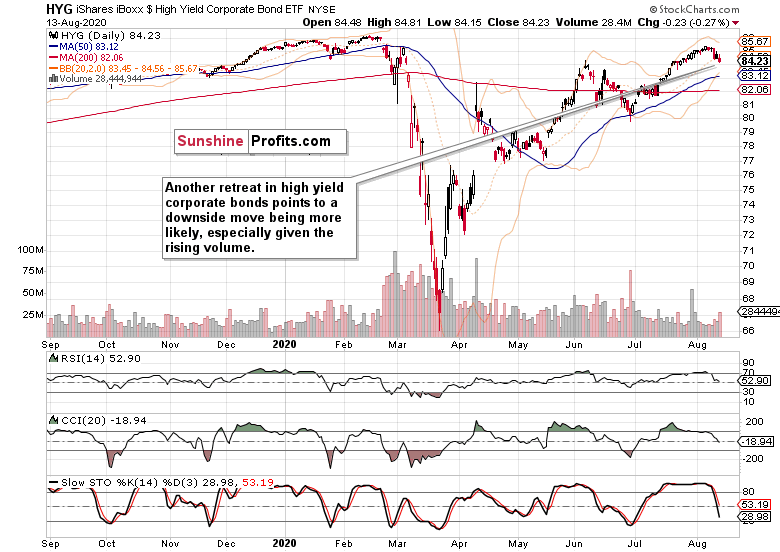

High yield corporate bonds (HYG ETF) recovery fizzled out yesterday, and prices closed at new lows. Does the high volume mean the bears are getting started, or that a meaningful accumulation is underway?

The next few days will be telling, especially when I look at investment grade corporate bonds (LQD ETF) (please see this and many more charts at my home site).They haven't found a bottom yet as the last five trading days in a row show.

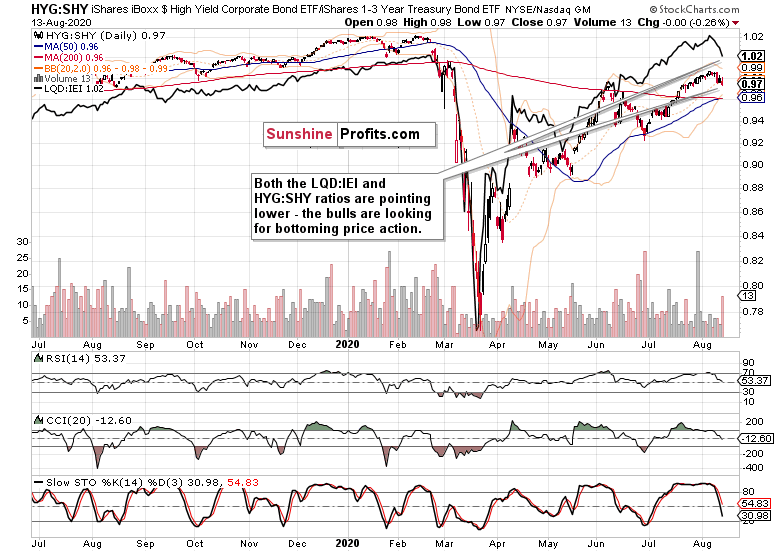

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – are currently pointing down.

Will the investment grade bonds find the way higher first, just as they did in May or June – and will that be enough to promptly turn around their junk counterparts?

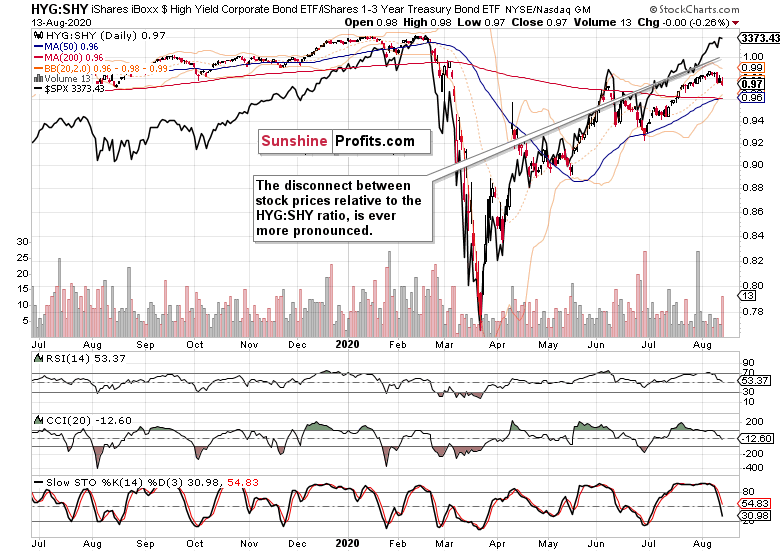

The overextension of the S&P 500 (black line) relative to the HYG:SHY ratio is even more striking now. But stocks still continue to defy gravity. Will a resolution with a stock move lower or ratio's move higher follow? I am leaning towards the latter, in its time that might be closer at hand than the bears think.

Smallcaps, Emerging Markets and Other Clues

The Russell 2000 (IWM ETF) is holding up quite well relative to the 500-strong index. No sign of profit distribution here.

Neither the emerging markets (EEM ETF) are signaling danger – after outperforming since the start of July, they're taking a breather currently.

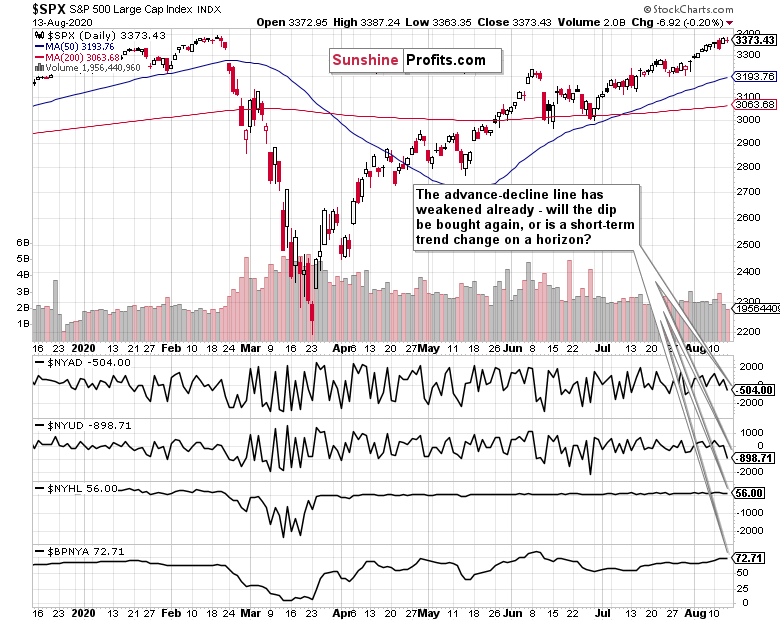

The daily market breadth chart caption says it all. The deterioration is visible, and the question remains when would the bulls step in. Remember, the bullish percent index remains solidly in bullish territory (making corrections likely to be bought), and stock price action hasn't shown us that it's willing to roll over in earnest though.

The metal with PhD. in economics ($COPPER) has given up this week's gains, yet yesterday's lower knot indicates that the bulls have stepped back to a degree. That increases the probability that once trading leaves this flag, they will do so with a break higher.

Summary

Summing up, yesterday's S&P 500 session leaves stocks extended relative to the credit markets, and neither long-dated Treasuries are signaling an immediate turnaround just yet. Much depends upon today's trading in the debt instruments, and I think that the worst of the decline there is past, and that higher prices would follow and help put a floor behind the relatively very extended S&P 500 vs. HYG:SHY.

The same goes for the S&P 500 market breadth indicators, where I also see stabilization followed by an upswing in the advance-decline line as the more probable scenario. And that means that the bulls better approach any trading opportunities with tight trade parameters (just as I did throughout many recent sessions), because the air near the Feb all-time highs is quite thin.

Related: Gold Is Starting Its Move