Written by: Sandra Rhouma

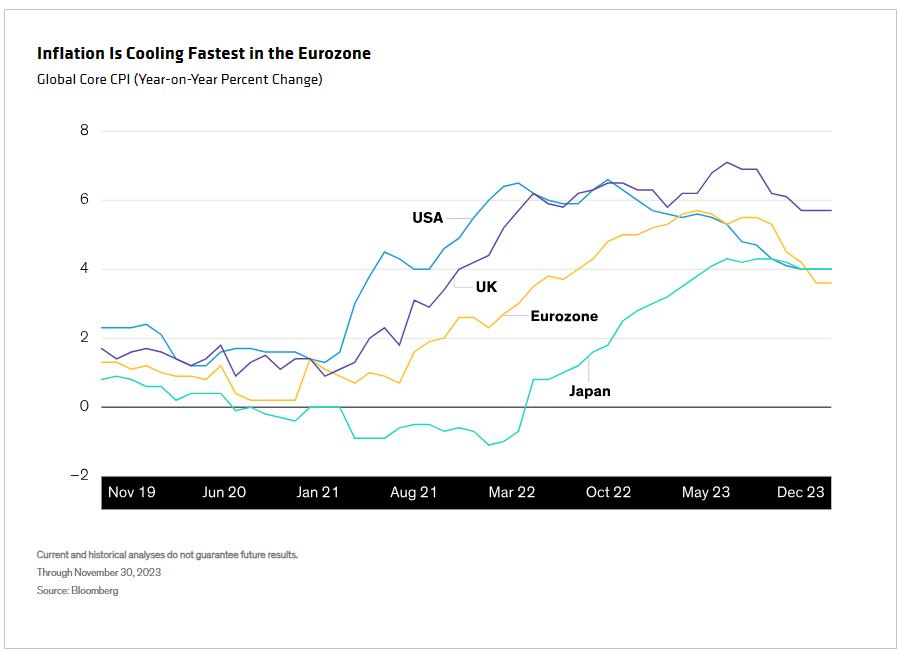

Across continental Europe and the UK, inflation rates are trending down, with euro-area inflation cooling the fastest among developed-market countries (Display).

While falling inflation rates have prompted renewed optimism from investors globally, we doubt that key data and central bank policies support imminent policy easing in the UK and Europe. We also believe that markets are now pricing in faster rate cuts than central banks are ready to deliver.

Central Bank Meetings: Bias Remains Hawkish

As expected, the Bank of England (BoE) left the bank rate unchanged at 5.25% at its December meeting. The Monetary Policy Committee again voted six to three in favor of a pause, with the three dissenters voting for a hike. The post-meeting statement was again hawkish: the BoE expects to keep policy restrictive for a long period, retaining the option to hike rates again. And despite recent positive data, key indicators of persistently upward-trending prices—such as services and wage inflation—remain worrisome.

The European Central Bank (ECB) also kept rates on hold, as expected, and its press-release language was also unchanged: core inflation had eased, but the ECB stayed focused on price pressures given strong growth in unit labor costs. And the Governing Council reasserted its determination to keep policy rates at sufficiently restrictive levels for as long as necessary.

It also brought forward the run-off of one of the ECB’s main bond-buying programs, the Pandemic Emergency Purchase Programme, which will entirely discontinue reinvestment at the end of 2024. We see this as a further hawkish move; reducing the size of the ECB’s balance sheet will tighten financial conditions. There was one dovish signal: the ECB’s statement omitted a previous reference to inflation staying high for too long.

At the subsequent press conference, ECB president Christine Lagarde insisted that rate cuts hadn’t been discussed and that such a discussion was premature—a strong move to push back against declines in market interest rates. However, as 2024 gets under way, we believe that weaker euro-area inflation and other data will pave the way to rate-cut discussions in the first quarter.

Rate Cuts Are Coming to Europe—but Not As Fast as Markets Are Pricing In

The BoE will likely be the last to cut rates, but will move aggressively when it does. For now, UK consumer price inflation remains well above target, and strong wage growth points to ongoing risks of knock-on inflation effects. During 2024, however, we think inflationary pressures should ease faster than the BoE anticipates.

Even so, the Bank’s Monetary Policy Committee will likely need to be confident that consumer price inflation will return sustainably to the 2% target in the medium term before cutting. Hence, we expect a late start, with the first rate cut in September 2024 and further cuts at each subsequent meeting.

Market pricing, by contrast, implies an early but relatively smooth cutting cycle, with 115 basis points of cuts for 2024 and the first cut as early as May. We think this suggests implausibly large first-quarter 2024 declines in core inflation and wage growth. In the more likely context of weak but resilient growth in 2024, we think the BoE will remain particularly cautious before acting.

The ECB’s December Eurosystem growth and inflation forecast remained conservative, suggesting more downward revisions ahead. In particular, the forecast projects core inflation to remain at 2.1% in 2026, owing to strong growth in unit labor costs and domestic price pressures. And while it lowered economic growth numbers for 2023 and 2024, it expects a strong rebound in 2025.

On that basis, we believe the ECB will continue to favor a patient approach, even though signs of falling inflation will soon become increasingly evident. We expect the ECB’s first rate cut in June 2024, with 100 basis points of reductions for the year. The market is more aggressive, pricing in the first rate cut as soon as March and total cuts of 150 basis points in 2024.