Here’s a strategy for tax-smart income via 1035 exchange for beneficiaries of nonqualified annuities

A tax-smart plan can start with a 1035 exchange

It used to be, your options were limited if you inherited a nonqualified annuity — and the tax headaches that might accompany it. That all changed when the IRS agreed that the beneficiary of an inherited annuity is the new owner of the original contract, and meets the requirements to make a 1035 exchange. As the beneficiary, this gives you the freedom to select a new annuity tailored to your financial goals.

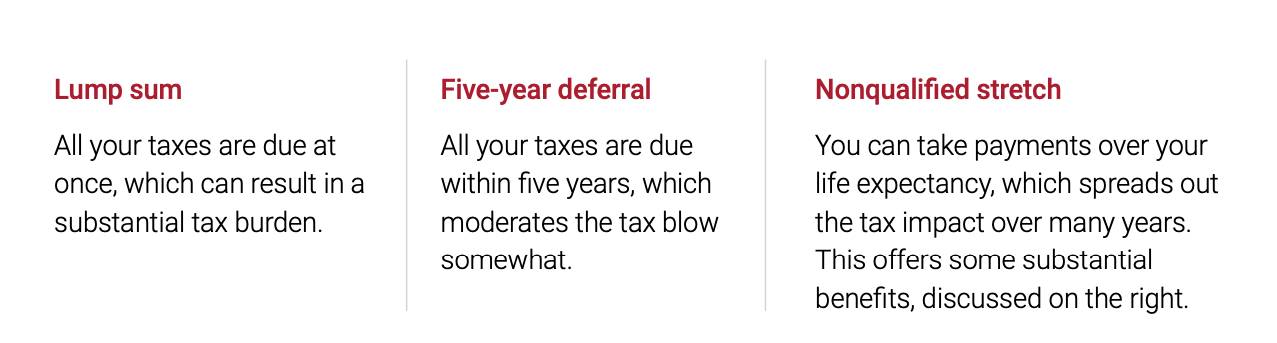

When you access the money,1 you have three death claim options:

Variable annuities are long-term investment products that offer a lifetime income stream, access to leading investment managers, options for guaranteed growth and income (available for an additional charge), and death benefit protection. To decide if a variable annuity is right for you, consider that its value will fluctuate; it’s subject to investment risk and possible loss of principal; and there are costs associated. All guarantees, including those for optional features, are subject to the claims-paying ability of the issuer.

Lincoln’s tax-savvy solution for a nonqualified stretch

Here are three powerful ways you can soften the estate tax burden and create tax- efficient lifetime income with a Lincoln variable annuity and i4LIFE® Advantage, an income benefit available for an additional charge.2

1. Lifetime income

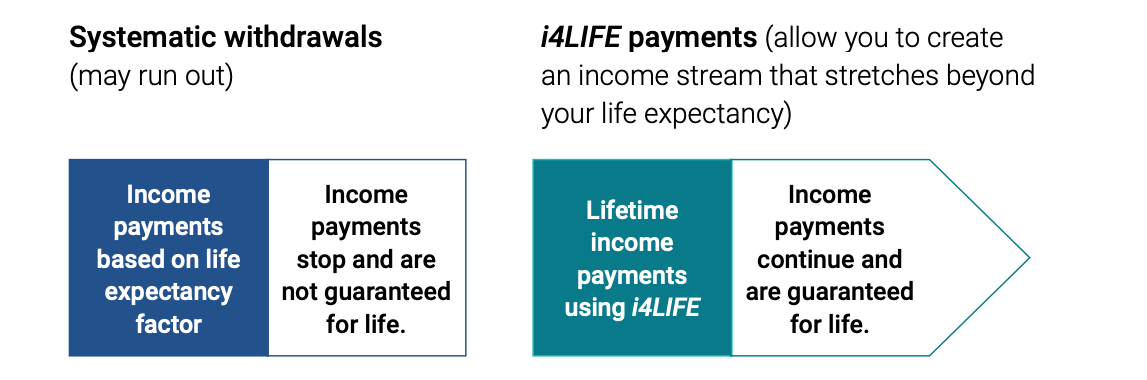

If you choose a nonqualified stretch, there are two ways you can take the payments. If you need lifetime income or want to pass on the assets to your loved ones, you should carefully consider these options.

Note: If you need a minimum amount of guaranteed income, which will never fall and has growth potential, you can elect the Guaranteed Income Benefit (GIB) if you are age 70 or younger.

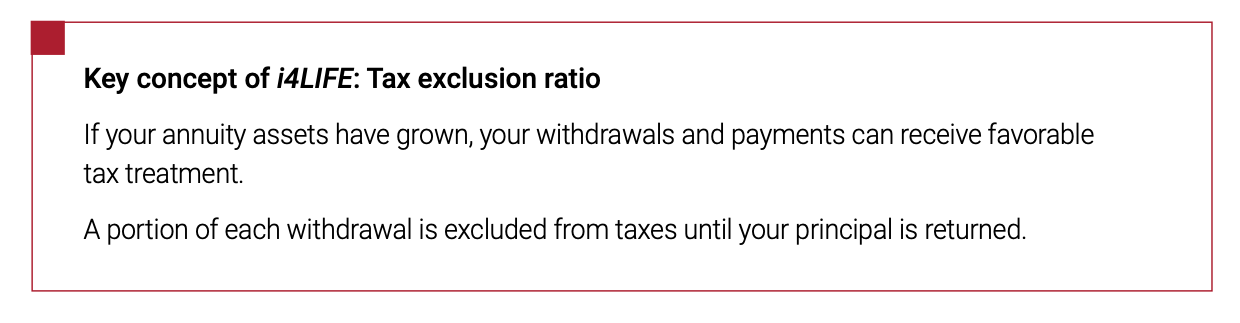

2. Tax-efficient income

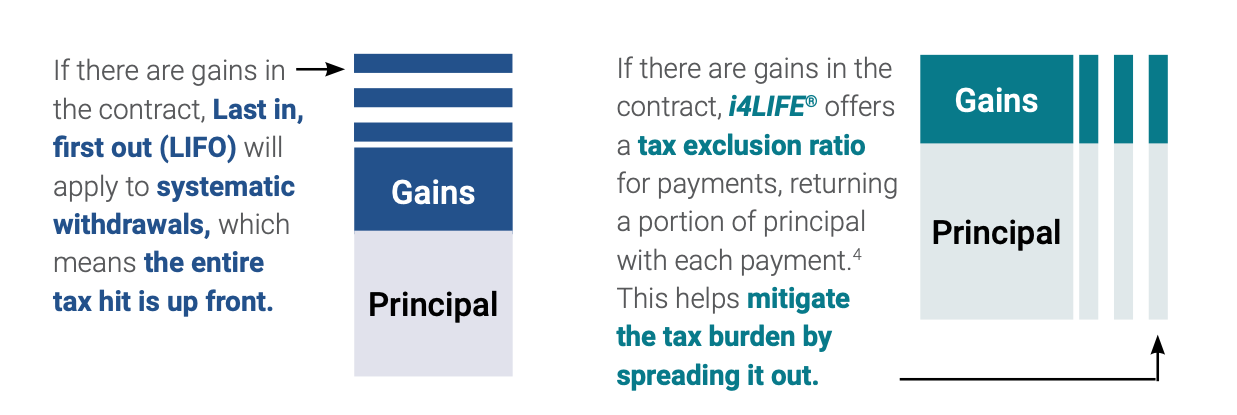

The way you take income from an inherited nonqualified annuity can affect the way you’re taxed, especially if the assets had the chance to grow. This example shows how an income payment might be taxed, depending on the option you choose.

3. Flexibility for additional withdrawals — and more tax benefits!

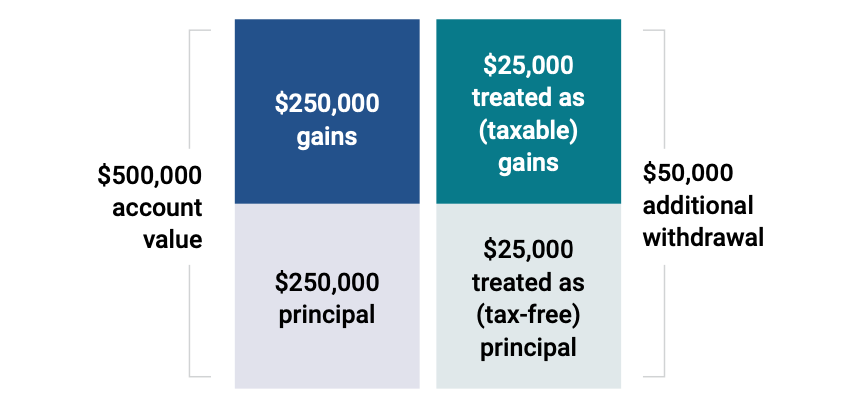

With most annuities, when you turn on a lifetime income stream, you lose control of your assets. With i4LIFE, you stay in control of your death benefit and account value — giving you flexibility to control the amount of income you want. So if you want to take an additional withdrawal, you’re able to during the Access Period.3

In the example below, if you took a withdrawal from an annuity that grew to be double in size, half of your withdrawal would be tax-free, because it benefits from the tax exclusion ratio once you’ve started i4LIFE payments.4

To learn more about i4LIFE® Advantage, visit https://www.lincolnfinancial.com/public/individuals/products/annuities/variableannuities/optionalfeatures/i4lifeadvantage.

Related: How to Prepare for the Huge Wave of Peak 65 Retirees Coming in ‘24

1 PLR 201330016 allows you to do a 1035 exchange on your inherited annuity. IRS requirements of Code Section 72(s) must be followed when accessing money from the new account. Please consult an independent tax professional for more information.

2 This patented income distribution method meets the requirements of 72(s). i4LIFE® payments must begin within 12 months after the original owner has passed away.

3 Additional withdrawals are subject to ordinary income tax to the extent of the gain. Withdrawals will reduce the account value, death benefit, GIB amount (if elected) and income payments proportionally.

4 For illustrative purposes only. The taxable and tax-free amounts will be based on contract-specific values at the time of withdrawal.

Lincoln Financial Group® affiliates, their distributors, and their respective employees, representatives and/or insurance agents do not provide tax, accounting or legal advice. Please consult an independent professional as to any tax, accounting or legal statements made herein.

Variable annuities are long-term investment products designed for retirement purposes and are subject to market fluctuation, investment risk, and possible loss of principal. Variable annuities contain both investment and insurance components and have fees and charges, including mortality and expense, administrative, and advisory fees. Optional features are available for an additional charge. The annuity’s value fluctuates with the market value of the underlying investment options, and all assets accumulate tax-deferred. Withdrawals of earnings are taxable as ordinary income and, if taken prior to age 59½, may be subject to an additional 10% federal tax. Withdrawals will reduce the death benefit and cash surrender value.

Investors are advised to consider the investment objectives, risks, and charges and expenses of the variable annuity and its underlying investment options carefully before investing. The applicable variable annuity prospectuses contain this and other important information about the variable annuity and its underlying investment options. Please call 888 868 2583 for a free prospectus. Read it carefully before investing or sending money. Products and features are subject to state availability.

Lincoln variable annuities are issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, and distributed by Lincoln Financial Distributors, Inc., a broker-dealer. The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so.

Contracts sold in New York are issued by Lincoln Life & Annuity Company of New York, Syracuse, NY, and distributed by Lincoln Financial Distributors, Inc., a broker-dealer.

All contract and rider guarantees, including those for optional benefits, fixed subaccount crediting rates, or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer or insurance agency from which this annuity is purchased, or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

There is no additional tax-deferral benefit for an annuity contract purchased in an IRA or other tax-qualified plan.