From a financial standpoint, being prepared often means saving for future needs.

Among those citizens who have the financial wherewithal to fund accounts that place assets in safe and prosperous places for when those assets are needed, being prepared is relatively easy.

Amazingly, those affluent people often fail to make the decisions they need to be prepared for some of life’s most difficult moments, moments that could be made easier by proper financial decisions in the past if only they had chosen to make those decisions.

One of the most salient points from Spectrem’s new study on end-of-life finances is the indication that affluent investors believe they are well-prepared from a documentation and care standpoint for what happens as they approach their final days. And, in many cases, that report Down to the Last Detail indicates that those same affluent individuals are lying to themselves, or mistaken, or both.

For advisors, the study provides a step-by-step procedure to determine whether their clients are properly prepared for the future. Considering the significant percentage of investors who seem to have missed a step or two along the way, advisors can use this information to provide guidance and understanding to the importance of the steps that need to be made.

The study reflects on how a person’s personal financial preparations are altered and updated when they participate in an examination of the readiness of a family member who has either passed away or is approaching such an event. Many of the investors involved in the study reported that they updated their own preparations upon seeing how their family member’s assets were impacted and the decisions their family member failed to make in advance of the time of need.

The first step to the findings in the study was the response to the prompt “I am at least somewhat prepared for financial aspects of passing away and the distribution of my assets”, to which 86 percent responded in the affirmative.

The prompt is vague enough to leave open the many possibilities in which the respondent is not properly prepared, and the follow-up questioned proved the point:

- Less than half of respondents have made a list of their investment and bank accounts. There is nothing complicated or costly about this function. It’s time-consuming, perhaps, depending on the complexity of the portfolio involved, but not providing this information is just a brushoff to beneficiaries and descendants.

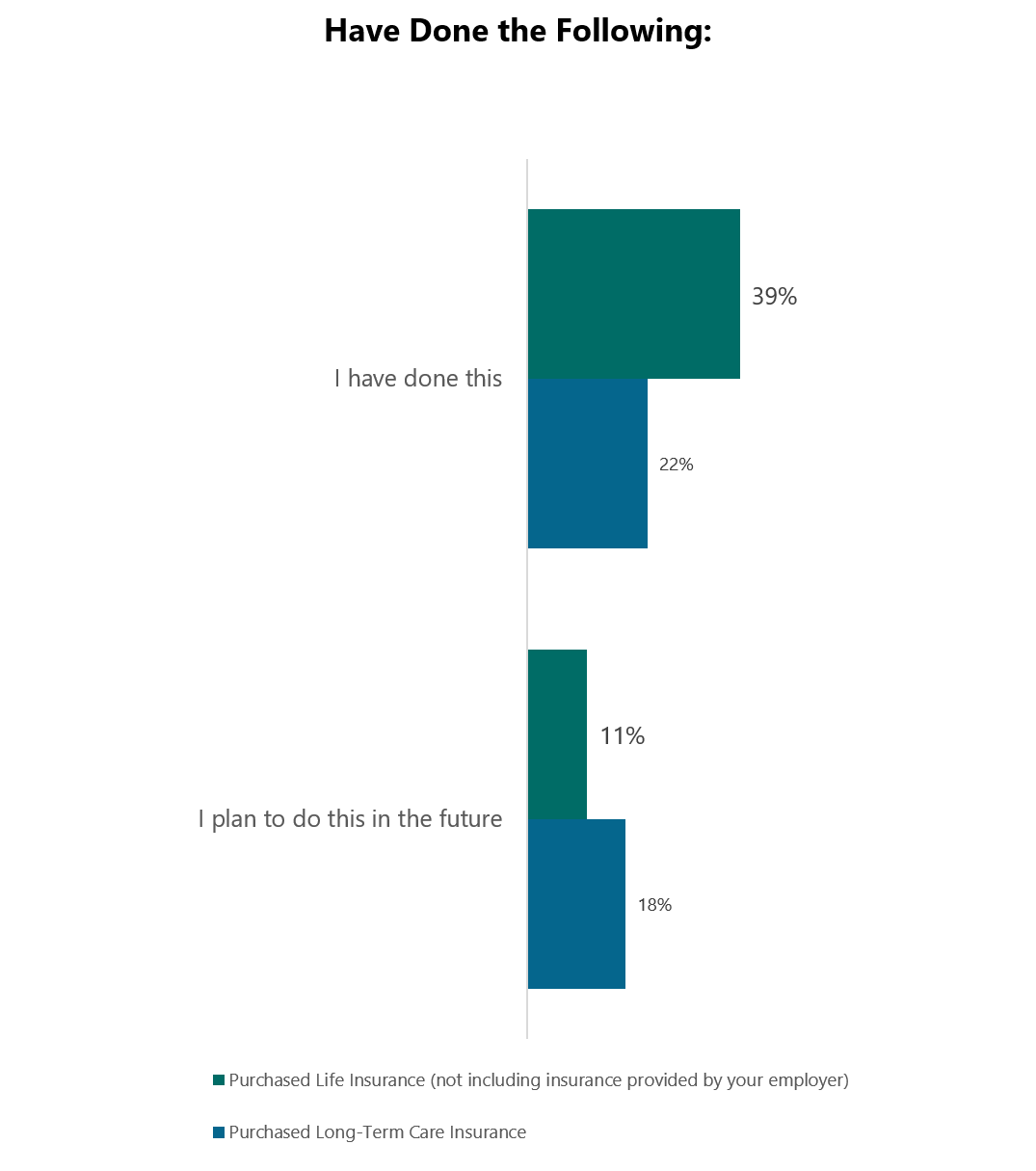

- Likewise, less than half of investors have purchased life insurance beyond what they received from their employment, and less than half have converted term insurance to whole life insurance. Less than half own long-term care insurance, although many investors made such a purchase after witnessing the financial burden of care for an elder relative.

- Perhaps more importantly, only two-thirds of investors have created a will and granted beneficiaries on all of their banking and investment accounts. Those two failures can do nothing but prolong and exacerbate wealth transfer issues down the line, sending matters to probable unnecessarily.

Convincing a client to complete end-of-life documentation and financial planning does not create revenue directly for an advisor. But the study shows that investors who work with a family member’s advisor on such matters often start a business relationship with that advisor. Similarly, investors recognize when their own advisor goes above and beyond the tasks which provide revenue and report increased satisfaction when an advisor provides guidance that is not necessarily profitable.

Related: A Comparison of Stock Market Crashes