Americans are living through of period of time when it is hard to trust others. Many of the major sources relied upon for information including government, media and even health providers have provided us with questionable information, often changing their recommendations dependent upon new information —- or arguably due to political persuasion. During this uncertain time it’s more important than ever that individuals have someone that they can rely upon and trust, especially with their finances.

The pandemic has caused extreme volatility in the financial markets from unprecedented drops in the spring to the Dow Jones Industrial Average breaking 30,000 in November. During that time, many investors have reached out to their financial advisors or may have benefitted from information and materials provided to them from their financial advisor. These interactions, regardless of the party that initiated the communication, are incredibly important in developing trust in a relationship.

Spectrem Group’s research throughout the years has consistently shown that the number one reason investors choose a specific financial advisor is because it is someone they perceive is “honest and trustworthy”. In our recent study, The Advisor Relationship: How to Develop Loyalty, 29% of investors indicate they chose their advisor because the individual was perceived as honest and trustworthy compared to only 18% who chose their advisor based upon the advisor’s investment track record.

But once the advisor is chosen, how do advisors continue to develop trust?

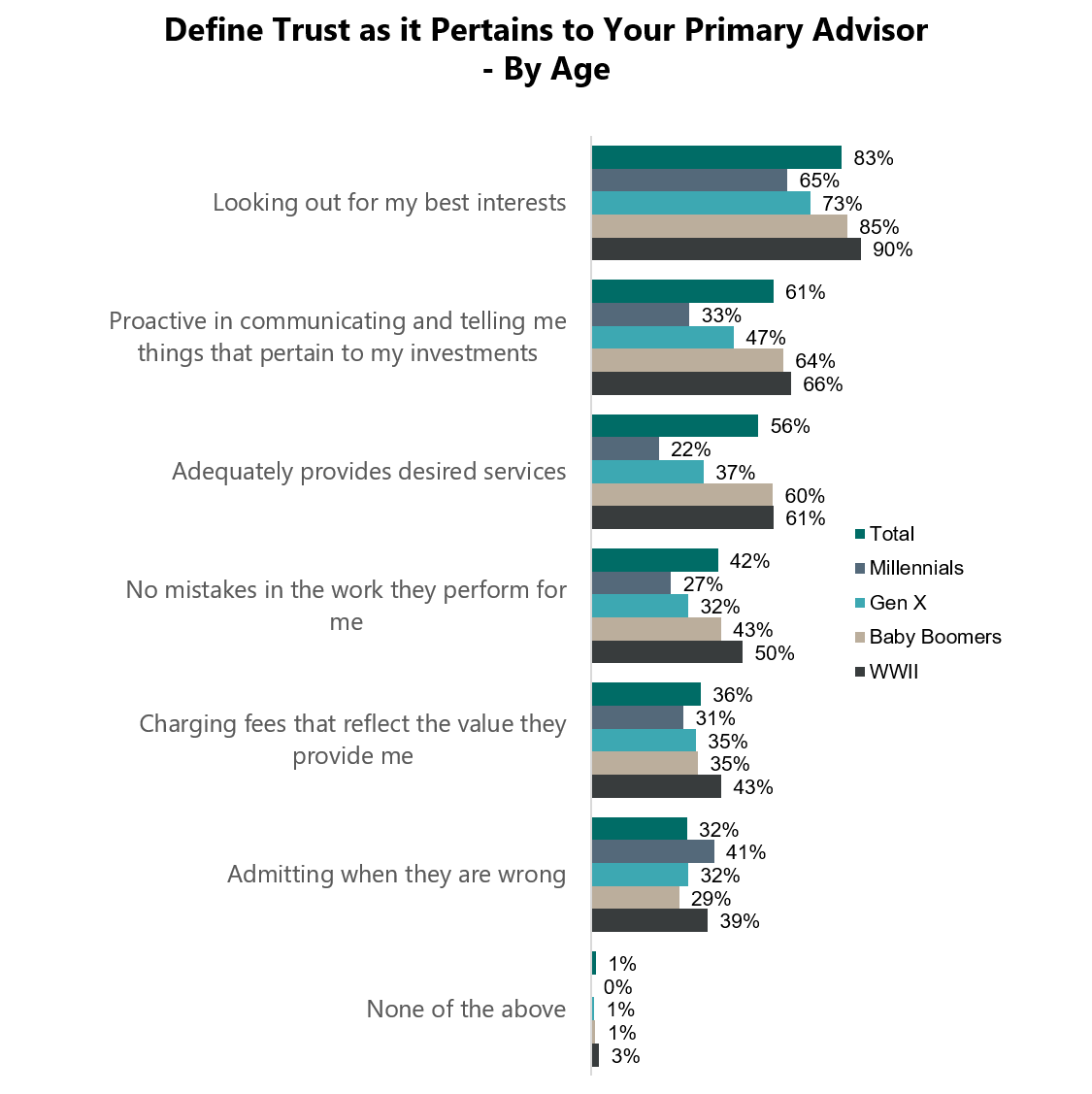

Investors (83%) indicate that “looking out for my best interests” is the primary way an advisor can develop trust. This is followed by be proactive in communicating (61%) and adequately providing desired services (56%). Forty-two percent of investors think it is important that there are no mistakes in the work performed by the advisor (and his/her staff) and 36% identify charging fees that reflect the value provided is one way to develop trust. Almost a third (32%) also want the financial advisor to admit when they are wrong.

As you can see above, age impacts the importance of many of these trust-related factors with WWII and Baby Boomers often having higher expectations than younger investors. Keep in mind that older investors often have longer relationships with their financial advisor than younger investors. It’s interesting to note, however, the importance Millennials place on the advisor’s ability to admit when they are wrong.

As this period of uncertainty continues, financial advisors need to continue to develop trust with their clients. Make sure that your clients know that you are looking out for them.... point out potential opportunities that meet their interests but also warn them against making risky or wrong decisions. Continue to be proactive regarding communications as the pandemic hopefully begins to unwind and as a potentially new administration makes economic policy changes that may impact their investments and their tax situation. And, as always, remember to provide exceptional service.

Related: What Makes a Millionaire More Likely To Create a Trust?