Don’t you hate it when someone tells you to do something you don’t want to do even though you know it is likely to be beneficial to you and to others?

Such is the case for financial advisors who are told they should make cold calls to attempt to attract new clients.

No one likes making cold calls.

There was a time, long ago, when cold calling enjoyed higher regard among advisors because it was one of the few ways for advisors to make contact or to be discovered by potential clients. But, today, social media and the internet make it easier for investors to search for and find advisors who have the qualifications they are looking for, reducing cold calling to an exercise often disregarded among some advisors.

But investors report that they might still respond to a cold call, even if that cold call involves no actual “calling”.

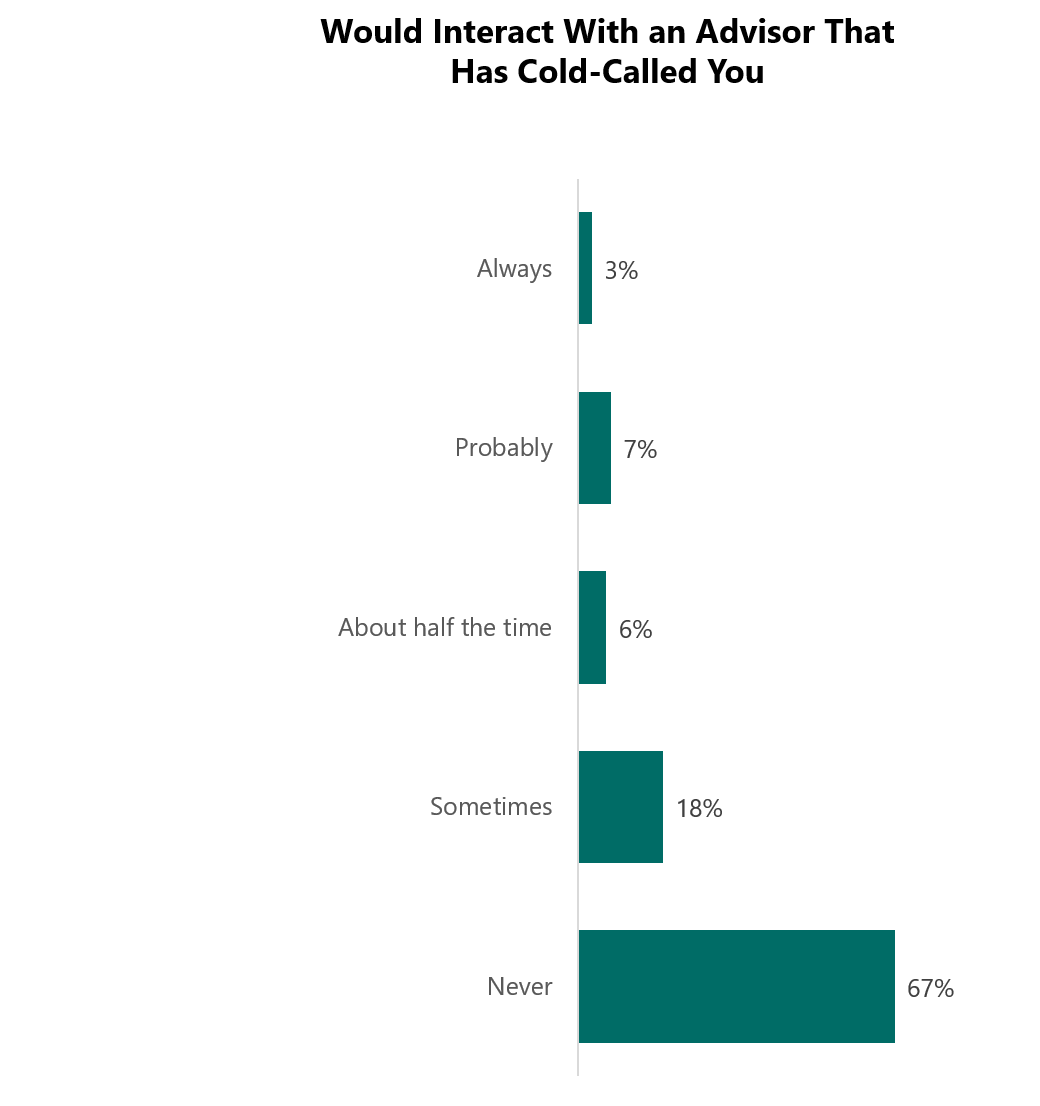

According to Spectrem’s study Preferred Sales Approach: Capturing the Wealthy Investor, 16 percent of investors with a net worth between $100,000 and $25 million (not including the value of their primary residence) are willing, to some degree, to respond positively to an unrequested outreach from an advisor. That includes 6 percent who said they would respond “about half the time”, 7 percent who said they would “probably” interact with an advisor placing a cold call, and 3 percent who “always’’ interact in those situations.

Obviously, that point indicates that cold calling still deals with a great deal of rejection. However, it remains a worthy exercise in self-promotion, and it provides an opportunity to assess one’s qualifications and attributes for those occasions when a chance meeting turns into a sales pitch moment.

And the good news is that those percentages mentioned above are much higher among younger investors who perhaps have not found a primary financial advisor yet or are still in the market for improved or different performance from an advisor. Among Millennials, 38 percent proffered some degree of willingness to interact with a cold-calling advisor, and 23 percent of Gen Xers expressed the same opinion.

Cold calling also need not involve the unpleasant experience of actually placing a call. While 39 percent of investors who said they would prefer to interact with a cold-calling advisor in a phone call, 24 percent said they would prefer to receive an unrequested email appeal, and 18 percent said they would be most likely to respond to a hard copy mailing. The phone calls and snail mail invitations were once the basis of an advisor’s approach to new clients, and they still have some appeal to investors who are searching for an advisor and perhaps do not know how to conduct an internet search they can trust.

So, like it or not, cold calling is still a worthy exercise. Sort of like sit-ups.

Related: Women Don't Want Female Advisors