Written by: George Walper, Jr.

Last week, Morgan Stanley announced that it was purchasing E-Trade for approximately $13 billion in an all-stock deal. The analysts all jumped on the deal, praising how it increases scale and will help margins due to the diminishing ability to charge commissions. Additionally, technology is becoming a critical driver for investors and larger organizations will have more funds to invest in continually updating capabilities. All of these reasons explain the importance of the transaction, but it may be more important that a merger of this type allows both organizations to attract investors across a spectrum of needs and provides new financial solutions as investors mature.

While Spectrem knows nothing about the financial implications between the two organizations, the melding of two organizations that seem very different provides great potential. Based on our research with investors, Spectrem believes deals of this type can potentially be very successful based upon the following:

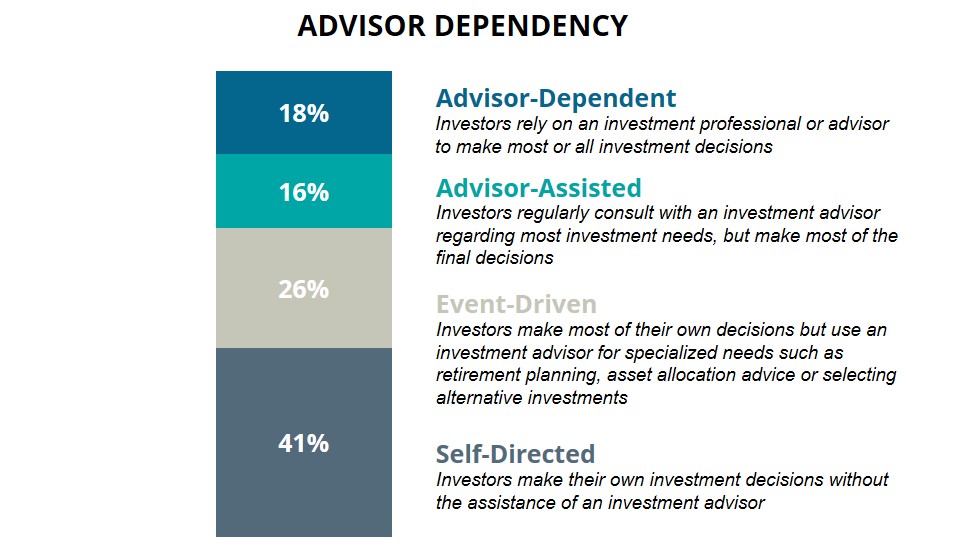

1. Brokerage firms need to provide robust solutions for investors that are self-directed as well as investors that want to totally rely upon an advisor - while including all of the investors that are between those two extremes. Spectrem has tracked the reliance of investors upon financial advisors for more than a decade; the use of financial advisors is asked of investors on a monthly basis. Generally, our research indicates that roughly two-thirds of investors use a financial advisor to some extent. Not surprisingly, as wealth and age increase, the likelihood of using a financial advisor also increases. Additionally, advisor reliance is based upon the perception of the investor regarding their advisor usage - therefore many individuals who identify as “Self-Directed” may still use a financial advisor to some extent. As you can see below, 41 percent of investors currently define themselves as “Self-Directed”. The remaining 59 percent that acknowledge relying upon a financial advisor define themselves in three different ways: Advisor-Dependent - when the advisor makes all or most of the decisions (18 percent), Advisor-Assisted - when the investor regularly consults with the financial advisor but makes the final decision themselves (16 percent), and Event-Driven - when the investor only reaches out to an advisor upon key life events such as divorce, retirement, etc. (26 percent). The data below is based upon research from our recent report entitled Portfolio Trends, Expenditures and Perceptions of Providers.

The information above includes investors with $100,000 to $25 million of net worth. Within Spectrem’s monthly research, data is segmented in numerous ways. As mentioned previously, younger investors are more likely to describe themselves as Self-Directed, as are households with less wealth. The Morgan Stanley- E-trade deal expands the opportunity to attact clients because the combined organization will appeal to the Self-Directed and lower wealth levels (arguably more inclined to use E-trade) as well as to the wealthier and perhaps older clients (perhaps more representative of Morgan Stanley clients).

2. The reputation of the firms is complementary. In the same research identified above, Portfolio Trends, Expenditures and Perceptions of Providers, Morgan Stanley is identified as one of the top 7 firms for “Expertise in Managing Money” by 74 percent of investors. It is also recognized for “Most Innovative Products and Services” (56 percent), as well as “Most Talented Advisors and Staff” (69 percent). E-Trade has not recently been included in our perceptions research, however, in the past it scored highly in the “Most Innovative Products and Services” category but did not score well in the “Most Talented Advisors and Staff” category. Participants in Spectrem’s qualitative focus group research have generally described Morgan Stanley as “high-end” or “stuffy” while describing E-Trade as a “technology” firm. Combining the in-depth services of a respected provider with the perceived capabilities of a technology-based firm may result in a “win-win” for both firms as investors increasingly demand both advice and technology.

3. Interest levels in online-only financial advisors is increasing, especially with younger investors. The Morgan Stanley - E-Trade merger will allow the combined firm to appeal to investors who do not currently want an in-depth face-to-face relationship. In Spectrem’s recent report, Wealthy Investors and the Use of Digital Tools, 34 percent of Millennials indicated they have a financial advisor that they have never met in person. Allowing young investors to begin a relationship via a digital relationship provides opportunity to become the preferred provider when the investor’s financial picture becomes more complex.

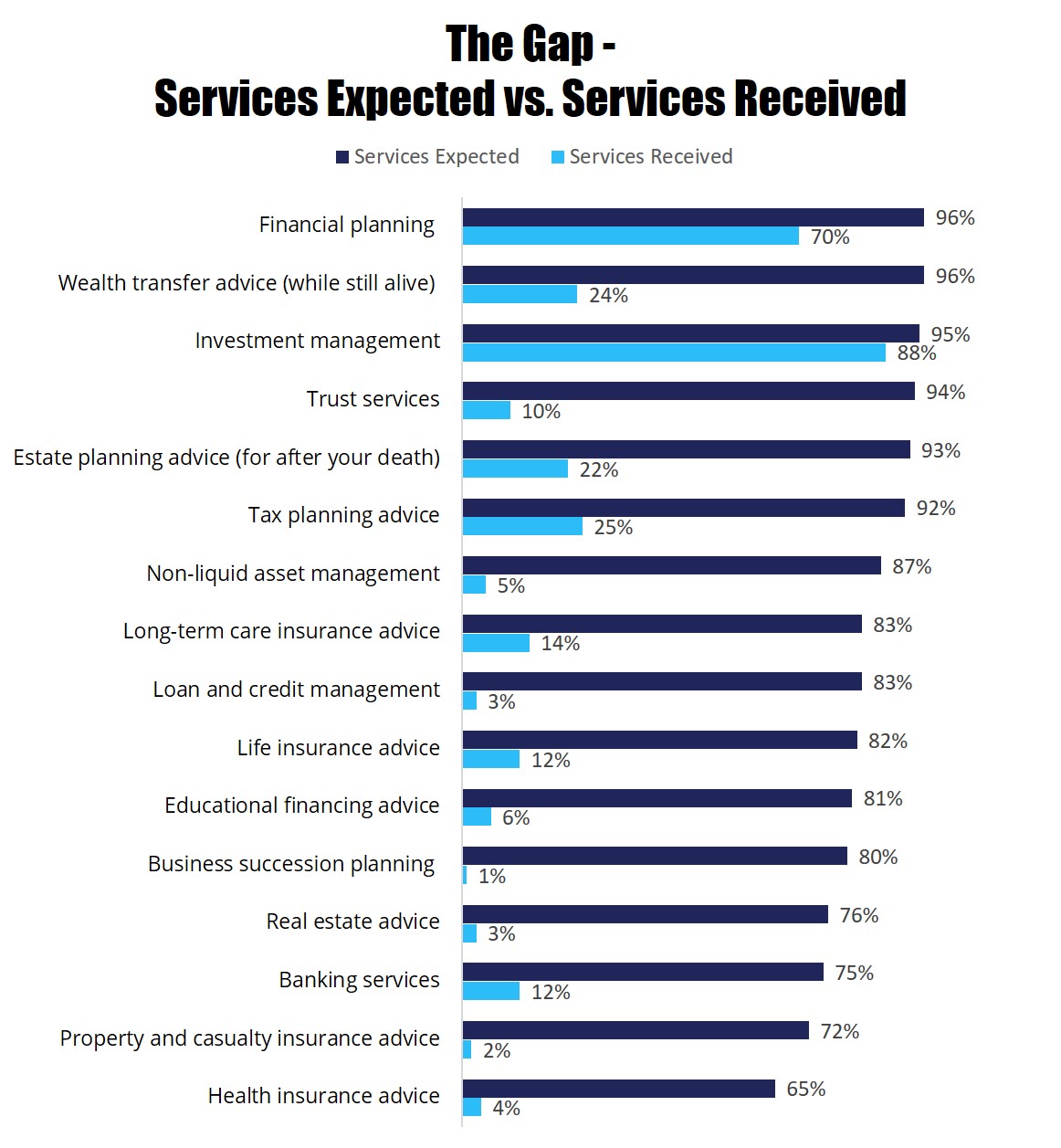

4. Financial advisory firms need to position themselves to provide holistic wealth management as the expectations of investors continue to change. While younger and less wealthy investors are somewhat less likely to demand an in-depth relationship with a financial advisor, increasingly those investors who do use a financial advisor have higher expectations. While investors who grew up before the age of technology (WWII) really only expected their advisor to recommend stock and then place the trade, younger investors are able to research stocks and place the trades themselves. Their belief is that the financial advisor’s role is to help them with the types of information and expertise they are not able to easily access online. When asked about their expectations of what is included in wealth management versus what is currently received by investors, Spectrem’s report, Defining Wealth Management, identifies significant gaps between wealth management services expected and those that are received.

The combination of Morgan Stanley and E-Trade arguably provides an infrastructure to bring the investor in at an early point of his or her investment journey and to ultimately guide them to a more in-depth holistic experience.

Will Morgan Stanley and E-Trade be able to effectively provide an all-encompassing, investment servicing and advice experience? It remains to be seen. Many before them have failed. To an outsider, it seems that the culture of the firms may be very different. Additionally, it’s always hard to combine services across two large organizations. But the ability to appeal to investors regardless of the amount of investment advice they desire, combined with the appeal of both technology and high-end expertise, is a compelling proposition in an industry that is experiencing significant change. It’s hard to be everything to everybody, so it will be interesting to see if Morgan Stanley and E-Trade can successfully overcome their future challenges and meet investors’ needs.

Related: The Most Impactful Referral for a Financial Advisor is From...