As Millennials become an increasingly important segment of the workforce and the client base of financial institutions, it’s imperative to understand their existing portfolios as well as their future potential investment intentions. Spectrem conducted research with high income Millennials, defined as Millennials with individual incomes exceeding $100,000 annually or $150,000 household income, and found some interesting insights.

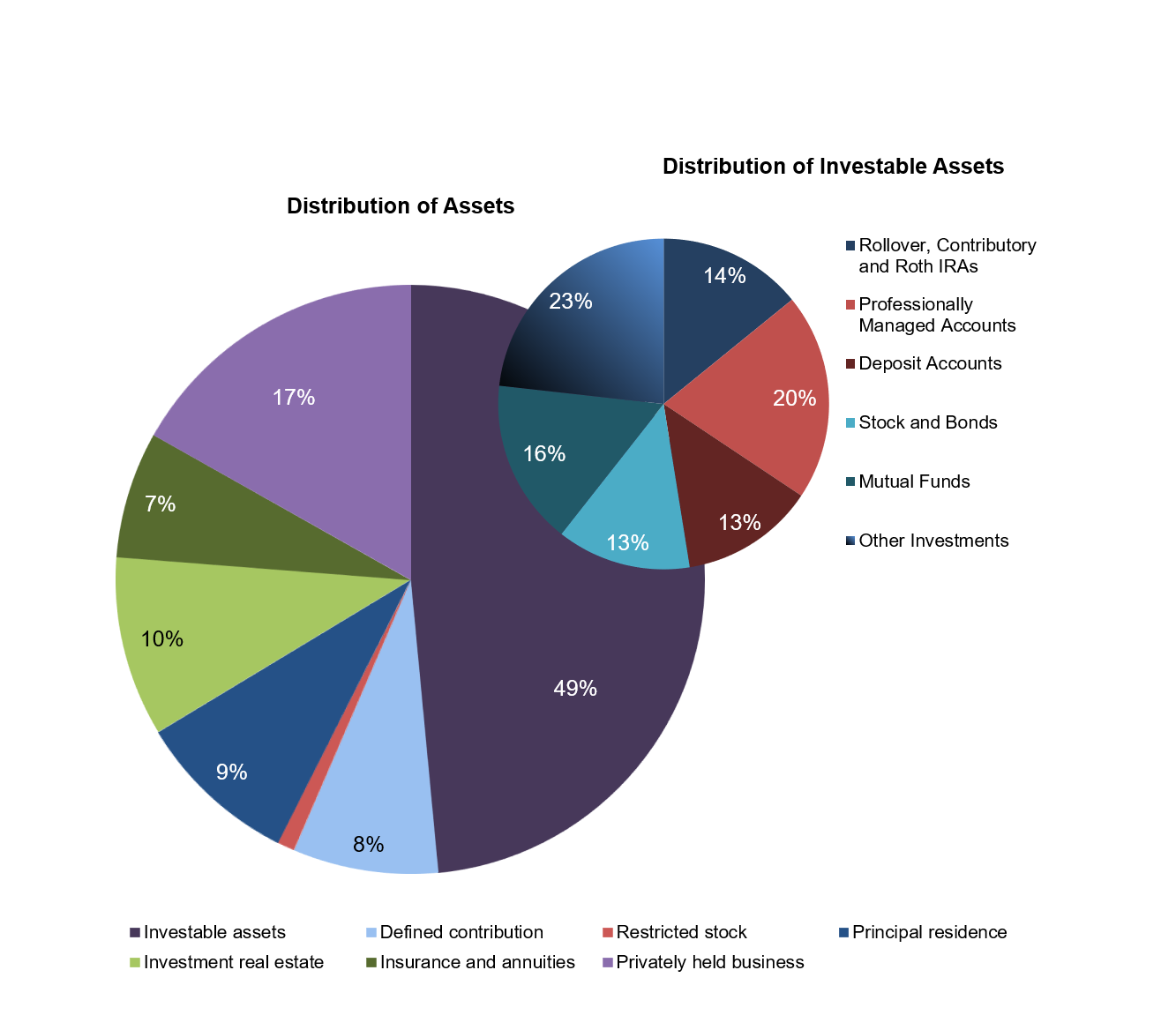

Forty-nine percent of the average high income Millennials’ portfolio is considered investable assets. Seventeen percent is represented by privately held businesses and 10% is investment real estate. Nine percent is represented by the value of their principal residence.

Among the investable assets identified above, 13% is in stocks and bonds and the same percentage is in deposit accounts. Sixteen percent own mutual funds. Twenty percent of high income Millennials have managed accounts and 20% is “Other” investments, which is somewhat unclear.

A large percentage (88%) of high income Millennials contribute to an employer-sponsored defined contribution plan and the average reported balance is $193,000. Half of high income Millennials report owning individual equities with an average balance of $123,000 and 47% own mutual funds with an average balance of $96,000.

Only half (49%) of high income Millennials currently have a financial advisor, so they provide opportunity for financial advisors and providers. While 30% found their existing financial provider via a referral from a friend or family member, the remainder found their financial advisor via multiple methods - websites, provider that they used for banking, provider that held their 401(k) account, seminars, and even general advertisements.

Attracting the large number of high income Millennials that currently do not have an advisor is an important for financial providers and advisors. So, what are the most important issues for these individuals that will assist in attracting these important investors?

- Financial planning is important to 49% of investors. Younger Millennials (56%) are even more interested in financial planning advice than older Millennials, who still weigh in at 46%.

- Millennials like to see all of their accounts at one place. Twenty-nine percent of Millennials indicate that this is an important feature for them. While this often puts banks at an advantage to other types of providers, financial advisory firms have multiple tools available to provide these options.

- As Millennials become parents, college funding advice becomes important. While many of these individuals are still paying off student loans, as they become parents, their experience has taught them the importance of planning for the future. At least 18% want to discuss this issue with their financial advisor.

High income Millennials, many of whom are professionals, mid-level executives or in the information technology sector, represent the future for a significant number of financial advisory providers. Understanding their existing portfolios and attitudes will assist financial institution in growing and retaining their business.

Related: