While the booming economy shows that the majority of US consumers are ready to spend, younger generations may have different priorities, according to our latest Logica Future of Money Study

Americans Are No Stranger To Managing Debt

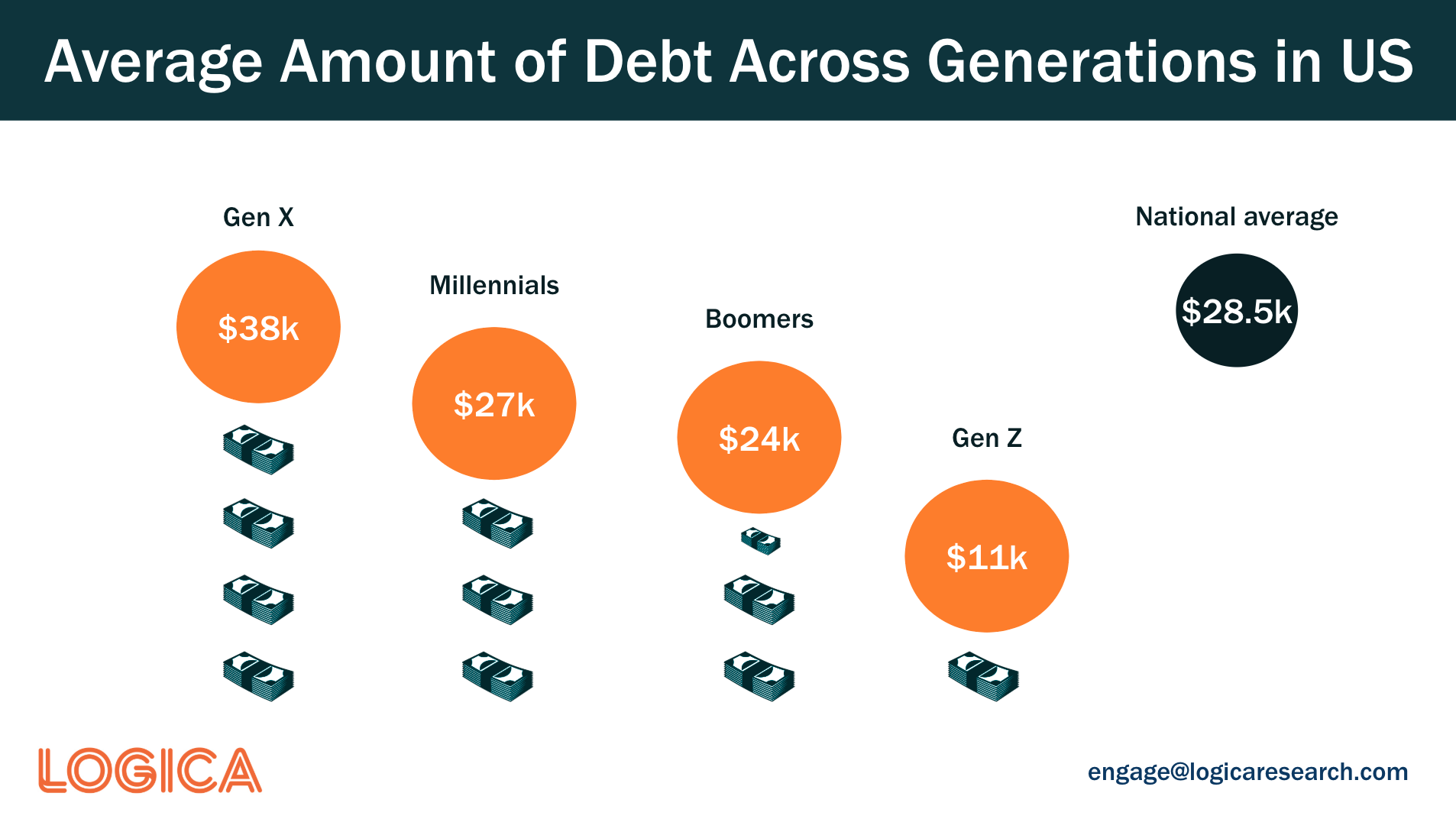

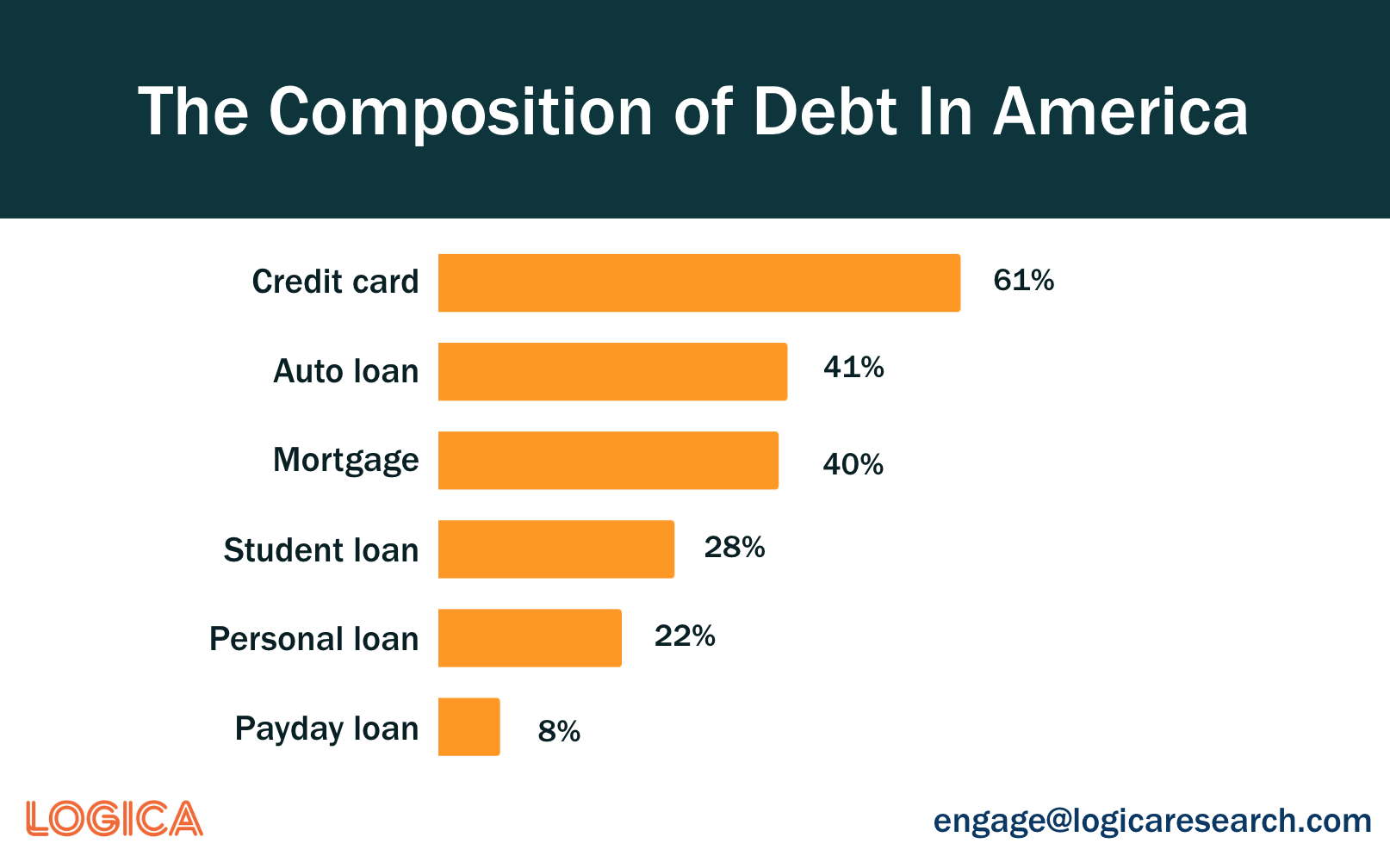

In our Future of Money Study, we found that 67% of Americans carry some type of debt outside of home mortgages. The most common type of debt for Americans is credit card debt (61%) and they are spending about $791 per month to pay off this debt. Excluding home mortgages, Americans in our latest Future of Money Study are carrying an average of $28,500 in debt, with the typical amount, or median, $9,000. We found that Gen X carries the most amount of average debt at $38,033, followed by Millennials with $26,518, Boomers with $23,753, and Gen Z with the least amount of average debt at $11,173.

Excluding home mortgages, Americans in our latest Future of Money Study are carrying an average of $28,500 in debt, with the typical amount, or median, $9,000. We found that Gen X carries the most amount of average debt at $38,033, followed by Millennials with $26,518, Boomers with $23,753, and Gen Z with the least amount of average debt at $11,173.