Thanks to the coronavirus and an upheaval in the oil production market, stock market values lost approximately 20 percent over the first two weeks of March, and investors expressed varying levels of concern over the economic impact of the crash.

But they didn’t immediately alter their portfolios as a result.

Spectrem’s report - The Corona Crash: What Advisors Should Be Saying To Investors Now – released March 13, details how investors responded to questions about the personal and national impact of the coronavirus crash which infected the American stock market. Investors were surveyed at the end of February and again March 4-9, to provide how much the impact of the stock market crash changed as the downturn continued.

Much of the stock market crash is related not to the coronavirus itself by to how governments and corporations are reacting to it. An Oval Office address by President Donald Trump on March 11, in which he announced a travel ban for anyone traveling from mainland Europe to the United States, caused the Dow Jones Industrial Average to drop the following day by as much as 2,000 points.

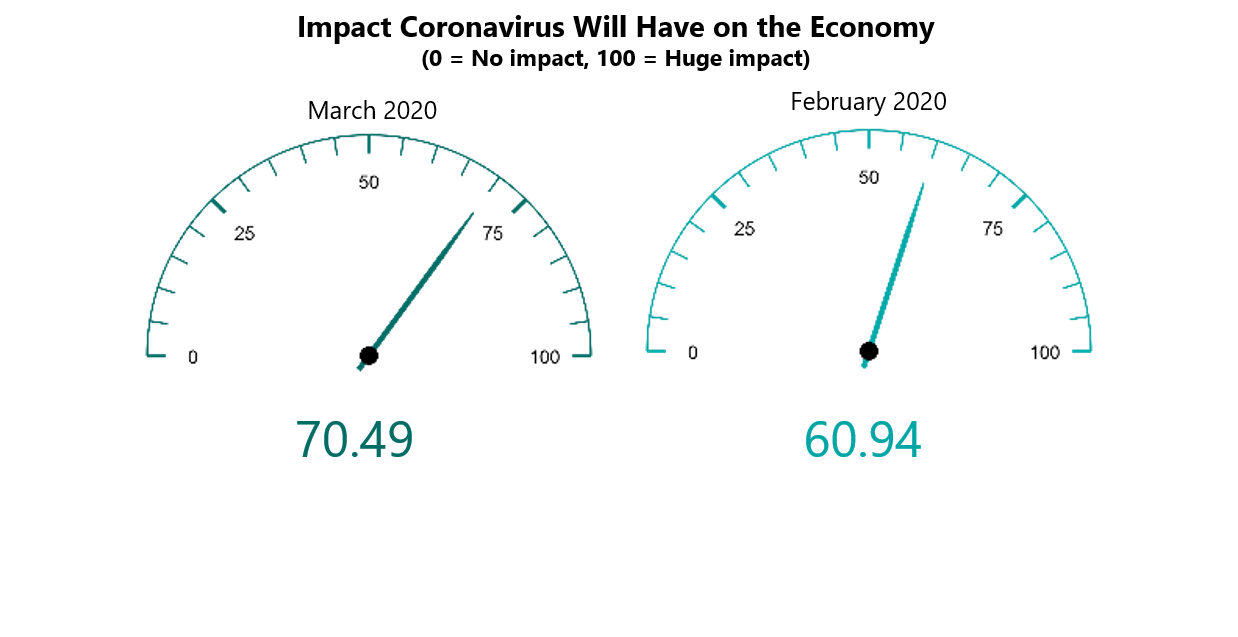

The most salient point of The Corona Crash is shown by the reaction of investors to the question “what is the level of your concern over the impact the coronavirus will have on the economy”. The first time the question was asked, after the initial major stock market downturn at the end of February, the investor reaction was 60.94 on a 100-point scale, and several days later, when the virus began to claim lives in the United States, that concern level rose to 70.49.

Investors were asked whether the crash caused significant loss of net worth in their portfolios, and the answers ranged from 9 percent among investors with a net worth under $500,000 to 18 percent among those with a net worth over $15 million.

However, a corresponding question showed that few investors have taken action related to their portfolios because of the crash. Asked what changes they have made to their portfolio, approximately 80 percent of investors with a net worth under $2 million made no changes, while the wealthier investors were more likely to purchase equities in response (more than 30 percent of those with a net worth above $5 million) than sell equities (approximately 17 percent of that same wealth segment).

The Corona Crash also includes investor expectations for advisor contact during the stock market slide, as well as their anticipated economic reaction to the potential outcomes of the election in November of 2020.

Related: The Most Impactful Referral for a Financial Advisor is From...