Written by: George Walper, Jr.

Recently one of the business cable news channels reported that the term “financial advisor” was trending on Google. The inference was, of course, that because of the market volatility that more people were actually looking for a financial advisor. While this may or may not be true, it’s important to seize the opportunity and ensure potential clients see that you have the expertise and ability to help them achieve a better outcome after this crisis than if they didn’t have an advisor. The challenge is that you need to do it all virtually.

In our recent report, Preferred Sales Approach: Capturing the Wealthy Investor, Spectrem found that approximately two-thirds of households with $100,000 to $25 million in net worth (not including primary residence) have a financial advisor of some type. The percentage increases with both age and wealth. However, of the roughly 33 percent of investors that do not currently have an advisor, about 41 percent are somewhat likely to seek an advisor sometime in the future. These percentages were before the Corona Crisis, therefore arguably even more investors are likely to be seeking a financial advisor today.

But how does a financial advisor and/or firm attract investors during a time when face-to-face meetings are not a viable option?

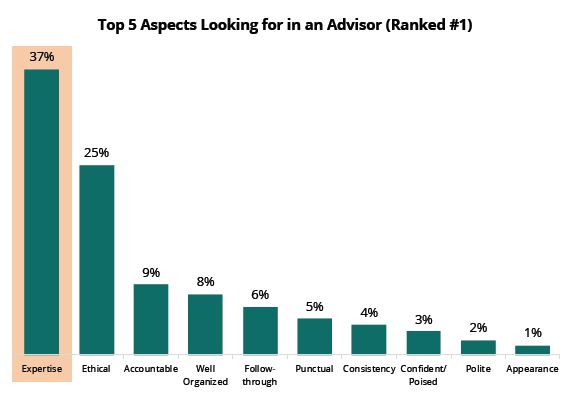

1. Demonstrate expertise via online videos, seminars and articles. Spectrem’s research asked investors to identify the top five aspects they were seeking in a financial advisor and then to rank the number one aspect. Expertise was identified by 37 percent of investors as the most important trait. Unlike some of the other traits which may require more face-to-face encounters, expertise can be credibly demonstrated virtually.

2. Make sure your website is appealing. Nearly two-thirds of investors that responded to Spectrem’s research indicated that they reached out to an advisor because the advisor’s website was appealing. It’s important to make sure that your website has educational materials available as well as online planning tools. Most importantly, make sure it is personable and inviting.

3. Investors are reading and watching the information they receive from financial providers and advisors while sitting at home at their computers. In the first module of our three-part report, The Corona Crash: What Advisors Should be Saying to Investors Now, Spectrem found that more than half of investors are reviewing the emails and other information they receive from their financial advisors. As mentioned above, writing articles and blogs can be an effective way of demonstrating expertise. It’s increasingly simple for an advisor to provide video content with the online video capabilities most have available through mobile technology today.

4. Cold calling is not dead and now may be the time to try again. Thirty-nine percent of investors indicated that a telephone call is the type of initial contact from an advisor to which they would most likely respond. A third of investors indicate that they would sometimes respond to a cold call. While no one enjoys doing cold calls, perhaps when individuals are sitting at home somewhat bored, they will be more open to answering a cold call and perhaps even chatting!

Clearly the current time isn’t conducive to selling any type of product or service, however, it may be that because individuals are concerned about their own financial health and stability they may actually want to talk to an expert. While no one can promise what will happen to the markets in the future, it might be the time to convince investors that they should be ready once the market does rebound.

Be well and stay healthy.