Stock ownership among Millennials, those born between 1981 and 1996, has become a hot topic in recent years. With the rise of the gig economy and increasing student loan debt, many Millennials are looking for ways to build wealth and secure their financial futures. Investing in the stock market has emerged as a popular strategy, but just how many Millennials are investing, and what are the implications for their financial well-being?

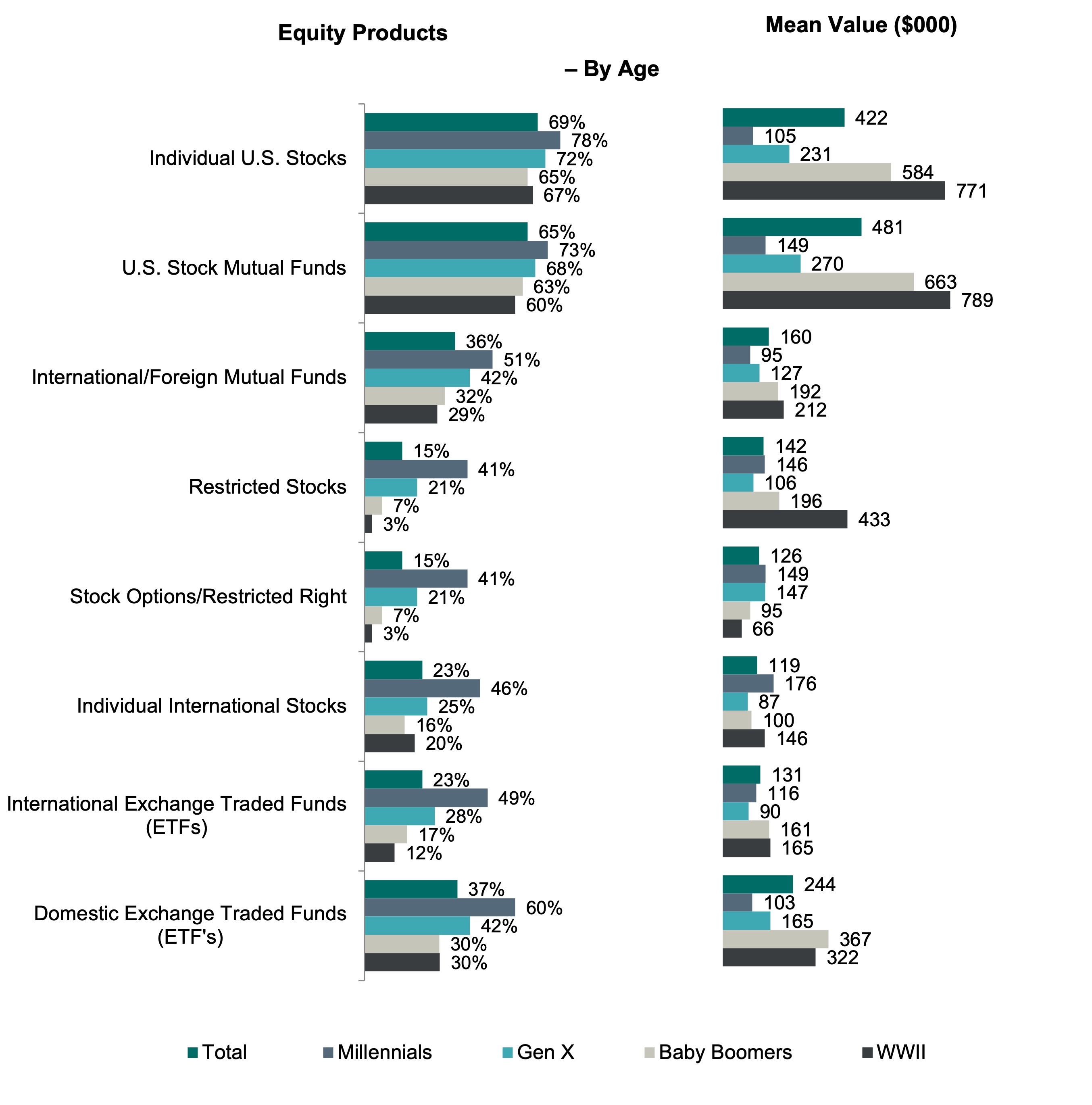

Millennials are more likely to own equities than their older counterparts, according to recent research from Spectrem Group. Seventy eight percent of Millennials, 72 percent of Gen X, 65 percent of Baby Boomers, and 67 percent of the WWII generation invest in individual stocks. The data also shows that the majority of all the different generations invest in U.S. stock mutual funds. For example, nearly two-thirds of the total population invest in U.S. stock mutual funds, while 73 percent of Millennials do the same. When it comes to international/foreign mutual funds, Millennials are again the most likely to invest with 51 owning international/foreign mutual funds. Gen X investors are the next most likely age segment to invest in international/foreign mutual funds.

There are a number of factors that may be driving Millennials to invest in the stock market. For one, many are drawn to the potential for high returns, especially as interest rates on savings accounts remain low. Additionally, the rise of fintech platforms have made it easier than ever for Millennials to start investing, with low fees and easy-to-use platforms.

Moreover, some experts believe that investing in the stock market can be an important tool for building wealth over the long-term, especially as traditional pension plans become less common. By investing early and consistently, Millennials may be able to accumulate significant wealth over time, which can help them achieve their financial goals and weather economic downturns.

Despite these potential benefits, it is important for Millennials to approach investing in the stock market with caution. While some stocks may offer high potential returns, they also come with significant risks, and it is important for investors to diversify their portfolios and avoid putting all their eggs in one basket.

It is important for Millennials to approach investing in the stock market with caution and to be mindful of risks. This can be done through the use of a financial advisor. By doing so, they may be able to build wealth over the long-term and secure their financial futures.