Written by: Amanda Jerelyn

The outbreak of the Covid-19 pandemic has severely impacted the nations and global economies. Thousands of millions of people lost their jobs as businesses around the world succumbed to the epidemic.

PNAS (Proceedings of the National Academy of Sciences of the US) surveyed small businesses to evaluate the impacts. The survey was conducted on 5,800 small and medium-sized businesses in March and April, and it concluded that;

- As soon as the crisis began, mass layoffs and closures all over happened swiftly.

- The rising risk of layoffs and closures is negatively associated with the unexpected length of the crisis.

- The third is that all the small and medium-sized businesses are fragile.

Although many businesses tried to stay afloat by managing a stay at home Salesforce, many organizations almost collapsed facing Covid-19.

But the new Regression analysis report from the Allica Bank presented analytical research stating that there are successful chances for SMEs to stay afloat and precisely recover from the Covid-19 damages.

6 Top-Notch Suggestions From The Mass Regression Analysis Report By Allica Bank

Businesses are essential for the sustainability and stability of any countries' economy. The mass regression analysis report presented by Allica Bank stated that the Federation of Small Businesses mentioned that SMEs account for three-fifths of employment in the entire UK.

But fortunately, all the small and medium-sized businesses were well designed to react quickly and briskly to the terrible challenges that Covid-19 has brought. The mass regression analysis report presented by Allica Bank provides top-notch suggestions that would help SMEs recover quickly from the damages.

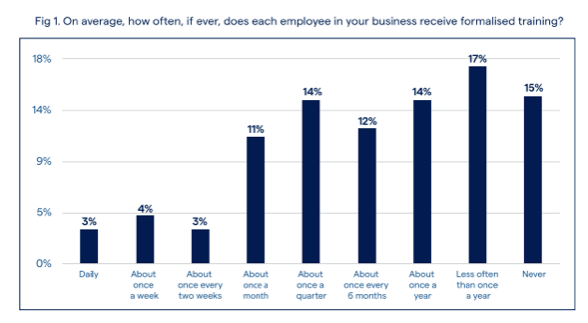

1. Provide Regular Training For Your Staff

Employees are the greatest asset to your company. These are indeed times, ones that need constant training and communications to improve the employees' morale and staff retention. Evaluate where you stand and how you must decide your planning strategy.

Toby Mason, COO of the Allica Bank, stated that regular training could greatly impact the employees' performance and build individual character.

MRA report of Allica Bank stated the following solutions;

- Training your employees for any unforeseen circumstances would allow getting more from your people.

- If you have trained or are providing training to your employees in a designed time sphere, it would help in swift recovery after the pandemic.

- Training your employees in specific niches would give you an edge in ineffective planning. E.g., training for cost-effective methods, better project managing, or financial assistance with the new technological advancement.

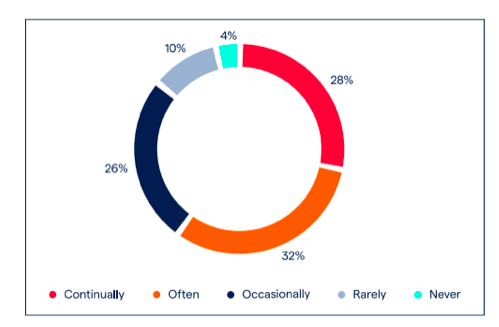

2. Make Time To Focus On Innovation And Technology

We all are living in a world filled with great technologies and innovations. Being a business that falls in the SME category, you're always on the rotation and are precisely evolving. The report states;

- Smaller and medium-size allows you to mutate in different shapes and change the working dynamics.

- The focus on innovation and technology help business in predicting the performance.

- Businesses that are well-integrated with technologies are on the rise as76% get new opportunities to grow.

- Chris Weller, the CCO of Allica Bank said that one doesn't need a houseful of technicians and developers to edge the advancement level. But simple creativity and restructuring your services and products would do the job.

- See where you stand and how often you consider innovation for your business.

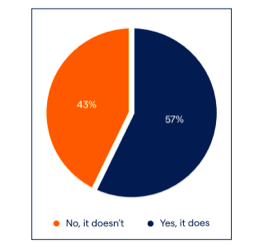

3. Have A Formal, Long-Term Vision

Having a long-term vision and actionable plans are important for any business. The report mentions;

- The long-term vision isn't just for the present. For business, it would get the results in the longer run.

- The report said that for another factor for SME growth can be decided if the company has a long term vision.

- 66% of the businesses are successful only because they had the vision.

- Create a long-term vision and track them with OKR (Objectives & Key Results) and KPI (Key Performance Indicator) models.

- Remember to add financial planning and resourcing strategy whenever creating a long term plan.

- Feel the importance? Find where you are and change the paths.

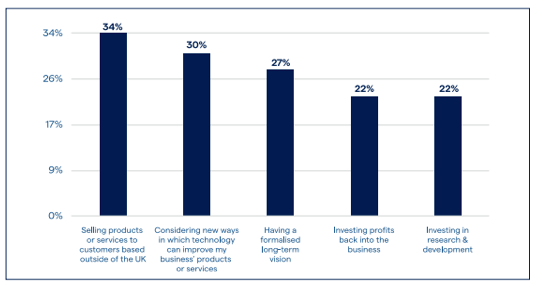

4. Broaden Your Customer Reach And Find New Markets

Every business's growth plan depends upon the increased number of customers. You must have the following;

- Branding and marketing to reach more customers can be increased with effective skills and technologies can lead you to success.

- Expanding customer marketing requires more adaption and learning skills. You must use top-rated platforms and ways to capture more customers.

- Taking your business to the different platform would also help you like. You can shift to another paradigm if the situation gets terrible, like the current one.

- Many people think that expansion is expensive. But using the right cards at the right time is all the way you can smarten the process.

- Targeting outside your reach and with new technologies would help. Here's how!

5. Develop A Reinvestment Plan To Strengthen Your Business

Investing in the right field to strengthen your business brings the desired results. According to the report;

- Investing can be done in any critical area that is lacking. For instance, research and development, hiring new resources, or new technologies would surely strengthen your business.

- According to the Allica Bank's MRA report, one of the best SME is to reinvest for better results.

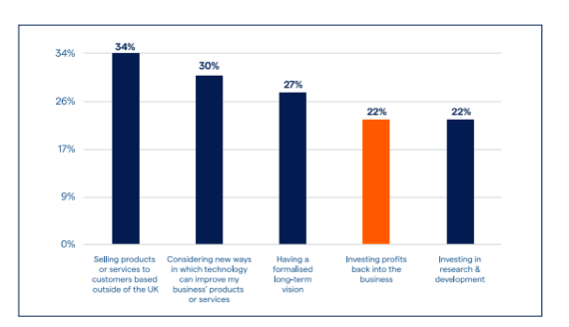

- 22% of the businesses reinvested from their profits in the last three years have doubled the yield by 9%, which is greater than the others who don't reinvest as their turn over is 5%.

- According to James Heath, the CFO of Allica Bank, reinvesting in your business is one of the most sure-fire ways to empower and strengthen your company; though it is a daunting way, the results are still more desirable.

6. Look Wider And Use The Power Of Your Network

Building business is difficult, but opening to new challenges and innovations would help you strengthen your business.

- Having a high level of interactions and relations with external businesses would enable you to learn better and apply appropriate options.

- Strengthening your business also require to collaborate with the authentic third-parties and right business partners.

- Teaming up with external partners would provide new insights and fresh perspectives that you need to succeed more.

Innovative Resilience of SME's To Overcome The Losses

Covid-19 has brought uncountable obstacles and challenges to all the fields of the world. Businesses, educational institutes, the healthcare sector, transportation, and aviation, etc. each sector have been impacted heavily.

Innovative resilience is a must-have in each sector. But for the business of small and medium sizes, it is essential to practice and initiate some resilience steps to overcome the losses and to spin the wheel.

Following are some of the innovative steps that SMEs can take to have a swift recovery.

A. Market Your Business

Small and medium-sized businesses can use different platforms for marketing their product and services. Your business strategy must consist of likable business ways that people are attracted to and made purchases.

Using different platforms of social media to connect with people or using digital technology to curb the harms caused by this vicious virus.

Small and medium-sized businesses can easily change the paradigms and go digitally because of small or medium-sized resources and ways. The adaptability to new platforms is crucial as in the time of crisis; you can change your work patterns and still manage to run your business simultaneously.

B. Clear All The Loans And Debts

Business-related bills must be submitted in due time. Just as you are concerned with your personal credit history (like credit card bills and other utility bills), you must be concerned with business credit history.

The Covid-19 period is indeed challenging. Most of the businesses are closed, which loaded them with extra due bills. The more you let them into pending, the more horrific they grow. Timely changes and adaptation to innovation would pull you out of these.

C. Seek Financial Assistance For Sales Funnel

Professional financial assistance is of utmost priority in overcoming the challenges created by Covid-19. After the closure for a long time, reopening would require financial help to get back to the track. In this regard, The Small Business Administration has announced to give low-interest loans to small and medium-sized businesses.

Facebook, the leading social media giant, has also stepped in and announced to provide $100 million to the small businesses heavily impacted by a coronavirus. Furthermore, they said that 30,000 most eligible and needy businesses would be getting this award to counter the piled up challenges.

D. Segregation In Business And Personal Finances

Small and medium-sized businesses are often found mixing up both personal and business finances. Although you wish to give your company the best, mixing up both would lead to more complications.

Have a separate business and personal accounts. This would help you monitor your cash flows, and you could focus on more important things like winning your customers, etc.

E. Create Efficient Budget

As a business owner, it is paramount for you to make smart choices that cover everything while having a smart budget.

Your business-budget strategy must include;

Planning before setting a budget and a will to stick to it and don't expand.

While planning and thinking over, efficiently include all the possible expenses.

Try to cover more with less investment – only if it's possible.

Plan on having some backhand cash that can support you in any unprecedented time.

F. Create Ease For Supply Chain Bottlenecks

The world has seen how the essential makers and their supply chains have lacked production because of the unnecessary purchases that customers made.

Customers must be convinced that the production is in process, and a continuous supply of certain products will be made so that customers are convinced, and the supply chain of that product must be bottlenecked.

G. Keep A Diligent Monitoring

Monitoring is paramount, whatever you do. Businesses must track all the expenses. Even if you are a small tea seller, keep a track record of the cups that you have sold in the day. As soon as the businesses open, it would help if you tracked this to cover up the debts that have been increased overnights.

H. Plan To Increase

Obviously, after all the months of downfall and challenges, now is the time to jump off your fall production. The future is uncertain, so compelling and strategic planning, with transformation, is of high importance. Keep short and long term financial and business goals to succeed.

Conclusion

When everything seems to be appearing as another odd, remember that an airplane takes off against the wind, not with. Bad times are like a learning opportunity that learners and successful minds don't miss.

Grow, rise, and shine again!

Related: Is Personal Agility Lighthouse Model, A Tool For Adaptive And Agile Leadership?

Author Bio: Amanda Jerelyn is presently working as a Business Manager at Dissertation Assistance, an excellent platform for dissertation writing services. She has a reputed name in the industry with her great opinions for businesses. She has presented excellent way-outs in this write-up that SMEs can adopt to recover.